Table of Contents

Looking for ways to extract money from the markets and thinking that the Forex or the stock market is too complicated? In today’s article, I’m going to introduce to you a fairly new concept called social trading platforms.

With these platforms, you can make money without the hassle of having to trade by yourself – you can just copy others who know what they’re doing.

What are social trading platforms?

You may be familiar with social networks but never heard of social trading platforms before. Social trading platform/network is similar to the social network. Instead of seeing someone sharing photos, you see them share their trading results.

The most important feature of a social trading platform is the ability to copy other traders.

If you think a trader is successful and has the same investment style as you, then you can choose to copy that person. It means all his open transactions will be automatically copied

into your account.

Several social trading platforms also equipped with chat or comment features. It opens the possibility to learn and discuss the market in real-time – another feature similar to social networks.

You don’t need to give out your personal information or access to your account, as the “copy” feature is automatically done by the system.

The social trading concept also gives benefit to professional traders. These are traders who are usually being copied by beginners. They receiving a small fee to motivate them, and they earn an additional income as money managers.

The reason social trading platforms are growing exponentially is the combination of professional traders’ skill and beginner traders’ capital.

Since the professional traders will receive a fee from their followers, and beginners can make money by copying, it’s a win-win solution for both types of traders.

Benefits of Social Trading

There are several benefits of social trading, such as:

-

- Open concept – all gains or losses from a trader will be disclosed automatically to their followers.

-

- Passive income for beginners who copy successful traders

-

- Additional income for professional traders

- Opportunity to discuss and learn more about the markets and about the strategies of the pros.

While having several strong benefits, social trading platforms also have their disadvantages.

For example, the professional traders are not selected by risks or experience. Usually, they are people with skill and luck until they passed the minimum trading criteria to be considered as a professional. Followers need to learn about risks on their own and decide carefully whom to copy.

There are also complains about copied trades having high slippage. This may happen as a result of poor internet connection. Many social trading platforms have eliminated this risks by letting traders set a maximum acceptable slippage. It means if the actual slippage exceeds your parameter, the trade won’t be copied.

What kind of Trader are you?

We already mentioned above that beginners need to understand the risks and their own investment style before copying others. Ask yourself these questions to understand which traders you should copy:

-

- Do you want to make short-term profits or long-term growth?

-

- Can you deal with negative results for weeks or do you want instant profits?

- How much risk are you willing to take?

There are usually 2 main types of traders on the social trading platforms – day traders and long-term traders.

Day traders are those who are after short-term profits, and will open and close their positions during the same day.

You are less likely to suffer massive losses by copying these traders.

On the other hand, long-term traders will use their own strategy to read the market and leaves position open overnight. This kind of traders are thinking that the forex market fluctuates and won’t continue in the same direction all the time.

If you copy the long-term traders, you may get higher profits than the day traders do. However, keep in mind that you may experience bigger losses too.

Overview of the 2 biggest platforms

Now that you know what a social trading platform is, let’s take a look at 2 of the biggest platforms out there.

eToro

eToro was founded in 2007 and currently served as a leading social trading platform with over 5 million traders globally.

This site is for entry to medium level traders, just because the platform is so easy to use.

The web or mobile interface is clean and easy to understand. You can make your own trades or copy others. You can easily copy which traders to follow based on their trading style, performance, risk score, etc.

These traders will receive a small fee, to motivate them that someone like you is copying them. Do not worry about this fee as they are low and won’t affect your account much. Consider it like this: if the traders are good, they should earn you bigger money than the fees.

Other than the ability to copy others, eToro also implements social sentiment. You can see what other traders are thinking about each stock or currency. They also provide an abundance of free trading education, just spend a little bit of your time to watch their educational videos.

Tutorial on using eToro

Now, eToro may not be the cheapest broker, since they required you to deposit a minimum of $200. However, if you aim to copy other traders and learn from them, then this platform is right for you.

Here is a tutorial and tips to copy others on eToro:

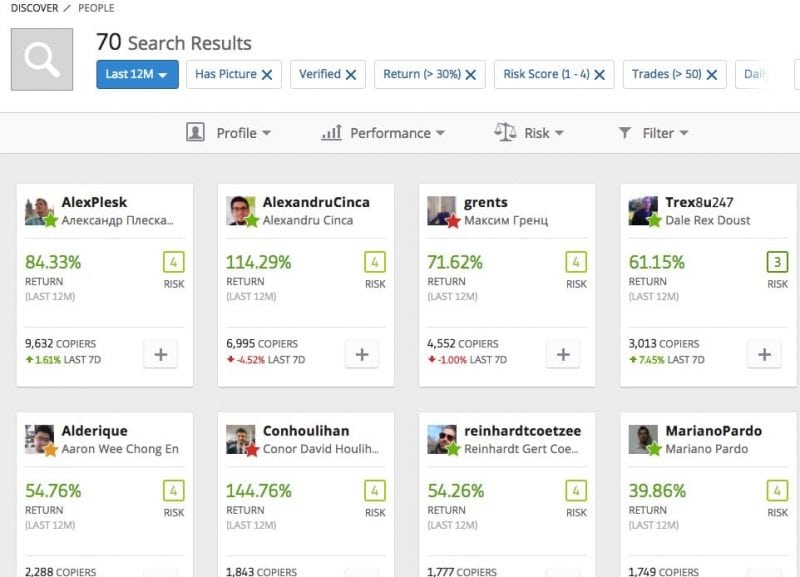

#1: Invest time to find the traders that have the highest return while keeping a good risk score.

#2: Use filters to your advantage – filter them by time, profile, social, and most importantly, by performance.

In the performance filter section, choose the return for 30 % (since there are fees involved in copying others, it is better to look for traders with a minimum 30% return).

While in the profitable months’ section, choose 70%. Profitable months means the number of months in a year the trader had profit. Every trader will have losing trades or losing months. By setting it to 70% then you will find the cream of the top.

Next filter you want to set is the Risk filter. Set the numbers from 1-6 in the Risk Score part, so that the result will cover riskier traders. Set 5% in the Daily Drawdrown to keep your risk under control.

Daily Drawdrown helps you set the maximum percentage of money the trader lost per day. So, by setting it to 5%, the result will include riskier trader with5% risk per day. Remember, the higher the risk, the bigger the rewards.

#3: Sort them based on “Return” – although technically all the people pop up here are those who fit your criteria and you could pick any of them.

By sorting based on return, you can check which one of them have the most return in the past months. Don’t be lazy to click on the profile and check them out.

Check out his past performance, risk score (remember the higher the number means riskier trader). Also, check the copiers part of the trader profile. it lets you know how many people are copying this trader, and the amount of money they put on him.

Next is to check their Max Drawdrown to analyze their risk and return ratio. The smaller the number on this and the bigger number on a return is what we want.

Last, check his Trading Stats, which shows how much transactions this trader had in the past months. We want an active trader with more than 75% success.

Also, be aware if a trader only trades in one instrument. There are cases that traders made their own copier accounts – meaning he copy himself. It might look good on the profile but usually, this kind of trader only deal with one kind of instrument.

Choose at least 10 traders to minimize your risk. Remember the old saying “never put your eggs in one basket” rings true in any kind of investment. By diversifying your capital to 10 traders, it will minimize your overall losses.

eToro is a very good platform for beginners. However, for advanced traders, there are better platforms out there for pure trading purposes.

Zulutrade

Zulutrade was founded in 2007 and considered as Forex auto trading platform. The main uniqueness of Zulutrade is that it enables traders to share their knowledge with beginners who are interested in learning to trade. Traders can leave comments and also see live feeds of others.

Similar to eToro, Zulutrade is also a social trading platform where you can either trade or copy other traders to make money in forex. It is meant for beginner traders or people who don’t have time to do the trading. However, Zulutrade has a slightly higher deposit than eToro, $300.

Not just copying other traders, Zulutrade also gives the ability for you to trade on your own. The platform is easy to use, and you may feel like playing a game with real money.

Tutorial on using Zulutrade

By using a social trading platform such as Zulutrade, you can locate the top 5 traders who are able to make profits out of their trading venture.

Here are the tutorial and tips to copy others in Zulutrade;

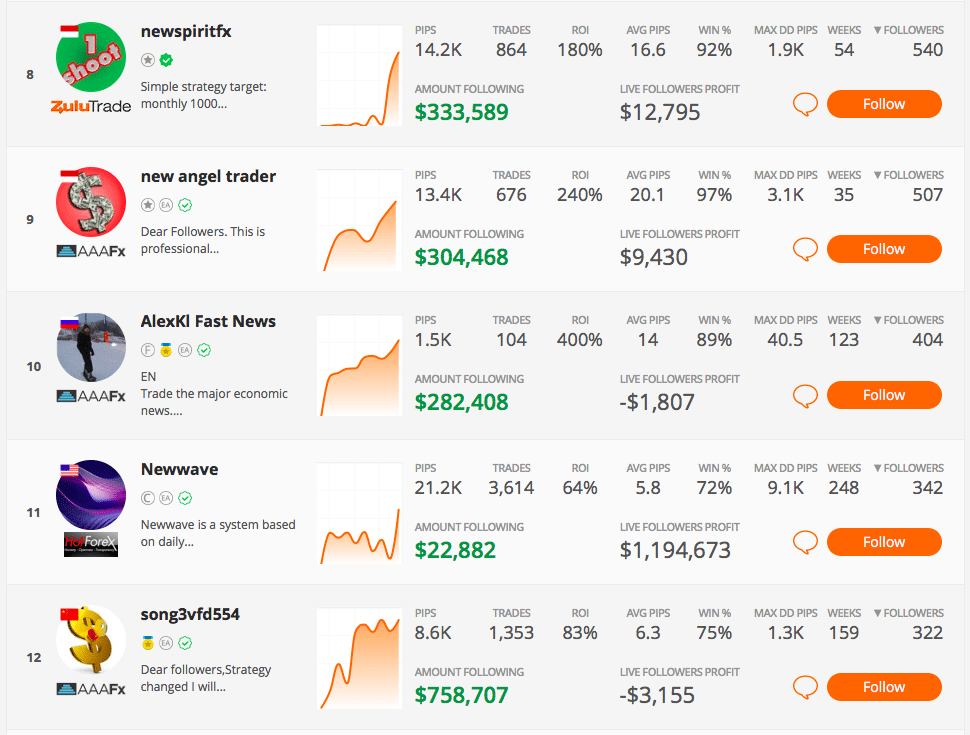

#1: Search the top traders – traders are ranked based on the total amount of money others put to copy them. Just check the top 5.

#2: Click on each profile – you need to learn the trader’s stats, choose traders who have minimum 75% winning ratio. After checking and confirming everything is okay, just click the orange “Follow” button.

#3: Define the ZuluGuard – there is a pop-up box that appears everytime you hit that follow button, and you need to define some values.

Choose the amount you want to use for copying the trader – this is based on your available funds. Just fill with a percentage (75% is the maximum percentage). Remember to spread your funds to different traders.

Choose the number of lots you want to be executed in your account. Generally, it means how much size to use for each trade that is copied. Usually, people just fill with 0.1 lots.

After that, you are all set. Since there are many profitable traders in Zulutrade platform, you can choose whoever suits your risk preference.

Overall, Zulutrade is great for beginners who want to copy the success of professional traders. You also can learn their strategies by asking questions to these professionals or even try to play on your own.

Finding professional traders

Here are some tips on searching the professional traders to copy;

-

- Look at their winning percentage. A high number of winning percentage may look good, but the high numbers can also come from the traders who keep on losing until they eventually succeed.

-

- Observe their performance in the longest time possible. Choose traders with the most consecutive profitable months.

-

- Look at the comments the traders leave. Logically, if a professional trader often comments and discuss their market views, it’s possible they are following the market closely. You may want to follow this type of guy.

-

- Also, look at how the followers leave their ratings and comments. Since the social trading platform is very vocal, they will leave a comment or give a rating for someone deemed as professional– or whether the traders change their strategy resulting in massive losses.

- In Zulutrade, look at the“Profit made from following this trader” table, located on the left side under the statistics. This table shows the real money that other followers have made with this trader so far. Any amount above $5,000 means that a trader has gained people’s trust. Also, try to avoid traders with profits below $500.

Conclusion

Whether you are a beginner or a more experienced trader, it’s wise to consider utilizing social trading platforms to your advantage.

They are a great tool to diversify your portfolio with a good risk/reward instrument. Always remember though that never put your eggs in one basket – the more you diversify, the less risk you will have.

![Etoro Review – My Honest Opinion [+TUTORIALS]](https://foxytrades.com/wp-content/uploads/2018/03/Etoro-Review-100x70.jpg)

Great! Thanks for sharing the information about Forex trading. keep posting.

Hello, I’m Hannah. Have you tried other online investments? I was once hesitant to invest my money online. Recently, i found Zuma Investment LTD, a registered UK company, I tried venturing into online investments because I was personally attracted to their investment programs. This is their website: http://www.zumainv.com