Table of Contents

Are you an aspiring investor who dreams to venture into day trading? Perhaps you’ve imagined the possibility of working only a few hours a day at the comfort of your home (as long as you have a WiFi connection and a device) and you can be financially stable even before reaching 30?

First of all, I’m glad to know there are still people like you with dreams and ambitions. I myself trade (but mostly based on swings), resigned from my job in a proprietary trading firm after 3 years and started trading on my own. Like you, I just knew that the 8-hour workday is not for me.

However, let me tell you upfront that the reality of day trading (in the beginning) can be slightly less glamorous. It requires discipline and practice on your part to be successful in this endeavor. Do know that there are many people who lose money because they were enchanted by the belief that they can turn quick profits in day trading.

In this article, I hope to share tips to beginner traders so they can speed up their learning curve and minimize their losses. That is, by first having a goal of earning US$200 a day trading stocks.

What Day Trading Is

But first, let me share with you what day trading is. This practice involves purchasing and selling security within a single day or also referred to as short-term trades. This is one of the best ways to invest in the financial markets because unlike standard stock market investing, trades are not held overnight.

Yes, day trading is a potentially lucrative practice but also a potentially devastating loss within one trading day. That is why having a goal of earning $200 a day trading stocks is more achievable as a beginner than setting unrealistic profit targets.

The amount of $200 may seem small, but when the amount is combined daily and you consider the things you learn in the process, it could have a significant impact on your trading later on.

So, how exactly do you make 200 dollars a day trading stocks?

Tips on How to Make $200 a Day Trading Stocks

1. Create a Trading Strategy

Sure, there are good day trading strategies that you can follow, saving you time finding a system that works. But it can also be a DIY career. Don’t worry, building your own trading strategy or trading plan can be easy, fun, and even quick.

Characteristics of ideal trading stocks to look for

As you create your trading strategy to profit 200 dollars daily, you will have to decide on what type of securities you are going to purchase and sell. Your option is to trade futures, bonds, options, currencies, and commodities( although stocks are among the most popular to make money).

Your market is big as a day trader.

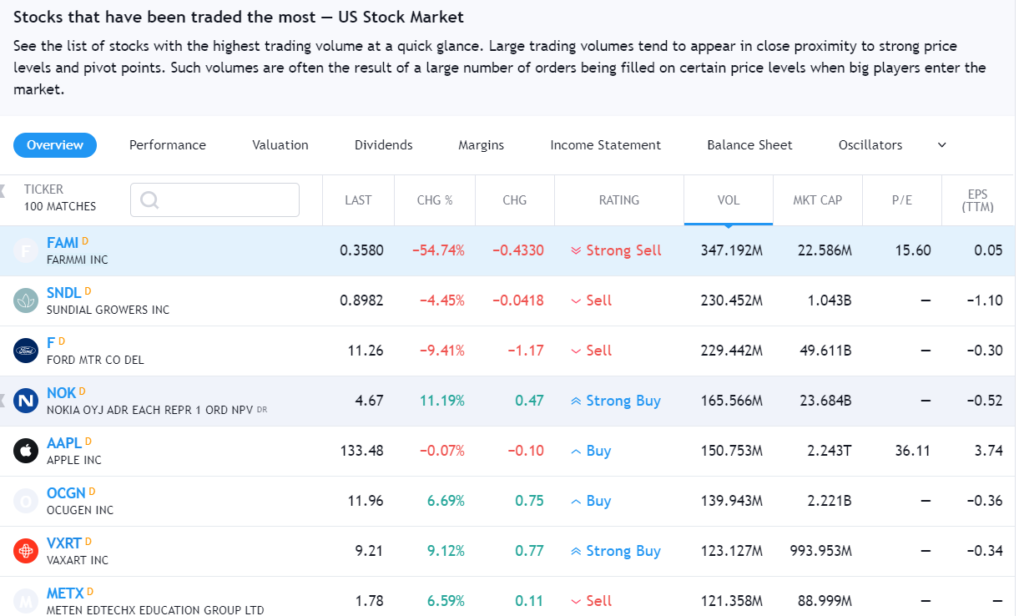

The characteristic of the best securities that I look out for when day trading is that they should have good volume. This measures the commitment behind the stock price movement. If a stock moves on high volume, it means many investors or traders are involved in that move and it’s not difficult to find a person to buy from and sell to.

I also look out for newsworthiness. This is because it gets people interested in selling or buying security, which consequently helps create liquidity and volatility. So, I recommend you also follow the trading news to find ideas.

Another characteristic of a good day trading stock I look out for is volatility (although not too much). It is a measure of how returns or prices are scattered for a certain financial product. Volatility also means that the price of security is changing frequently. This is an important movement for a day trader to make a profit.

2. Set up a Trading Account

You can set up a trading account through trading platforms or through your bank. Compare the brokerage rates as well as the services they provide. Once you get in touch with a selected broker, you will be required to fill up an account opening form and submit the necessary proofs of identity.

Some online brokerage platforms I can name include Interactive Brokers, TD Ameritrade, and Lightspeed Trading.

3. Create a Watchlist and Determining How the Markets Function

Now it’s time you build a stock market watchlist. Collect some liquidity components and leading companies in key sectors. Do these stocks have a good daily movement? To potentially make money as a day trader, consider stocks that have been traded the most.

If you’re in the US, it could be Farmmi Inc., Sundial Growers Inc., and Ford Motor Co.

4. Start Small

Begin small (to make money in day trading), most especially as a beginner. This is because you will likely lose money and make mistakes at the start. So, you have to keep an especially tight rein on your losses. You also need to have that goal of earning 200 dollars a day and gain some experience along the way.

5. Simulate on a Test Account (Weekly or Monthly)

As your goal is to earn 200 dollars a day, I encourage you to do a paper trade to practice buying and selling stocks. Choose a stock market simulator, which feels and looks like a real trading platform.

Begin playing each scenario with virtual money to find one that works best for you.

6. Diversify: Why it’s a Must as a Trader

Trading is about risk management. That is why diversification is a must to make money (200 dollars) every day by trading stocks. When done right, it can protect a trader like you against some risks.

Bottom line: It’s Not Easy Making 200 Dollars Daily Trading Stocks, But it’s Possible!

Before giving up your day job, create your rules first that you can follow every day. You may use the tips here as a guide to making 200 dollars daily by trading stocks.

And remember that anyone can trade, but not everyone can trade consistently and profitably. Becoming a good trader takes patience and time as you gain experience looking at price action and reading stock charts.

Disclaimer: The information I share here is based on my personal experience as a trader and not the holy grail. You may want to consult your personal investment or tax advisors before you invest your money.

If you have any comments or questions, I would love to hear them. Don’t hesitate to comment down below.

![Etoro Review – My Honest Opinion [+TUTORIALS]](https://foxytrades.com/wp-content/uploads/2018/03/Etoro-Review-100x70.jpg)