Welcome to my Trading 212 review. You must be here cause, firstly, you are interested in online trading and secondly, you must have heard or read the magical combination of these two F-words “fee” and “free”.

Are they a legit broker? Do they really offer brokerage without fees?

I invite you to investigate it with me along this article and see if Trading 212 is really a dream come true or a well-hidden scam.

To shed some light on what you can expect in my review I have made a short list of the aspects that I will go through:

- Is Trading 212 scam or legit?

- Who is it for and what products do they offer?

- Trading platform

- Educational materials

- Fees

- Promotions

- Pros and cons

Feel free to skip to the summary if you’re in a hurry or check out the table of contents if you are only interested in some particular aspects. Let’s go!

Is Trading 212 scam or legit?

I think that before we move any further, we should be sure that this company is for real and legit in the first place. So let’s talk a bit about its background and its compliance with the regulations.

Trading 212 is one of the most known securities brokerage trademarks out there. I’m saying trademark as this is the name that everybody has heard of but it actually belongs to two companies named Avus Capital UK Ltd and Avus Capital Ltd.

Don’t worry, this is not something unusual, most of the online brokers out there are trademarks owned by other companies and this is the way they normally operate. The companies who own the brokers are the ones registered with the regulatory bodies.

Trading 212 originally started out as a Bulgarian company before it was incorporated in the UK in June 2013. The history in Bulgaria goes actually back to 2004 so the founders are definitely not newcomers in this world.

The brokerage is domiciled in London and they advertise themselves as the ones to democratize the financial market by increasing access for ordinary people. They are aiming for it by offering revolutionary zero fees and an easy to use mobile app that boasts a wide range of features and functionality.

The two before-mentioned companies that own Trading 212 are regulated by the FCA in the UK and the Financial Service Commission in Bulgaria.

They are also in compliance with the EU’s Market in Financial Instrument’s Directive and Trading 212 is also registered in more than 10 other regulatory bodies in the countries it operates in.

This kind of heavy regulation sounds quite safe, doesn’t it? Just to add to it, FCA is the main regulatory body in the UK and it is also one of the most well-known and trusted in the whole world.

Moreover, Trading 212 also keeps investor funds in segregated accounts which are insured to augment fund safety.

Not a regulatory body but someone to keep a close eye over Trading 212 is the press. As Trading 212 has proudly filled the position of the “most popular trading app”, it has brought and will keep on bringing a lot of attention to its activities.

To conclude this section, then despite that it can be tricky for you to determine the legitimacy of a broker with a 100% certainty, as far as the modern laws are concerned, Trading 212 is definitely not out to scam you.

Is Trading 212 unique?

Are you likely to find similar services offered by other apps? Sure!

It’s 2019 so it’s really not that surprising that you’ll find tons of online brokers. To the untrained eye, they’re pretty much the same. But usually, there’s a spectrum in online trading and each trader falls into a category.

The type you decide to choose will depend on the type of investor you are or want to be.

So what type of trading platform Trading 212 really is? I think it mainly comes down to which type of users is it meant for, what kind of products it offers and the usability of the platform, so let’s check these out in the following paragraphs.

Who is Trading 212 for?

You’ll recall that it was incorporated mid-2013 in the UK, less than 6 years ago and it operates in 65 countries. The total number of downloads reaches 14 000 000 with more than 200,000 monthly active users. These zeros are quite impressive by themselves, aren’t they?

When you for example take one of its competitors eToro, then this app has over 3 million account holders in more than 200 countries, but the average number of monthly users is the same – 200,000. You’ll have to agree with me that in terms of scale Trading 212 has a way higher percentage of users.

Ivan Ashminov, who is one of the co-founders calls the charges on stocks a disgrace and finds it a strong obstacle for youngster to enter this market. Therefore, the goal of Trading 212 has been set to democratize trading by making the platform attractive also for the younger generation.

This is also proven by the fact that they basically offer only one type of account for everyone. So the conditions including any fees, charges and leverage don’t depend on your experience or income. You can easily switch between demo account and real account just by choosing to fund your account.

This is also proven by the fact that they basically offer only one type of account for everyone. So the conditions including any fees, charges and leverage don’t depend on your experience or income. You can easily switch between demo account and real account just by choosing to fund your account.

They do offer something for the more professional crowd as well. It is so called Pro account that you have to apply for when you open a ‘regular’ account.

However, it is important to note that it’s not something for everyone. You have to meet their requirements that involve trading experience, capital and trade frequency. Once you hit that level then in exchange for waiving regulatory protection you will gain access to higher levels of leverage.

In conclusion we can say that while Trading 212 is all about attracting the young crowd, it actually really caters for everyone’s needs.

What products and services do they offer?

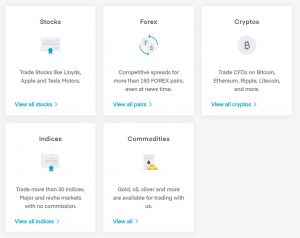

In terms of products, it offers what most traditional brokers offer. That means you will be able to trade stocks in the form of equities and CFDs.

You could also trade over 150 currency pairs, indices, commodities (like gold, oil and coffee), as well as a wide range of cryptocurrencies (including Bitcoin, Ethereum and Ripple). They even offer share dealing service (ETFs).

As I said, in this regard, they’re just like any other brokerage firm.

As for their services, as an account holder, you’ll have access to customer support service 24/7. Whichever medium you choose to use, calls, emails or live chats, they’re known to respond quickly and professionally to all of them.

It is also worth mentioning that the customer support is available in many different languages.

Trading platform

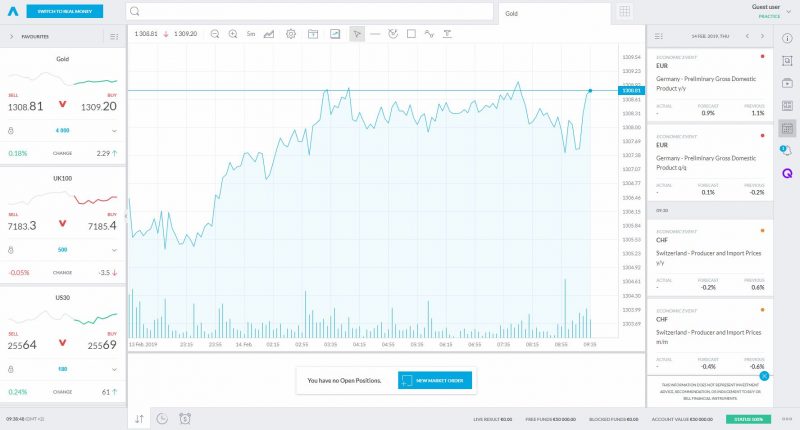

In the last part of this section I will focus on reviewing Trading 212 online platform and the type of users this platform suits. Before we move on, I have to say that the trading platform is overall the strongest elements of this brokerage service.

Unlike most brokers who use the MetaTrader4 platform, Trading 212 uses a proprietary platform thanks to its support of algorithmic trading.

You should note that the main difference between MT4 and a proprietary platform is that while the MT4 is more of a one-size-fits-all kind of platform, then the latter is bespoke to the firm, thus developed in-house to meet precise requirements and trading needs of the broker.

The proprietary platform is just as compatible with whatever device you choose to trade with including Android, iOS, and desktop operating systems.

Aside from this technicality, the user interface is very easy to learn, just like any MT4.

Though it offers a decent range of features, charts and analysis, they have succeeded to make it really easy to navigate around the app. Thus it is also great for you if happen to be a newbie.

Demo account

Before you actually begin risking your hard-earned cash, you get access to a demo account (£50,000 worth) which you can use to simulate real investment performance without the actual risk.

Again, this feature is great if you’re not familiar with online trading. You should know that this feature is not unique to Trading 212 as other online brokers offer this option as well.

Educational materials

Trading 212 is also known for offering a wide variety of educational material. Their blog is regularly updated with vital topics and interesting discussions.

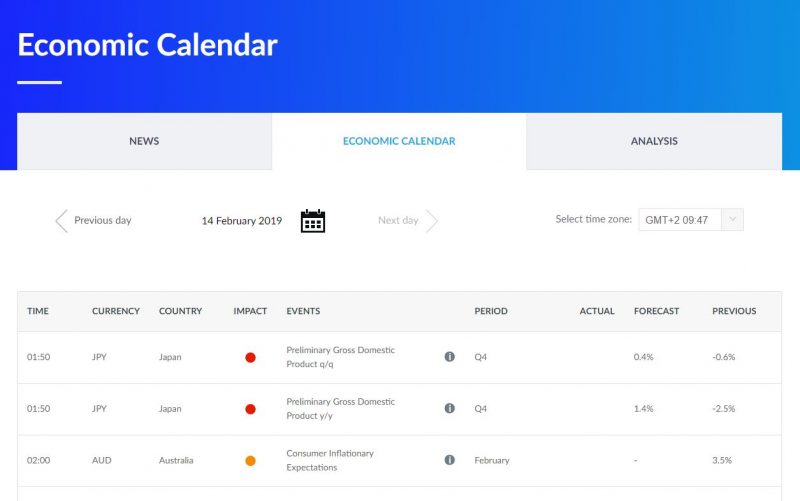

On the platform, you’ll have access to tons of data, research, and tools with market indicators as well as tech patterns. These all include the latest news and charts that will help you make your decisions.

Trading 212 also has a regularly updated economic calendar that displays an indicator chart. It is an extremely useful tool for improving your strategy as it shows the impact of every upcoming event.

The educational tools on this platform have been praised especially because its high-quality materials are accessible to even mere visitors. You don’t have to qualify as an account holder to learn from them. This goes very much in line with their objective of democratizing the financial markets.

Is there a catch?

Trading 212 claims on its site to be the “first and only zero-commission stock trading service in UK and Europe”. It is worth finding out the amount of truth to this claim.

I have to admit that regarding commissions there actually is no catch, they really do offer completely commission-free trading across a broad range of assets.

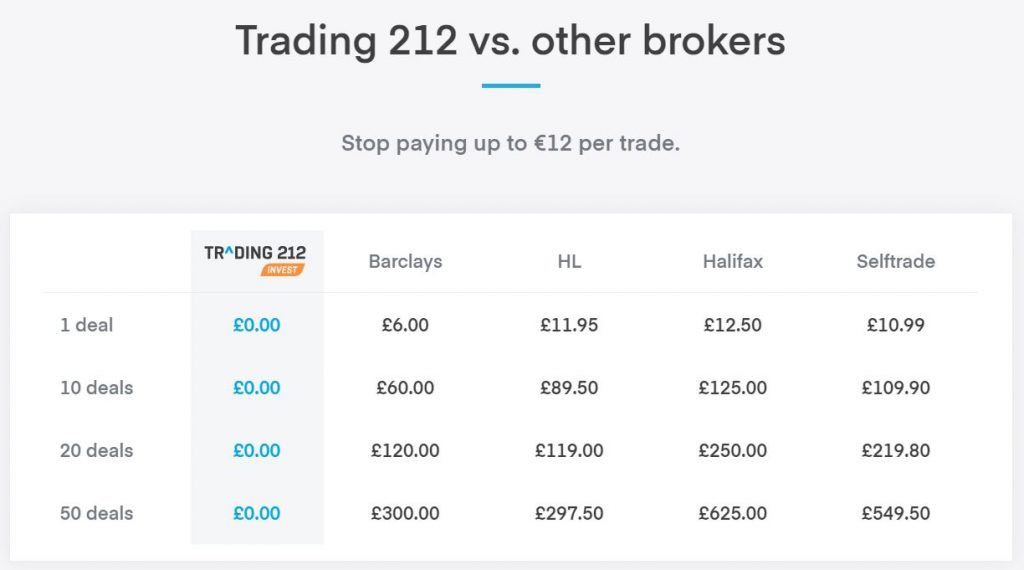

This really makes Trading 212 stand out among its competitors. Let’s see an example. If you’re buying stocks directly through fidelity or Barclays, you’ll spend not less than £6 per deal. It does make a difference, doesn’t it?

But they aren’t running a charity, right? They clearly didn’t customize their own bespoke trading platform just to give it away for free. So what do they have in mind? How do they make money?

When you’re trading online, it’s normal to be suspicious of free stuff that isn’t promotional as there could be hidden charges. Some fees you’re likely to come across include premium research, broker-assisted trade (sometimes not disclosed) and even inactivity (for passive investors) fees.

Any other hidden fees?

If you’re not careful, you might encounter some other fees while using Trading 212.

Although most of these costs have little to do with the actual stock trading itself, they are worth noting.

Although most of these costs have little to do with the actual stock trading itself, they are worth noting.

Credit and debit cards, Skrill as well as wire transfer are accepted and make it quite easy for you to deposit money into your Trading 212 account. If you deposit or withdraw money via a credit card, it’s free of charge. However if you use a bank transfer, the bank will charge you £5 for it.

These fees are usually at the discretion of the financial medium you use so they are out of Trading 212’s control.

For withdrawals of larger sums – The process is identical as it is with smaller sums, with only one difference – when it comes to withdrawals of sums equal or over 15 000 EUR ( or it’s equivalent in other currency ) the client would have to fill in a SoFD ( source of funds declaration ) as a regulatory requirement. The processing period is the same, so with that being said there are no difficulties or delays when it comes to larger withdrawals.

Currency conversion charges, as well as government stamp duty plus PTM levies also apply, but that is something quite common.

When it comes to spreads, it depends on the type of asset, but I have to admit that some of them are quite tight.

However, I think you should really check the Trading 212 products page yourself for more detailed information regarding spreads and margins. It’s important to know what charges apply to witch products before you start off.

Promotions

Amongst seasoned investors, Trading 212 is considered quite a generous broker.

Currently, they are giving away free share of up to £100 to anyone who opens an investing account. There are some requirements to it though in terms of your location etc, so make sure you check the terms and conditions on their web if it got you interested.

The main point is that like most trading platforms, Trading 212 do reward their customers, particularly the loyal ones. Therefore be ready for the operators to regularly launch attractive promos to keep you loyal. If you decide to go with this platform, take note of this so you don’t miss out.

Pros

Here I have listed the main pros and cons of Trading 212. Some of them are based on user reviews that I had a look on.

- Everyone’s favorite: Zero Commission on unlimited number of trades

- A vast amount of free educational videos and other materials available to everyone interested in learning more about financial markets

- Very easy to learn and user-friendly mobile app. It is free and easily downloadable to anyone using either iOS or Android and despite its simplicity it offers a broad range of features and functionality.

Cons

- Trading 212 is fully optimized for mobile users and some more frequent traders may see that as an issue as they prefer to use a terminal, typically with several screens.

- Some more experienced users might prefer MetaTrader4 platforms to the bespoke Trading 212 trading app.

- May not be the best choice for trading cryptocurrency

- Difficult to withdraw large sums of money (over £250 000)

Long story short

If you’ve skipped all the way to the conclusion, then these main points should be help you to make your decision.

Firstly I confirmed that Trading 212 is a legitimate broker, mostly because it is in compliance with the regulatory bodies in the UK as well as several others in Europe. Since these bodies were enacted with protecting consumers, you can be assured it isn’t a scam when it comes to legislation.

Firstly I confirmed that Trading 212 is a legitimate broker, mostly because it is in compliance with the regulatory bodies in the UK as well as several others in Europe. Since these bodies were enacted with protecting consumers, you can be assured it isn’t a scam when it comes to legislation.

Next, we noted that as the main aim of this online trading platform is to democratize the financial market, it targets people who would normally be excluded from trading activities such as young people and middle to low-income earners. It hopes to attract them by offering zero commission on unlimited number of trades

Furthermore, we found out that although Trading 212 doesn’t use a MetaTrader4 trading platform, its proprietary platform offers just as easy to learn user interface as MT4. It also offer a great deal of features and functionality.

When it comes to products, you’re just as likely to find whatever asset you want to trade on Trading 212 as on any other online broker’s sites.

One of Trading 212 best features is the ability for account holders as well as ordinary visitors to access quality educational tools on investment.

Although most people gave glowing reviews after using this trading app, some found that it excelled at some sections more than others.

For example, it isn’t considered the best place to trade bitcoins. Of course, we also noted that some of these complaints about their inability to trade cryptocurrency were made during highly volatile times, so it’s likely it affected the whole industry and not necessarily Trading 212 alone.

Conclusions

To conclude, Trading 212 is an excellent brokerage service that I would recommend to traders with different range of experience.

It is a revolutionary company that has taken a mission to make trading accessible to everyone irrespective of their experience or income.

So far all their services including the impressive trading app and tons of free education available to everyone on their website have proved they are really good at what they do.

Just have a look at their demo account first if you’re interested and you’ll see yourself.

![Etoro Review – My Honest Opinion [+TUTORIALS]](https://foxytrades.com/wp-content/uploads/2018/03/Etoro-Review-100x70.jpg)

This is another bad trading experience I got ripped off by a bogus broker recently it was impossible to get a withdrawal even after several attempts. I had to hire a recovery firm to get my money back. Glad this is finally over for me.

Most of these broker cant be trusted I was burned by this broker getting a withdrawal was very difficult I had to hire a recovery solution firm to get my funds back. infoamy8atgmaildotcom

I’ve been with this broker for a long time. I had good service and communication. Relatively quickly withdraw money, BUT ….. Until when problems started. They have a frequent collapse in the server and this is not a coincidence! They had a lot of hurt people with BTC trading, They just closed open positions without warning. My positions were also closed after a crash in their server for more than two hours. When they recovered everything was a mess! I was offended by more than 4k and did not meet understanding! They behaved arrogantly and relied on my helplessness. Do not invest in this broker, They have no scruples to take the money in one way or another. They will deceive you !!!

TRADING212 NOW OFFER A FREE COMPANY SHARE (up to £100 or 100EUR) signing up bonus!

Deal is: Sign up with Trading212 via this link trading212.com/ref/3nMXB8V , open a real investor account and deposit £1. Wait (up to) 24 hours you will be credited with a real company share up to the value of £100. I’d also be given a share for you signing up.

As the name suggests, Trading212 is an indices trading platform of the ‘inverted candlestick upwards pressure movement” variety. If you’re into that you can play with your share, or just cancel the position and withdraw back to your card after 3 days.

I was given ABN AMRO (20 euros). Wife (who I referred (tip there..)) had Infineon technologies. As always, do your own research, not a recommendation etc.

They demand to be able to see your account numbers if you provide a bank statement otherwise they don’t allow the bank statement as proof of address. Dodgy as hell! No other financial institution makes that demand, in fact most tell you not to provide the account numbers.

I’ve been waiting for over a week for a withdrawal and nobody is communicating

Hi just wondering if any one knows how to close the account I can’t find it anywhere?

I am currently looking into this company and some people saying it is good and some saying avoid, I found this on a facebook page where someone else was trying to close their account and this is the information they suggested, ‘Info@trading212.com you have to email here to cancel’. I don’t know if that works but maybe it will help you too.

Is this a legit free share offer or a scam?