Table of Contents

EquityFeed is a popular trading platform that provides intuitive and innovative solutions to the retail day traders. It’s a subscription-based and standalone research and trading platform with tons of useful and successful tools for investors and traders.

EquityFeed is not an online brokerage but can easily be connected to any existing online brokerage account for easier execution and management of trades.

The platform is designed to connect traders with multiple markets. This gives them a chance to not only locate a trading opportunity but also other opportunities once they occur.

Here is my honest EquityFeed review;

EquityFeed Inception

EquityFeed was started in 2002, and since its inception, the software has been providing the most innovative trading solutions for the traders.

Over the years, the platform has redesigned, redeveloped and improved its technology to offer a user-friendly trading platform that’s all-powerful. This has led to traders using the EquityFeed platform to take advantage and also dominate the stock market trades.

It is an excellent piece of software that adds tremendous value to traders. One of its main competitors is StockstoTrade, which we use.

Features

EquityFeed’s platform is java- based, downloadable and can run from anywhere globally as long there is an internet connection. The platform saves its layouts on the cloud making it easy to access your trading even when traveling around the globe.

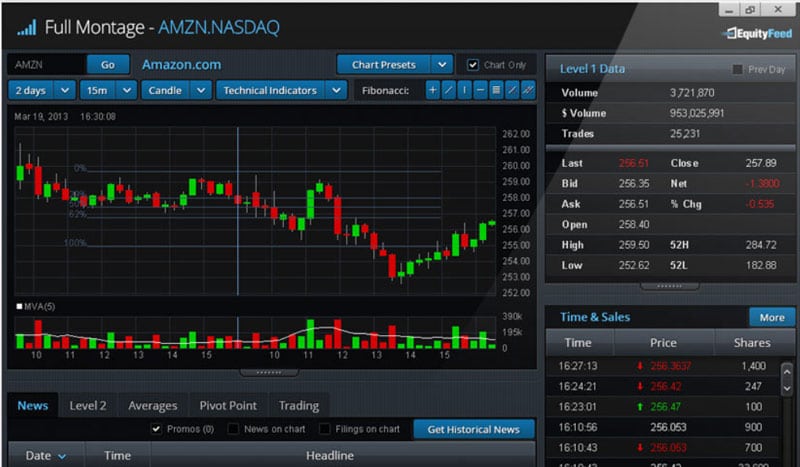

Stock charts

The charts are quite versatile, and they come with various pre-configured indicators like pivot points, moving averages, stochastic among others.

It also has different tools that help you to interpret the price action swiftly. Ensure you have the screen real estate to help you handle windows if you are using multiple time frames.

Technical indicators

The platform provides you with the standard professional indicator tools that are useful for identifying the best price action. Famous indicators are moving averages, pivots points, stochastic, Fibonacci tools and RSI.

The platform also gives you the ability to draw the trend lines.

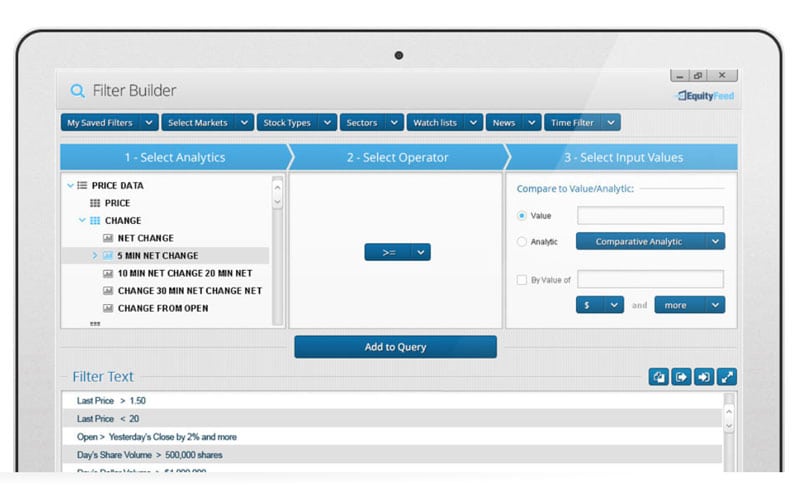

Powerful stock scanning

EquityFeed has a powerful mechanism that allows the traders to scan specific sectors, different markets, and stocks based on their personalized criteria. This is one of the real gems of this platform.

The scanner provides you with the fresh and authentic shares to trade using your robust trading methodology. The scanner alerts you when there is a raging stock that is promising, and gives you guarantee to win.

Compatible brokers and order entry

You can directly link your existing brokerage account to your EquityFeed to place the trades comfortably through the platform.

Currently, the platform is known to support brokerages like TD Ameritrade, Interactive Brokers, Real Tick, and Lightspeed.

Saved layouts and customization

It is easy to always save your layouts to avoid repeating the same process. You need to keep all your filters saved to ease the loading of the scan windows and avoid re-entering the setting once you decided to open a new window.

It’s also easy to customize every window, starting from the font, to size, to calibrating the different configuration of the filters, making the platform flexible.

Platform differentiators

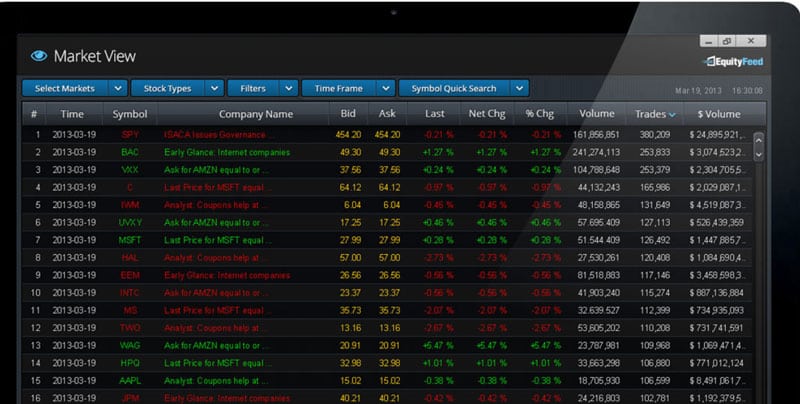

Based on your desired parameters, the platform offers a stable solution for filtering your whole market portfolio. It comes with a unique color-coding with Trade alerts module that helps to paint a single picture of the market.

The Market view window provides various screenshots on how the weakest and strongest ETFs and stocks are performing. This makes it easy for an experienced and seasoned trader to watch the performance of every top share in all the sectors.

Alert management

The Alert management features are uniquely designed to work with the pattern recognition, hence alerting you to successful and proven events occurring in real time.

You have the power to take advantage of the securities averages and new highs and lows. The pattern recognition makes you see lows and highs, breaking price averages, breaking volume averages and the movement of the large blocks trades.

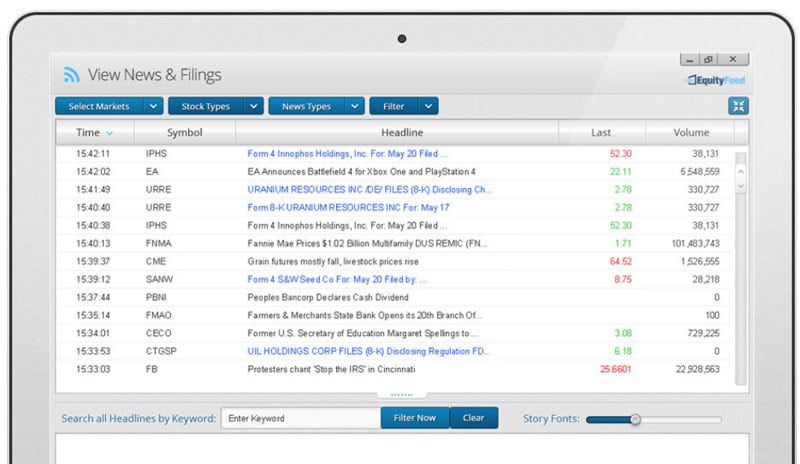

News streamer

As a successful trader, you can take advantage of the available news to maximize your profits. EquityFeed’s News Streamer is the most advanced and fastest in the market.

If you need real-time news, then this platform is specially designed for you. Its news filtering features help you to customize the stocks according to your trading preference.

Market monitoring

Market monitoring gives you a chance to keep eyes on various securities. It also acts as a revolutionary tool, and it is designed to display the entire equity markets.

Additionally, the stocks are sorted and then ranked according to your trading desires, to help you select active securities in the display.

Decision support

The EquityFeed platform has the Chart Montage feature that allows day traders to specially select trades that interest them and also conduct in-depth monitoring.

In-depth monitoring plays a significant role when you need to decide on the winning trade. The Chart Montage feature is a clean compact window that delivers real-time data. The data is vital when studying a stock before you trade.

Watchlist

Successful traders know that you need to keep the best securities in a personal portfolio. It gives you the power to continue monitoring their changes in real time.

The watchlist gives you the opportunity to monitor various headline news and how they impact your selected stocks. With EquityFeed you can create multiple watch lists with the unlimited ticker symbols.

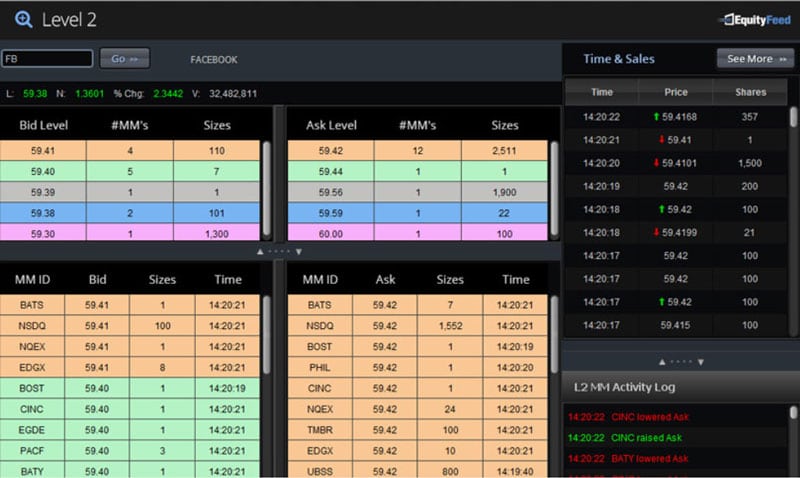

Level 2 quotes and screens

Market depth is known as the key for you to successfully buy and sell equities. The platform provides you with level 2 quotes that display the stock order book showcasing the market maker, their price level and the liquidity of each price level.

Personal alerts

The personal alerts give you various kinds of signals that may interest you and help you to set it up.

It serves you like the personal butler by alerting you with real-time information whenever there is significant news on any stock that interests you.

It gives an immediate reaction to the process volume, the stock change and asking, and it modifies the necessary bidding.

EquityFeed pricing

EquityFeed has various packages to suit your pocket, and they include:

Individual markets package

Under the individual market package, you will enjoy exchanges like NASDAQ, AMEX, NYSE, OTC and level 2. EquityFeed provides you with an intuitive calculator once you select one of the above markets.

A monthly charge is displayed according to the stock exchange that you use. If you choose NYSE or NASDAQ, a charge of $135 is shown. For both NYSE and NASDAQ you will be charged $170.

Market bundles

EquityFeed has grouped several U.S stock exchanges for you to choose the best and at the most affordable prices. This also helps you to diversify your trading activity and portfolio.

The market bundles give you a chance to access NYSE, NASDAQ, OTC, and AMEX at a price of $200 and if you decide to add Level 2, you will be charged a total of $220.

Microcap bundles

With Microcap bundles, you get to enjoy access to the following stock exchanges for just $5 and when they are under OTC, AMEX, NYSE, and NASDAQ.

You can choose a package of $150 per month, and once you decide to add Level 2, you pay a monthly charge of $170.

Tips on pricing

- For each package, you are entitled to 14 days free trial giving you a chance to access the all-powerful features and learn how it works.

- You will enjoy unlimited watchlist, access to the pre-market data, customizable layouts, 100% real-time streaming and the post-market data.

Who needs EquityFeed?

The platform is well tailored to meet the needs of both seasoned and experienced traders who have a sound trading methodology.

The platform scanners open up big chances of trading candidates. It’s up to you the trader to use your skill sets to capture the information and execute a winning game plan on the trades. For new traders, you need to restrain from jumping from scanned stock to the other; this is a recipe for failure.

Pros

- It offers you two weeks of free trial without having to use your credit card.

- It’s an excellent tool for the seasoned traders with a robust winning methodology but in need of more stock to trade especially during the day.

- It has the best and the most in-depth real-time stock market scanning tools.

- It’s a flexible platform which offers a chance of all-in-one trading when linked to an online broker.

- Unlimited watch lists.

- Unlimited ticker symbols for every watch-list.

- Opportunity to create your unlimited custom layouts.

- After-market data in real-time until 7 p.m EST.

- Pre-market data in real-time from 7 a.m EST.

- Reliable and fast support through email.

Cons

- EquityFeed is quite expensive for the newbie’s

- May significantly slow down your computer.

Refund policy

Once you sign for the paid subscription and you one day feel the platform is not giving you a winning streak, you have the right to cancel your services with EquityFeed.

The cancellation is made via your account profile, but you have to pay for using their services in the current month.

Software and installation

For you to operate the platform, you don’t need any special software. Installation is quite easy if you are a computer literate. However, your computer needs to have a processing CPU of 2 GHz. The minimum RAM requirement is 2GB.

Installation takes less than fifteen minutes after which an activation link is sent to your email. For you to obtain the real-time quotes, you just need to sign an agreement.

To launch this program, you just need to login to your LaunchPad. There you can easily access all the tools and features that they offer.

You can launch out some tools and explore their other options and menu structure.

Tips

- You can quickly orient the LaunchPad either horizontally or vertically. Horizontal LaunchPad uses less room, and you just need to click the little rotating circle button.

- In case you lose your LaunchPad in level 2 news and quotes, you can easily get it by right-clicking on your upper menu bar that’s in the open space on any tool. Your menu will resurface including the options to show the LaunchPad.

- Ensure you add a shortcut to EquityFeed on your desktop; this is after you have run it for the first time. This makes it easy to launch the application, and faster.

Conclusion

After testing EquityFeed, we are super confident that the platform offers the best experience for both seasoned and rookie traders.

It’s significantly featured with powerful technology, making it easy to use from any part of the world.

For experienced traders, EquityFeed opens your eyes to more profitable trading opportunities. For the unsuccessful trader, the platform pushes you to the edge and gives you a chance of making a consistent profit on stocks.

The main aim of this EquityFeed review is to showcase the most significant advantage of this platform to you, and that’s its ability to filter the stock market and show you the leading stocks of your preference.

![Etoro Review – My Honest Opinion [+TUTORIALS]](https://foxytrades.com/wp-content/uploads/2018/03/Etoro-Review-100x70.jpg)