Table of Contents

For active day traders involved in the hunt for valuable stocks, Stock scanners could be the saving grace. These filter software can sieve through a profound number of stocks and scan the right stock for your trade.

Stock scanners employ a number of filtering criteria. Some could rely on technically analysing, and some fundamentally to match stocks with your trading requirements.

Some common criteria include assessment of chart patterns, price, dimensions, and the degree of volatility. Although there are more than one scanner to help you locate suitable stock, some work better than others.

Below is a comparative analysis of top 3 rising and best stock scanners to help you choose.

Trade Ideas

Standout features

Filtering stock to a potential few that could best suit your needs could be a hefty job. For the most part, it is contingent on recognizing your own needs, possessing and employing research skills with deftness and thorough meticulousness.

Although there may be a modicum of luck’s play, nevertheless, you can always capitalize on your chances of betting on the best stock for your business by relying on a diligent filtering tool that does the background check for you and brings you the best out of that which is available.

Trade Ideas very diligently filters through the affluent list of stocks to generate its own manageable and non-intimidating list of stocks that would manage best with your own list of pre-requisites.

It is loaded with dependable features that makes this task achievable for Trade Ideas in a short amount of time; this and some other features have rendered it the most exploited filtering app in the stock market.

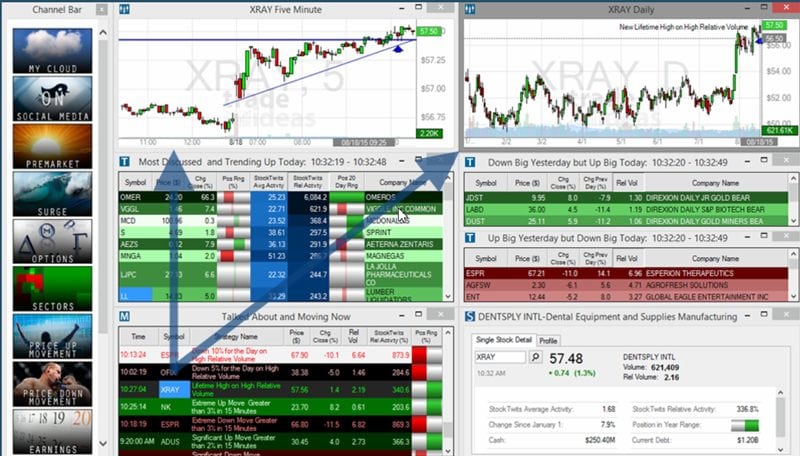

Out of the many features that Trade Ideas is equipped with, charts is one tool that makes the task of filter and analysis a lot easier.

Trade Ideas remains efficient in catching up with new alerts along with the entries and exits. It offers the traders a visual report of what has been on the market and that which has freshly arrived eliminating the need to quit platform for updates.

The Alerts Window is another feature that makes the task of research thinner and easier to execute, especially when trade execution that comes off a certain strategy proves to be a hard task.

The windows allow an overview of the entire history of events for the day and alert you with the updates of real-time progress on the charts, the notifications depending upon the chosen filters for evaluation.

Trade Ideas allows accessibility to another powerful feature on premium payment. OddsMaker is a powerful backtesting feature to run and analyse your trading approach before its final execution. However, the most revolutionary feature available at this platform is the introduction of the Artificial Intelligence (Holy Grail) Technology.

This is an additional feature that boosts your chances of making successful trade over 60 percent by meticulously researching overnight for the best stock available for you in a short time. It spares you the tedious tasks of gruesome studying of what is up for grabs and what not from a grave mesh of stocks. This technology exploits every kind of relevant data for a simplification of strategies into concepts that are practically workable.

It comes with other additional features of accessibility to a live room where you can interact with other traders as well as the staff of the platform. The platform also offers training in this business for inexperienced traders upon subscription with reasonable charges.

It also comes with auto trading for executing the process automatically although you might activate the computer-assisted mode for involvement in the process.

It is also loaded with a standard subscription package with $99 a month, a standard package with $188, and one for professional investors for upgrading business that charges $5500 annually.

Pros

- Trade Ideas is loaded with features that can be customized

- The auto trading and AI Holly Grail is definitely a plus to the system that shares a lot of workload.

- It is equipped with informative blogs for beginners and offers accessibility to live chat rooms that generate the opportunity to come up with better ideas indiscriminately for both experienced and inexperienced traders.

- Allows assessment of the daily progress in real-time

- Managed by an experienced staff that also offers free services of training to turn you into a better trader.

Cons

- Although extremely informative, but the amount of profound information on the blog can be a bit overwhelming for inexperienced traders.

- Charts are not one of its main or best features. It’s an add-on feature with limited number of indicators.

- Offers a limited number of headlines in place of streaming the news.

EquityFeed

Best features

Another revolutionary trading tool that offers greater compatibility, accessibility to miscellaneous markets and customization opportunities. Some of its trading features are enough to channel your trading policies into successful execution in a short amount of tie.

However, before traders contemplate opting for Equityfeed they might as well understand that this Stock Discovery platform is, unlike many other platforms, a standalone brokerage that does not allow free accessibility online.

This might sound like a let-down at first but compound this with the mass availability of innovative and flexible features and filtering tools to boost your success rates by leaps and bounds and you will not mind paying the extra cash as much.

Equity is a downloadable app that is operable via an internet connection. It also secures layout that could be accessed without an internet connection around.

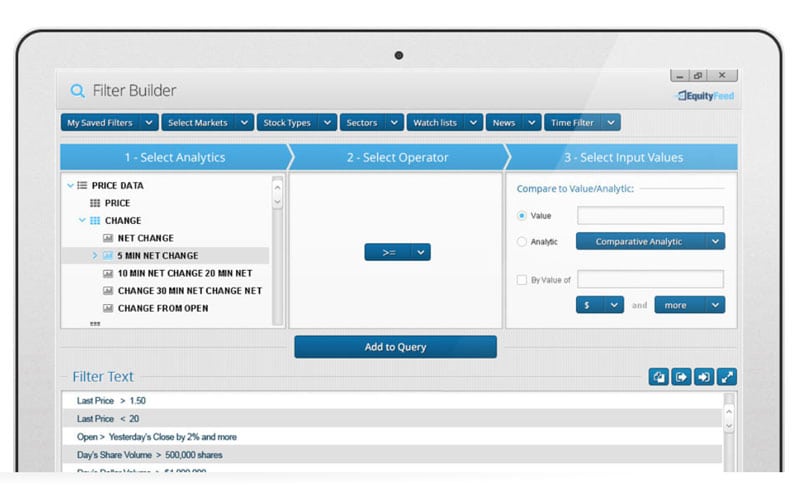

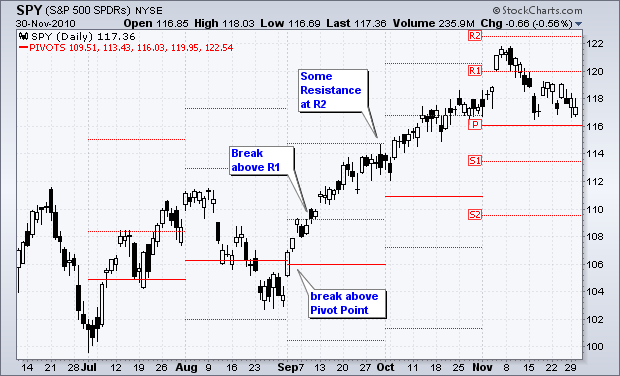

Unlike Trade Ideas, One of the main features of Equityfeed is its complex yet flexible charts that are equipped sufficiently with multi-programmed indicators such as moving averages, pivot points, RSI, Fibonacci etc.

Screen real estate allows working with more than one-time frame, and upon clicking on Chart Montage you are directed to a new window laden with tools for the assistance of the traders in almost every way possible.

It is also equipped with a level 2 screen that visually presents the liquidating states of prices in the market. But remember that these sizes might not always correspond with the real-time trading scenarios to keep the market impact in place.

The platform keeps the traders updated with newsfeed pertaining to company events, major insider sales, shifting stakes. These have a direct impact on stock prices and ends up fluctuating the demand and supply rate in the market.

The stock market could be a bit of a quagmire especially for inexperienced traders who jump to conclusions and concrete measures without studying the firmness of the ground first.

EquityFeed’s Stock Scanners and Trade Alerts are there to help just with this bit of gamble, ensuring safer bets, minimizing your chances to meet a plummeting bargain. The scanners and alerts filter the stock performances giving quick notifications regarding the days’ work both before and after the market paly. It brings real-time feedback on the sectors hitting high or low on the cash-flow.

This is done through a coloured indicator system registering with red the declining stocks and the all-time highs in green. It is an extremely useful and powerfully impactful design that comes in handy in real-time trading. The IF/ Then tool, operable in one window, is an easy-to-work-with tool to explore the safety of the ground before you step on one.

Interactive Brokers, TD Ameritrade are two online brokerages that EquityFeed supports for to place stocks for trading. EquityFeed allows connection with these online platforms along with some others.

This platform also allows its users to set up multiple watchlists in several windows for more comprehensive studies of the stocks. Multiple monitor screens for watch-list based on other filters could be a plus. It also allows customizing your saved layouts. Moreover, if you save your filters then you will likewise rid yourself of the cumbersome details of re-adjusting settings before popping up a new window.

This could save you time and trouble. Also, the platforms’ visual aid in terms of the color-coded trade alerts gives you an instantaneous idea of the day’s progress, a similar overview of the stocks’ performance in the market could be determined from the data available in the Market View window.

Generally, experienced traders are quick to bank on these statistics to charge forth with new moves.

Pros

- A meticulous and detailed stock screening app for a thorough but instantaneous understanding of market trends.

- Extremely compatible to work with especially for experienced traders who are quick to devise game-plans and consistently stick to it.

- Comes with an increased number of scanning tools and filter. It also offers a free trial that runs for two weeks before launching for subscription.

Cons

- Being a stand-alone, downloadable stock discovery app, it is understandable that tremendous bit of your RAM will succumb to it.

- It is not a free online brokerage, new traders may find it costly.

StocksToTrade

Features

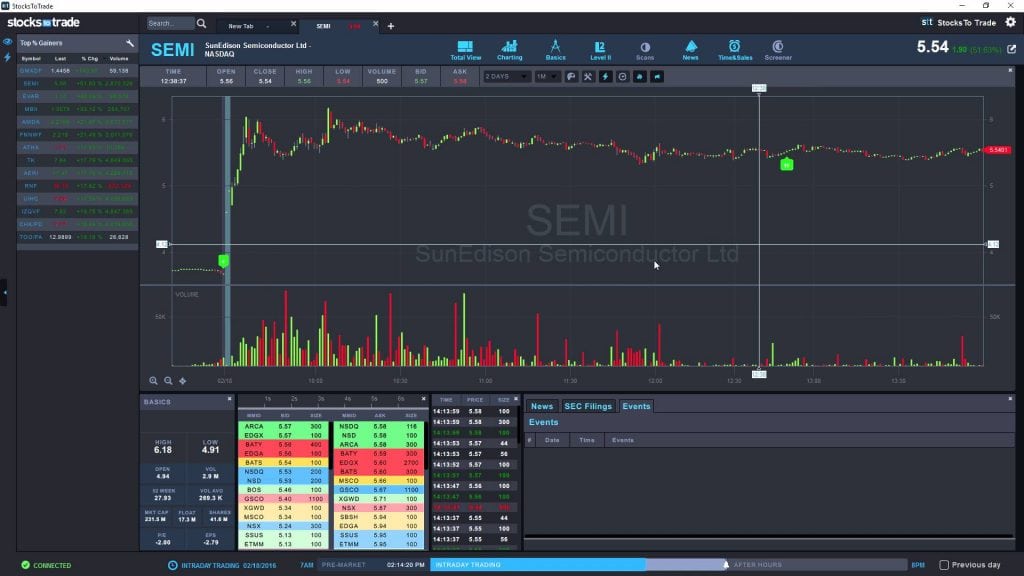

This program is an innovative idea of Timothy Sykes who has successfully combined multiple stock scanning techniques and ideas such as charting, training, newsfeed, watchlist etc. and dumped them onto a single platform for your feasibility.

This cloud-based software offers a number of different pathways for new traders to launch themselves and is operable from any available browser.

Out of its most amazing features, we would first like to talk about the Oracle. An algorithmic scanning tool that informs the traders of the real-time trends in the market. It gives an overview, in the form of upward or downward curves, of the stocks charting at the top and those that are not doing very well in the market.

It is a crucial tool especially for veteran stock traders to design trading strategy on the spur of the moment and which is also compatible with the current, real-time fluctuating trends in the business.

A handy feature of StocksToTrade is the paper-trading. It is exclusively targeted towards fresh and inexperienced traders to launch into trading practices with a premium balance of $30,000 although they will never be putting any real money in danger.

Think of this platform as a cosplay of what these an inexperienced trader will actually meet in the real market. The platform simply gives the traders a taste of what is to be expected in the stock market and grooms them by instilling some experience regarding placing your bets for demand and supply of certain stock and relevant entries and exits.

This platform also offers versatile, flexible and easy to read charts that allow multiple chart designs such as bar charts or candlesticks etc. along with offering a sizeable range of time frames starting from minute by minute scores to monthly alerts. The charts also allow customized settings and are loaded with crucial indicators such Bolinger bands, pivot points, moving averages etc.

The scanner can screen through NASDAQ, Pink Sheet stocks, AMEX, OTCBB and NYSE to filter the best stocks for your usage. You could personalize your own screen or use the platform’s. Conjoin these filters with level 2’s performance and you get sound scores on the most soaring stocks beckoning for investment.

A built-in twitter mechanism pulls out newsfeed based on certain keywords from various sites.

Pros

- Offers timely and relevant information.

- Great customization capacity.

- Complete with a handful of versatile and meticulous filters and tools.

- Paper-trade platform for fresh enrolments.

- Swing traders enjoy the active feed and alerts.

Cons

- Fresh traders may find the tool a tad bit costly.

- Some users have reported delayed functioning which could be a major setback in such an expediently fluctuating market.

- Does not allow integrating the platform with other brokers.

Conclusion

Although all three stock scanners are laced with tremendous features that can boost market understanding for successful business ventures each comes with its own set of cons.

On the whole Trade Ideas takes the lead, boasting reasonable pricing with plentiful guiding session and meticulous stock research for easy decision making.

On the other hand, EquityFeed and StocksToTrade serve better for experienced traders and professional investors who despise rummaging but retain plentiful background information and investment packages in store.

![Etoro Review – My Honest Opinion [+TUTORIALS]](https://foxytrades.com/wp-content/uploads/2018/03/Etoro-Review-100x70.jpg)

I find the trading view very good too. Wallmine is also great, it has a lot of metrics without being too much as TradeIdeas

I really appreciate your input, Danjo! 🙂

I’ll look into Wallmine and see if this is something that I should add here.