Degiro touts itself as one of the cheapest and ‘best’ brokers around.

Formed in the Netherlands back in 2011, Degiro has managed to gain traction throughout a number of European countries, with more being allowed onto the service on a regular basis.

Claiming to offer savings of up to 80% on other brokers, Degiro is the ‘go to’ broker for those traders who are looking to save a little bit of cash on the trades that they make.

I decided to give Degiro a spin to see if the service was worth spending cash on.

What is Degiro?

Degiro is a broker for a multitude of financial products including:

- Stocks

- ETF

- Funds

- Bonds

- Options

- Futures

- CFD

- Crypto

It is a service currently only available in selected European countries. In fact, this is one of only a few major brokers (particularly at this price point) that is actually based within Europe.

The company is currently based in The Netherlands and is registered fully with the financial regulators there. This means that if you trade with Degiro, you know that you are in the safest possible hands.

Who is Degiro for?

Degiro is suitable for both new and experienced traders who are very price sensitive. If you want a cheap option, then you will struggle to find something more affordable than Degiro.

However, do bear in mind that being ‘cheap’ does result in a few downsides (I will talk about those more in a short while).

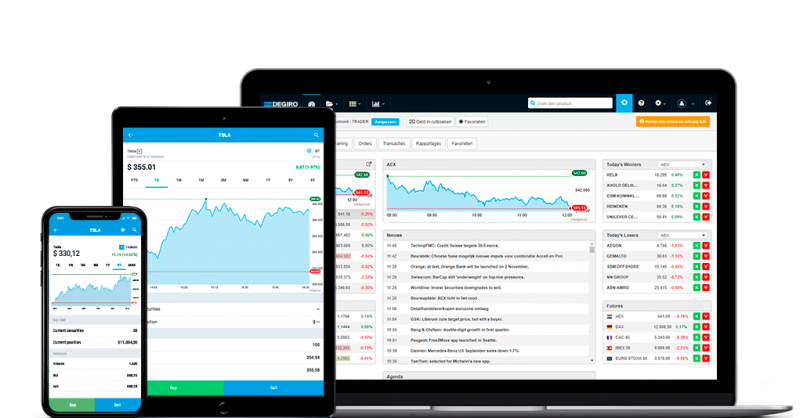

The Degiro Trading Platform

Let’s start with talking about what the trading platform actually looks like, because this is what you are going to be interacting with the most when you use Degiro.

Generally speaking, it looks good. All of the information that you need fits on a single page, with charts that look pretty decent. It is easy to find financial products that you wish to purchase too.

However, there are no research features built into Degiro. If you want to do research into financial products that you should be picking up, you are going to need to get a stock scanner of some description.

The second alternative is that you do your research using the good old internet, although this is going to be a whole lot more convoluted.

The lack of research facilities does go to show why the price of trading with Degiro is so low. They do not have to invest in developing additional features, they just need to maintain what they have.

The lack of research facilities does go to show why the price of trading with Degiro is so low. They do not have to invest in developing additional features, they just need to maintain what they have.

For some people, the savings that they make with Degiro will quickly be wiped out by finding a proper research platform that they need to use.

However, I honestly do not see this as much of an issue. This is because I have always found that research systems away from brokers tend to be a bit better and I maintain a subscription to them anyway.

I would have done so even if this had a fully-fledged research system put into place.

From the trading platform you will be able to do the following:

- Stop Loss

- Stop Limit

- Market

- Limit

- Trailing Stop

If you do not know what any of these terms mean, then you should do your research.

These are the same options that you are going to be able to get on any broker. They are not unique to Degiro.

The only thing that Degiro is really lacking is internal matching but, once again, this is something which many brokers out there lack so I don’t see this as a problem either.

It helps to keep the cost down somewhat.

One major issue with Degiro is that you are unable to customise the trading screen. This, once again, goes to show just why the system is so cheap. Granted, the layout is good enough and I think it should be fine for the vast majority of traders.

Granted, the layout is good enough and I think it should be fine for the vast majority of traders.

If you want a bit of customisation over your trading screen, then you are going to need to pay for it with another broker.

Nine times out of ten, I really do not think that it is going to be worth the extra money.

One thing that I really do hope that Degiro adds in the future are price alerts. No idea why they are not in place on the site right now. It could probably generate a decent amount of cash for the company.

This means that you are going to need to use a separate service if you want pricing alerts. The research subscription that you opt for will probably have this built into it.

Trading options with Degiro

While Degiro is lacking in a few trading options (i.e. the ability to trade Forex), it should be fine for the vast majority of markets:

- 32 Stock Exchanges

- 6,000 ETFs

- 68 Funds, which is a bit on the low side with most other brokers offering close to 200.

- 1,000 Bonds, which once again is a bit on the low side with other brokers offering 10x this amount.

- 13 Option markets

- 12 Option markets

- 900 CFDs

Honestly, if you are trading anything other than stocks or ETFs, then you are probably not going to want to be on Degiro. They are far too limited with other financial options.

This is very much a service for those who are mostly dabbling in stocks but who may be dipping into a few funds here and there.

This, again, shows how Degiro is able to offer such low prices. It is really able to cut back on anything which is unlikely to offer them a whopping amount of profit.

Research

I did talk a little bit about research under the trading platform section, so you already have a good idea about how limited Degiro actually is.

There is a news feed built into the platform, but it is nothing more than the same news that you will be able to pick up with the Financial websites, which will offer better news anyway.

There is a news feed built into the platform, but it is nothing more than the same news that you will be able to pick up with the Financial websites, which will offer better news anyway.

There is basic charting functionality, but you only have 20 indicators on there and you can’t even save the charts. This makes them nigh on useless.

It is unlikely to be something that you will be using that much. I barely use the charting functionality on Degiro.

It just isn’t worth it when there are so many better systems out there, and a lot of them are going to be free to use.

Education

Degiro is severely lacking in educational resources.

Sure, you tend not to expect that much in the way of education when you sign up to a broker as they really expect you to know what you are doing right away.

However, would it really kill them to add a few basic guides to making trades? Maybe some video tutorials?

While it may not benefit the experienced traders, a lot of newbies need a bit of a push in the right direction, and some decent educational videos may pull in a few more customers.

Opening an account with Degiro

It is a longish process to open an account with Degiro. However, this is for your protection more than anything.

In some cases, it may take a couple of days for your account to be up and running (this is because you will be asked to initially fund your account using bank transfer, which takes up to three days).

During the registration process, you will be asked which type of account you wish to open.

Each of the ‘account types’ will have a different set of features available, but they will all cost the same (i.e. the commission Degiro charges will never change).

I, personally, recommend that you go for a trader account as it will give you access to all of the services that Degiro has available.

However, during the registration process you should look at what each type of account offers to get a slightly better idea about what they bring to the table.

You will need to provide a scan of your passport during the registration process.

This means that if you do not have a passport, then you won’t be able to register. You may also be able to use an ID card, but Degiro is very specific about what types of ID it allows.

Before you complete your registration, you will be asked to complete a test which shows that you understand the perils of trading. It takes about five minutes.

You will not be allowed to open an account if you have not demonstrated that you know about the risk.

Since you are browsing this website, then I am pretty sure that you know about the risk of trading so this should be an easy step.

Honestly, I don’t really have any complaints about the account opening process at Degiro, other than the fact that it takes a couple of days to be ‘up and running’.

However, this is an issue you are going to be running into with most brokers so it probably is not going to be a concern for the vast majority of you.

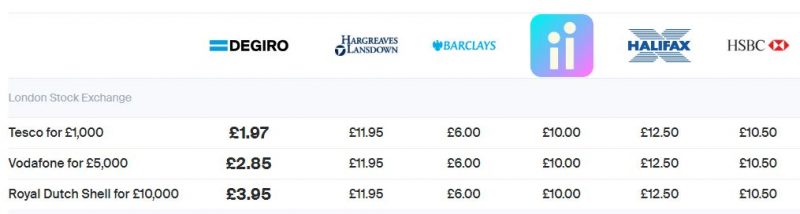

Price of Degiro

Degiro claims that it can save people, on average, about 80% on the normal cost of buying shares.

However, this is completely dependent on where you are located. Some countries in Europe will likely see bigger savings using Degiro than other countries.

It is worth pointing out that in order to do its ‘comparisons’, Degiro does use some of the more expensive companies out there to compare to.

The vast majority of people are probably not going to be buying shares through their bank, even though this is where the bulk of the comparisons are.

So, do not think that if you use Degiro you really are going to be saving 80% on the cost of buying shares. You will save money, but the saving will be a lot lower than what you may think.

The amount you pay for Degiro will be fully dependent on how much stock you are buying, what market you are trading on etc.

The problem is that Degiro doesn’t really go into a whole lot of depth about their charges. You don’t really know how they work out their calculation. I am unsure as to why they are not clear about it.

Thankfully, you should be able to see a list of what you are going to be paying on the transaction before you pay.

So, nothing is really ‘hidden’, it is just difficult to predict how much you will be paying before you get into the swing of things.

I have taken a sample of some of the prices that Degiro quotes on their main page here.

However, do bear in mind that this is related to the United Kingdom only. There will be other fees in other countries, some higher, some lower:

- Buying £1,000 of stock on the London Stock Exchange will cost £1.97 and £5,000 will cost £2.85.

- Buying £2,000 on NASDAQ will cost 49p.

- 1 Call on options is 80p

- Foreign currency spread is 0.10% of your transaction

I genuinely believe that the prices that Degiro are charging a little bit too cheap, and I wouldn’t be surprised if they put up their fees in the future if they want to keep running.

However, I don’t anticipate them climbing by that much.

I seriously suggest that once you sign up to Degiro, you take a look through the overall fees yourself just to get a feel for how much you will be spending per transaction.

Don’t worry, the cost is never going to be that high.

Deposit and withdrawal

If you want to get money into your Degiro account, you have just two options. You can either use bank transfer or SOFORT.

Thankfully, in both cases it is completely free to deposit and withdraw money from your account.

This is fantastic, because most other brokers will charge for deposit and withdrawals.

The only real problem with Degiro is that there is no way to deposit with your credit or debit card. This is a huge shame. Most other brokers allow it.  I wouldn’t even have minded paying an extra fee to deposit using my credit card (I know it costs money for a company to accept cards). I seriously doubt it is something which is coming in the future either.

I wouldn’t even have minded paying an extra fee to deposit using my credit card (I know it costs money for a company to accept cards). I seriously doubt it is something which is coming in the future either.

This is the only real niggle I have when it comes to the way that Degiro handles money.

It is also worth noting that you are only allowed to have a single currency for your Degiro account. If you open it in the United Kingdom, then your account will be limited to GBP.

There is nothing stopping you from opening additional accounts with Degiro (other than the fact it is cumbersome), but do bear in mind that if you wish to fund your account, you will need to have a bank account available in the currency that you wish to deposit.

So, Degiro is probably not going to be the right service for those who are planning to work with a multitude of different currencies.

Customer service

The customer service system is another area which shows just how much Degiro have tried to cut back on costs.

It is virtually non-existent. There is no live chat, and you will barely get any responses to emails that you send out.

The only reliable way to get in touch with customer service is via the telephone.

The only reliable way to get in touch with customer service is via the telephone.

Thankfully, this is a good method and I always found that they were able to help me out. I just wish that they were a little bit more receptive to the emails I sent them.

Conclusion

Degiro is a cheap platform. I give it that. If you want something that is ‘cheap and cheerful’, then you are unlikely to find anything better than Degiro.

However, the low price does mean that it is lacking in a lot of key areas which other brokers have invested cash in.

If you can look past the fact that you can’t customise the platform and that you are missing out on trading a plethora of different financial products, then Degiro may be for you.

However, if you are an experienced trader who needs a lot of control over their trading environment, then it may be worth spending a little bit of extra cash and look elsewhere.

This is really for the newer traders who are looking to cut costs in as many areas as they possibly can.

![Etoro Review – My Honest Opinion [+TUTORIALS]](https://foxytrades.com/wp-content/uploads/2018/03/Etoro-Review-100x70.jpg)