Today I’m going to bring to you my fresh from the oven Tim Sykes review- the biggest Day Trading education provider/salesman under the Sun.

Picture source: Inc.com

The main aim of my Timothy Sykes review is to actually find out if he is worth your time and hard-earned money. Will his teachings help you become a profitable trader or should you run the other way.

I do my very best to save you time and money with this (hopefully) entertaining Timothy Sykes review.

Review: Tim Sykes

Use: Day trading chat room, alerts and education service provider.

Effectiveness

Price

Beginner-friendliness

The trading strategies Tim teaches are effective and can make you money. He has 4 students that have become millionaires and all of them teach in Tim’s chat room and training programs. His most successful student has made over $7,000,000 in profits.

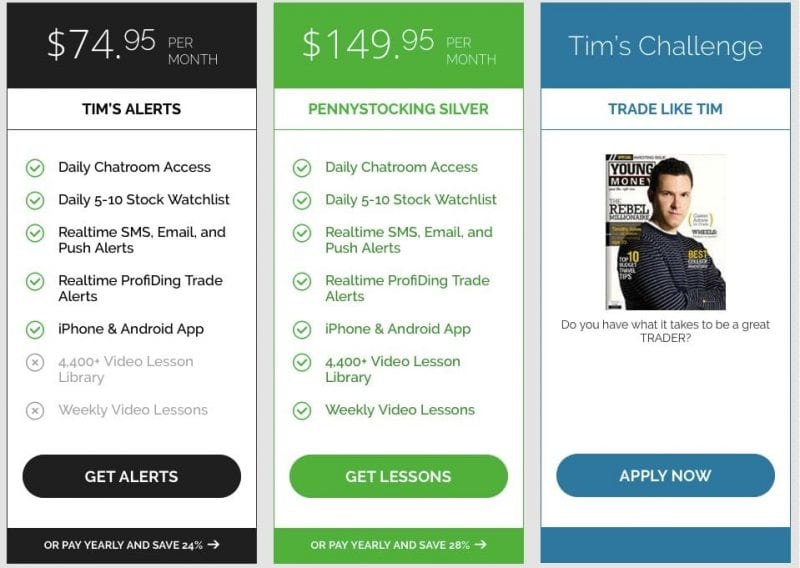

The basic service – Tim’s Alerts is the cheapest option on the market. However, I do recommend the Silver package, as you’ll also get the video lessons. The video lessons are the key to learning the strategies.

The chat room and the video lessons are geared towards beginners. However, if you already know your way around the markets, you’ll be OK too. Tim has put out over 5000 videos to learn from.

What I Like

- Very beginner friendly

- Trading strategies that work

- Easy to understand video lessons

- Other pro traders in the chatrooms

- Ability to ask questions

- Quality stock picks & trade ideas

What I Don't Like

- Tim's super salesy marketing style

- Chatroom software could be better

- Not the best option for advanced traders

Summary: Overall I think that Tim Sykes is the best option if you’re looking for proper day trading education or just good stock picks. I’ve tried out and reviewed a number of competing services, but none of them match what Tim is offering. Seriously.

Table of contents:

- Who is Timothy Sykes?

- What is Timothy Syke’s Strategy?

- Are his Claims of Success Really True?

- What is Timothy Sykes’ Net Worth?

- Timothy Sykes’ Rich Students

- The Education Options Timothy Sykes Offers

- Is Tim Sykes Worth Your Time and Money?

- Feedback from Others

- Conclusions

Ok, lets start off with a formal introduction of the rich jew:

(or click here if you already know who he is and want to skip this part)

#1 – Who is Tim Sykes?

Timothy Sykes is a famous penny stocks trader and educator who has been brought to fame by a TV show – Wall Street Warriors. He was featured as a reckless young day trader who was starting a hedge fund from his dorm room.

I’ve embedded the full episode that introduces him, in case you’re interested.

After receiving a ton of emails since the show went live, he decided to start selling his trading education, which has now grown into a business that is making him 10s of millions of dollars every year.

Yes, that’s right. Timothy Sykes makes north of 10 million a year from selling his educational products on trading, over 10 times more than he makes with trading itself. This was a huge red flag for me when I discovered the fact.

Although if I come to think of it, he was making about a million per year on average with trading penny stocks while having to take significant risks, the education gig has a much higher potential with little to no risk.

There is nothing wrong with focusing on selling education as long as there is real value in the education that he provides, which is something that I’ll get into in a bit.

But going back to how he made his first million from his dorm room and by the age of 22 at that, it started when his parents gave him bar mitzvah gift money worth $12,415 with the thought that he would waste it and learn the value of money.

Well, plot twist, the young Tim turned that bar mitzvah gift money into more than $200,000 in two years time. He admitted skipping classes just to trade penny stocks and it paid off.

By the time he reached his senior years in college, he was already a self-made millionaire. When he was interviewed by Under30CEO, he was asked “how the hell did you make $2 million from your college dorm room?”

To which Tim replied that his first million in the penny stock industry was made through trading hyped up penny stocks. That was when he discovered stock market patterns that were “predictable 90% of the time.”

It’s “pattern recognition, like a pendulum,” he added. Tim said that his early exposure to penny stock trading was about taking small gains almost every day and the gains just added as days pass by.

#2 What is Timothy Sykes’ strategy?

Really now, if it’s pattern recognition, you may think there must be some sort of strategy, right? Well, the famous penny stocks trader did share that he has a trading strategy.

Without it, you’re just gambling.

Cut losses as early as possible

The first-day trading strategy (and the top rule) is to cut losses as early and quickly as possible. This means that if a stock turns against you, exit immediately. Some people hold and hope that their penny stocks will rally.

Sometimes, it does increase but Sykes said he would rather move forward to the next play. He reminds those who are interested in stock trading that penny stocks are subject to extreme changes and are highly volatile.

As such, if the price action begins to move against him, it would get out quickly. This is also why liquidity is important to him. If the company is too illiquid, it isn’t easy to exit easily.

Look at the stock charts and recognize patterns

Another strategy he teaches his students who are a part of the highly coveted Millionaire Challenge, also known as Tim’s Trading Challenge, is to learn how to read stock charts and spot patterns from there.

I’ll talk more about the Millionaire Challenge in a bit.

Use technical analysis

Sykes shared that he has various students who are a part of the Millionaire Challenge and they have already crossed the million thresholds. These are the ones who focused on technical analysis of a penny stock rather than fundamentals.

The Timothy Sykes Training program teaches the value of determining penny stocks that are on the move, buying these stocks only when the momentum kicks off, and selling them as the momentum drops.

Does this mean fundamental analysis is not helpful? Well, Sykes said it’s more applicable for long-term investors. For short-term and new traders, technical analysis is better.

Know all possibilities

When Sykes mentors new traders, he also teaches them the common strategies and how each works. Some of these possibilities include:

- Day trading (trading stocks within the same day)

- Swing trading (same with day trading, but you hold the position for months, weeks, or days, depending on the trade)

- Position trading (can be used by master and new traders in a bull market although it usually fails in a bear market)

- Scalping (a trading style that specializes in gaining from small price changes. Think of this like micro-moments but this strategy requires intense stamina and concentration)

For new traders, Sykes recommends they go for day trading penny stocks. But regardless of the trading strategy you adopt, education will be very important.

If you don’t know a thing about a given stock, wouldn’t it be difficult to know its potential price action? he said.

You might be surprised, though, that Tim’s trading strategy reminds people that trading for profit is not a walk in the park. If it was, then every person would probably be doing it. No matter how prepared you are, you won’t get things right all the time.

But once you learn a variety of trading setups and styles, you can also hone in what makes sense to you and apply the best trades where you have the most consistency. Tim said the reason why he shares his stock trading techniques is so that others can learn from them.

In the end, he wants his students, whether from the Pennystocking Silver plan or Millionaire Challenge, to become self-sufficient traders.

#3 Are his claims of success really true?

There are so many snake oil salesmen selling stuff online, that an average internet user such as myself has become super skeptical of anyone making claims.

However, in Tim Sykes’ case, I do not believe that he would have been in the reality show if he didn’t have some sort of success. So he must have done something right.

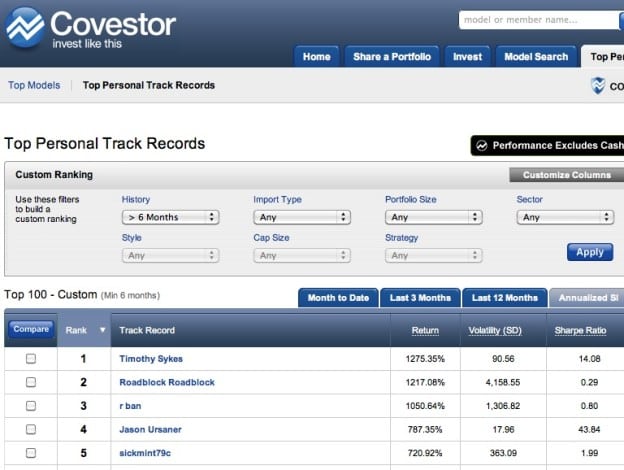

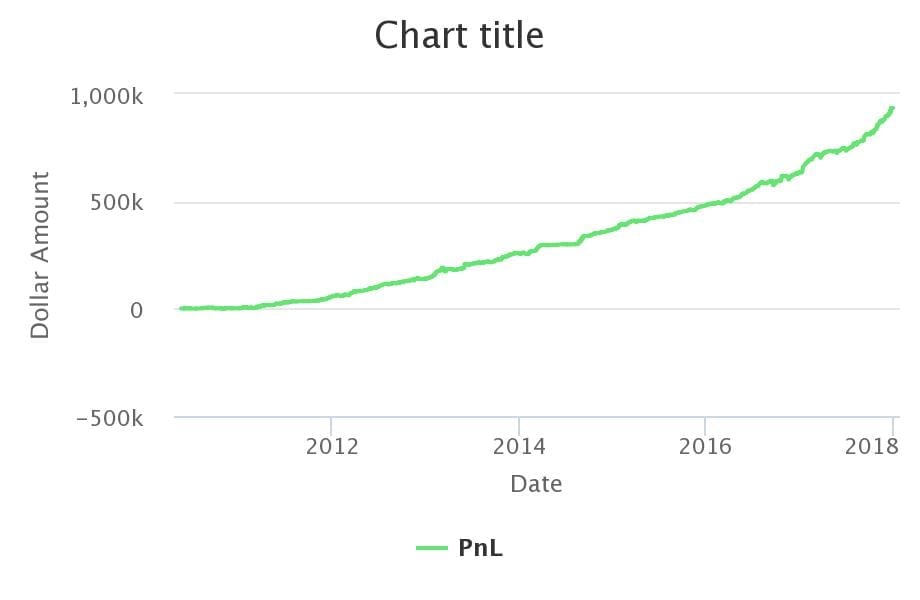

One very convincing proof of his actual success is the fact that Tim Syke ranked as a top trader on Covestor.com for 4 consecutive years. That is something that I don’t think is fakeable.

Now Covestor was a site, where your trades were automatically transferred to the website stripping you from the option to fake your results.

This means that his Interactive Brokers account’s results were directly uploaded to the website and anyone who wanted was able to copy his trades for a management fee, which was paid to Timothy Sykes.

Covestor has now been acquired by Interactive Brokers. But the same concept is still alive via various social trading sites such as eToro.

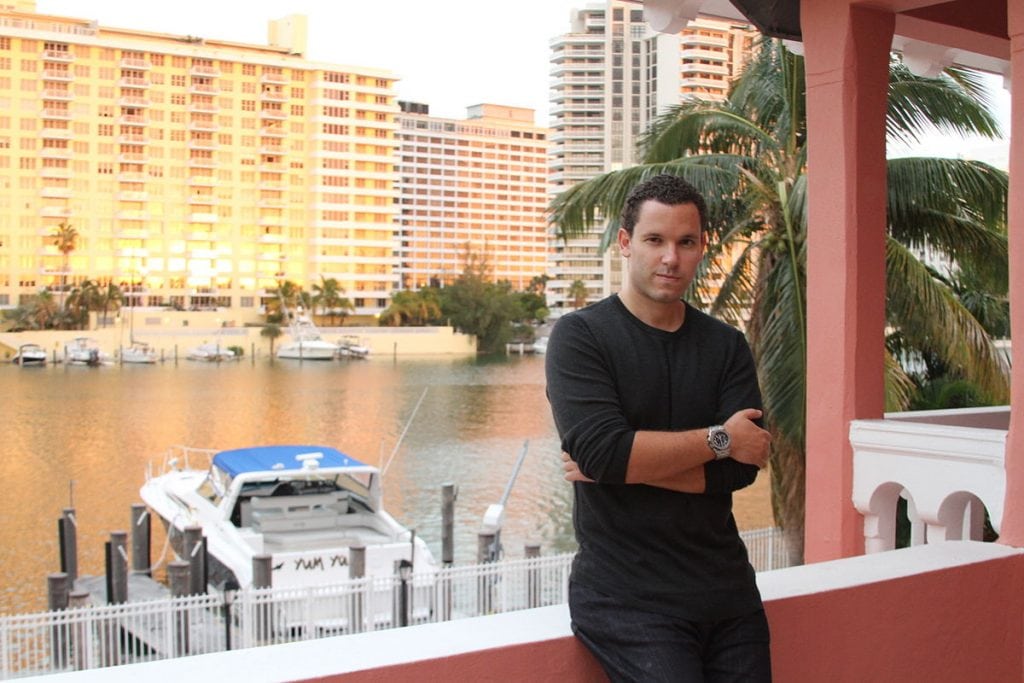

#4 What is Timothy Sykes’ net worth?

The fact that Tim Sykes is trading penny stocks and maintains a lavish lifestyle depicts the image of “The Wolf of Wall Street” and I myself was, at first, not sure if he is a charlatan or the real deal.

If you look at his Instagram feeds, you’ll see him in huge mansions, having wads of cash, traveling to exotic locations, and driving fast cars.

His net worth is about $15 million in the previous years, but most of it comes from teaching new traders in their quest to learn how to trade rather than Sykes trading stocks himself. Like I told you earlier, this was a red flag to me in the beginning too.

Fast forward in 2020, his net worth reached $20 million. His trading profits reached about 57% in 2010 and this skyrocketed to 237% in 2016. Okay, so this changed my perspective as there seems to be value in his teachings.

The fact that he has not kept his success and growth confined to himself is also quite something to me. Many of his students do claim that there is value in the penny stock lessons he provides.

Today, he is sharing his more than two decades of blood, sweat, and tears in stock trading to more than 3,000 “students” living in over 70 countries. Budding traders can take advantage of Tim’s Alerts, where Tim himself is posting his trades in the comment section.

He also shares his Pennystocking Silver watch list every morning.

#5 Tim Sykes’ Rich Students

Throughout the years, Timothy Sykes has managed to make a few millionaire traders through his educational courses, including Pennystocking Silver membership and Tim’s Alerts.

He has actually trained people to the level where they have become millionaire traders with Tim Sykes’ education.

There is currently no other trader providing education publicly, that has their students reach this level of success. Below you can see him with his #1 student Tim Grittani on Fox News.

Below I’ll list the most successful students of Tim ranked by how much money they’ve made from trading:

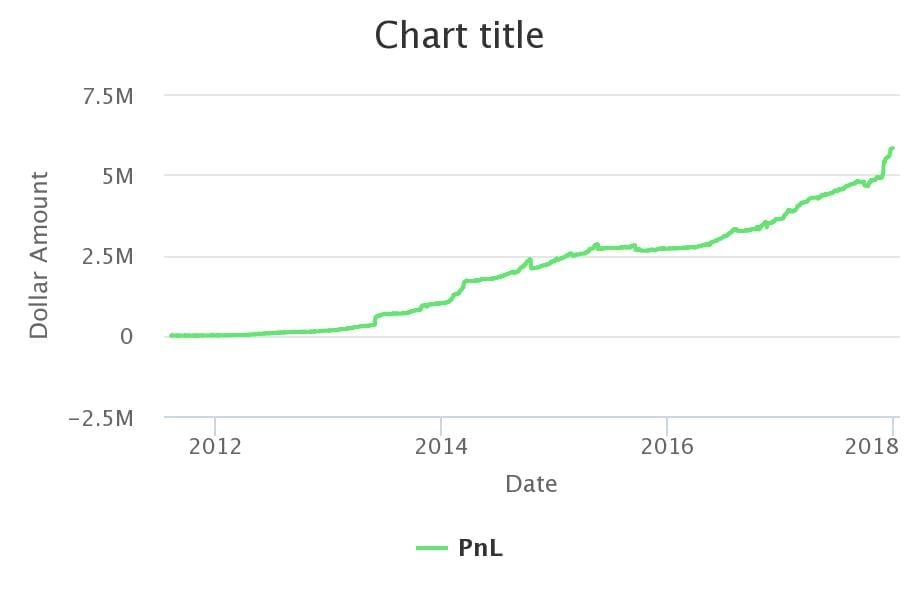

#1 Tim Grittani, up $5,000,000+

he same guy from the above picture. As soon as he reached above 1million, they appeared in a number of news articles and TV programs.

Grittani has made over 5M$ since joining Tim Sykes’ chat rooms and Millionaire Challenge and learning his methods.

He has said that he owes his success to the teachings of Sykes, however, Grittani has now managed to develop his own methods and trades based on his personal strategy.

Grittani has also published a Tim Grittani DVD back in 2017, where he covers his main trading methods and strategies.

Tim is also an active member in his former teacher’s day trading chat room. I’ve almost always received an answer when I’ve asked something from Grittani.

In Tim Sykes’ website, he admits that some people are saying that his Millionaire Challenge doesn’t work.

But the fact that Tim Grittani and other millionaire students that succeeded him surpassed millions in profits are proof that the Pennystocking Silver program and Millionaire Challenge do work if the students have what it takes to study the materials provided to them to learn about the penny stock industry.

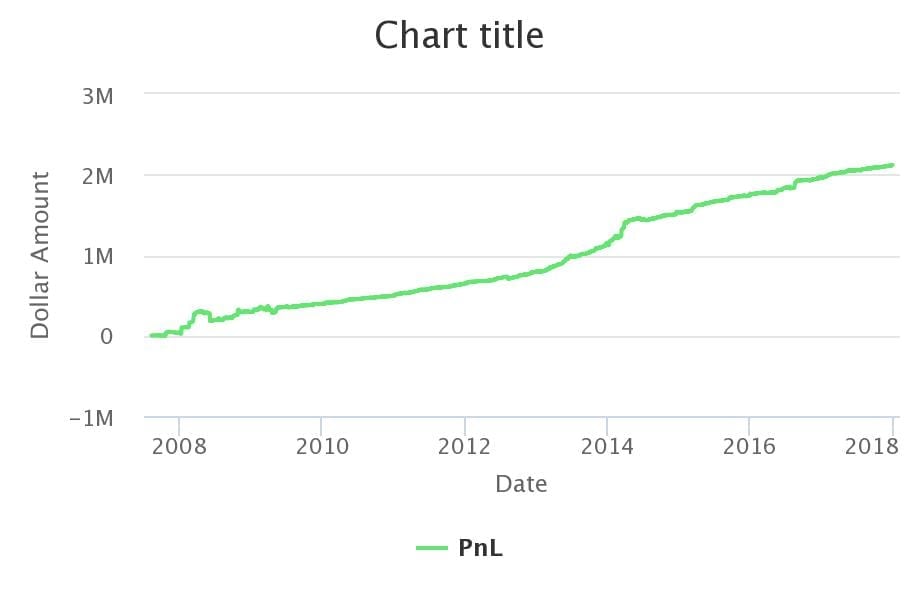

#2 Michael Goode, up $2,000,000+

Michael Goode is a cool, down to earth guy. He used to be a Tim Sykes’ #1 hater and decided to do a case study and prove that Tim Sykes is a snake-oil salesman.

In fact, he loudly mentioned what utter BS the Millionaire Challenge and strategies were.

So, how did it go? You can read about the full story from this article. Long story short – he ended up making money with Tim Sykes’ teachings. Within a year, he broke is $1 million profit mark.

You could guess it turned him from a hater to a supporter of Sykes’ program.

He now teaches in Timothy Sykes’ trading challenge and is also an active contributor to the trading chat rooms.

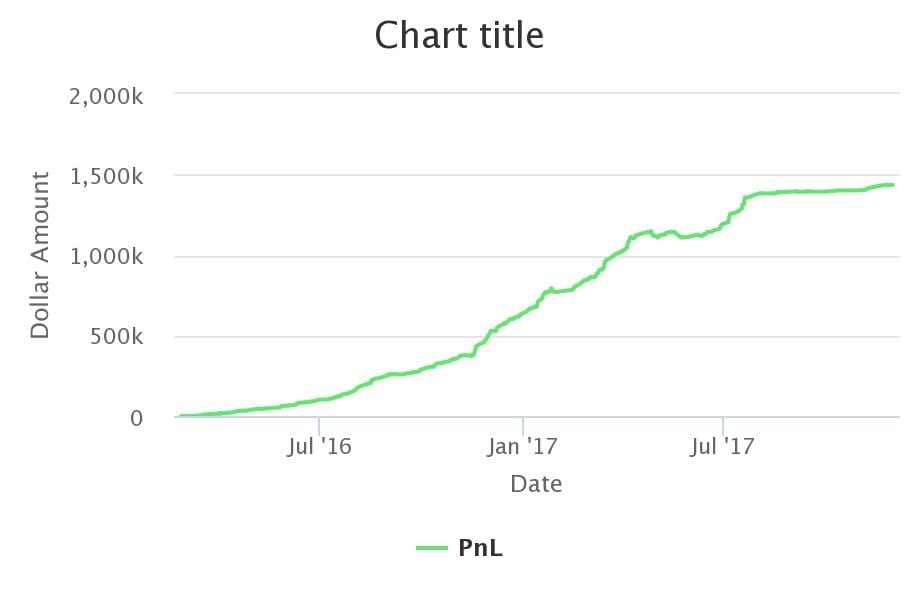

#3 Steven Dux, up $1,400,000+

Dux is a relatively new trader. He started in 2016 and flew past the million-dollar mark at the beginning of 2017.

That is super fast. He claims to owe his success to extensive studying of Tim Sykes’ methods.

Dux is originally from China and started trading while studying in an American university. He is rather active in Sykes’ chat rooms and he has recently launched his own DVD providing day trading education.

You can find it from his blog. It’s got some good reviews, although I haven’t personally bought it yet. I’m planning to and once I do, I will give out a full review.

#4 Marc Croock, up $900,000+

Marc is another one of Tim Sykes’ students that has managed to become successful.

He is yet to pass the million dollar mark, but given his steady results, he’ll end up there sooner or later.

Just like Grittani and Goode, he is also a moderator in Tim Sykes’ Sykes and an educator, publishing numerous videos with Tim Sykes on their trading strategies and specific trades that they made.

#6 The Education Options Timothy Sykes Provides

Sykes offers a tonne of material of him teaching his methods. He has tens of DVDs, trading videos, webinars, Pennystocking Silver membership plan, and live day trading chat rooms.

The DVDs

If I were to choose a DVD, I’d start off with “How to Make Millions“. It’s rather cheap and all the money that he makes from this particular dvd goes to charity.

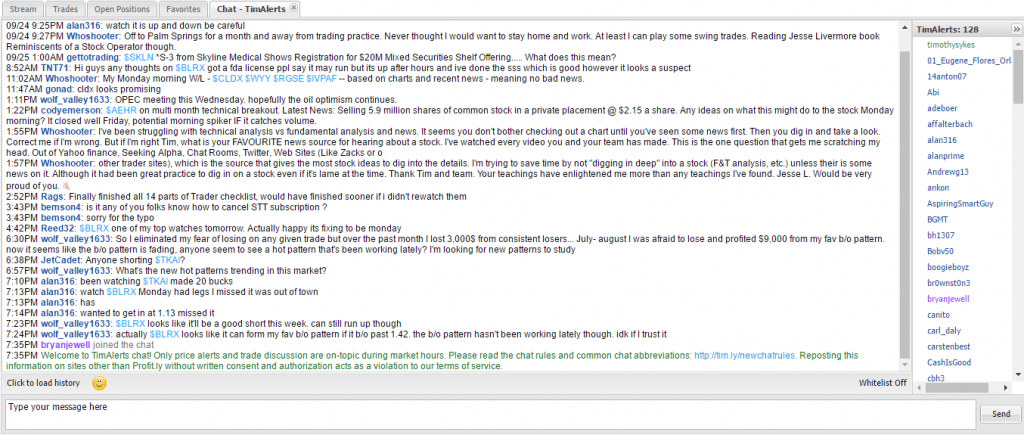

Day Trading Chat Rooms

The main thing that Tim Sykes offers and from where he makes the most of his money is his chat room service.

What it is, is a day trading chat room, where Tim and all the other chat room members announce their stock picks and if they’re buying or selling.

TIM ALERTS

The cheapest option – Tim Alerts, does just that. What you get to see are the stock picks and the relevant discussion that goes around it.

Various other traders (both pro-s and noobs alike) discuss the stocks in play and whether they are in or out. You get to ask questions publicly or privately to the person you want to chat to.

However, what’s missing from Tim’s Alerts chat room is that you don’t get the video lessons. So you don’t get to see the weekly video lessons that Tim puts out of the recent plays and the reasoning behind the trade executions.

Pennystocking Silver Plan

The second option – PennyStocking Silver, is the same chat room with weekly video lessons and you also get to access Tim’s archive of videos (there’s over 5’000 of them at this time).

In my opinion, the PennyStocking Silver is the best option to go for. What the pennystocking silver plan membership does is it teaches you how to fish in addition to just giving you the fish.

I like this option as you actually get to learn the ropes and see the logic behind the trade ideas.

The PennyStocking Silver gives you access to a comprehensive video lesson library to learn about the stock market, hedge fund, and more.

Once you’ve watched the video lessons from the PennyStocking Silver member platform, the patterns begin to repeat themselves and you start to come up with your own trade ideas. So you could ultimately become self-sufficient.

Tim’s Challenge (Millionaire Challenge)

This is the most serious, yet by far the most expensive option to learn from Tim. It costs around $5,000 to Sykes.

But what that money gets you is private consultation and trading education programs that are more like mentorship. Timothy Sykes puts the most amount of focus on the students of the challenge program.

This doesn’t mean that the other programs are not worth the money. I think they are better in terms of value for money, but the challenge program would increase the odds of success the most.

This is the most serious, yet by far the most expensive option to learn from Tim. It costs around $5,000 to Sykes .

But what that money gets you is private consultation and trading education program that is more like mentorship. He puts the most amount of focus to the students of the challenge program.

This doesn’t mean that the other programs are not worth the money. I think they are better in terms of value for money, but the challenge program would increase the odds of success the most.

#5 Is Tim Sykes Worth Your Time and Money?

In terms of trading educators, I truly think that Sykes is currently the best option available. Provided that you’re not able to land a job in a prop trading firm 🙂

Your chances of true success are at least 50x better than if you were to start out on your own, in my honest opinion.

Trying to figure trading out by yourself is an expensive venture. You will likely lose a significant amount on market education. Most people blow it all and quit trying.

My resolution is that yes, Sykes is worth your time and money, but you really need to put in the work to give yourself a chance of success.

The good thing is that he provides a system that actually works. Your part is to truly learn and implement it.

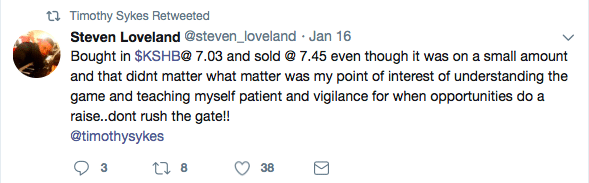

#8 Feedback From Others

Tim has a rather substantial amount of Twitter followers. There seems to be a substantial amount of traders that are trying to learn from Tim.

I think that as he is the only guy who has publicly shown his students actually making a substantial amount of money with Grittani at $5M+, Goode at $2M+, etc.. people tend to want to try the strategies out by themselves.

Also, as Tim has one of the cheapest trading materials out there compared to other guys pushing trading education, people are more prone to pick it up.

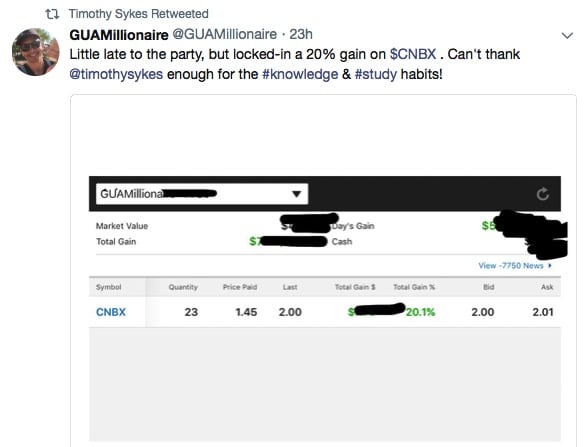

Feedback from Twitter:

Here are some tweets from the last 2 days:

I have to warn you that I didn’t find negative reviews from Twitter, I’m sure there are plenty, though.

Feedback from you guys:

I would really appreciate it if you could drop me a comment below, in case you have any experience with Timothy Sykes.

Also if there is something else that you think I should cover in this review, please let me know.

Conclusions

All in all, I like his trading style, I think it’s super interesting and helps you develop an edge over other market participants that you can utilize for your own financial gain.

He is one of the few trading educators/mentors that I dare to recommend.

Once again: if you’re interested in learning his strategies, I believe the best option would be to join his Pennystocking Silver Plan chat room.

Good luck in your trading ventures, guys!

PS! Do you have personal experience with Sykes? Let us know how it went in the comments below.

PPS! If you’re interested in annual subscriptions, there is currently a significant discount being offered – check this for more info.

Timothy Sykes FAQ

Tim uses Centerpoint Securities, but as they require a $30,000 minimum, he has recommended people starting out with less money to start with either:

- TD Ameritrade

- E-Trade

- Interactive Brokers

These are the current best options available for smaller accounts.

Timothy Sykes currently lives in Los Angeles, California. He is from Orange, Connecticut and has previously lived in Miami, Florida.

For this particular reason, Tim has co-developed a stock scanner called StockstoTrade. It’s a fast and lightweight screener that is built to find fast moving stocks.

It is also very good for finding penny stocks in particular, which a lot of other screeners don’t offer.

Tim’s best student is currently Tim Grittani. Grittani has made over $13.5M from trading based on the strategies he learned from Tim Sykes and further improved upon.

Some of his other millionaire students are Steven Dux and Mark Croock. Read this more in depth article about his top students here.

Tim Sykes uses Stockstotrade.com, a platform that he co-developed, to find stocks.

Tim’s Trading Challenge currently costs over $5,000 to get in. Also, it is advisable to have at least the same amount of money to start trading with.

Tim posts his day trading alerts and stock ideas live on his trading chat rooms found here.

He also shares some of the ideas on Twitter, but you will only see them hours after, which in most cases is too late.

Tim recommends to start with at least $1,000. However, the more you can afford to start with, the better are your chances of success.

This is mainly due to the amount of trading costs that you will occur. With a smaller account, fees will eat into your account balance and make it hard for you to return a profit.

Because most people on Wall Street are incentivised to take money from you. They are earning money on the people that they serve and thus are more interested in making money for themselves than to you.

You can sign up with Timothy Sykes’ via this link.

![Etoro Review – My Honest Opinion [+TUTORIALS]](https://foxytrades.com/wp-content/uploads/2018/03/Etoro-Review-100x70.jpg)

The way he makes money is clever. I mean, it makes sense that you make the most out of stocks that move the most. He plays low priced stocks, be it pennies or others. Those can move 10-20% per day, unlike Apple and the likes, which never move more than a few per cent daily.

I’m short on time to follow his alerts, but I am a member of the silver chat room and I would vouch for it. Also tried Warrior trading, which was complete rubbish imo.

-Rob

Hey Rob,

Yea, you’re right. Low priced stocks move the most so it makes a lot of sense to focus on those.

Thank you for your thoughts!

Insightful overview, also bought the DVD you recommended..

Will see how it goes.

Etienne, would be awesome to hear your thoughts in regards to the DVD.

What is thoughts in regards of the DVD?

But which one wud u recommend – the dvd or joining the chat rooms??

Which of them gets me the most bang for my buck?

Hi Alexie,

If I were to choose one option, I’d go for the Silver chat room. It has a tonne of videos teaching the main strategies included. So in my opinion, it’s defintiely more value for the money.

I want to buy the Pennystocking Silver chatroom thing, but do you happen to have a coupon code for it?

Hey, unfortunately there are no active campaigns for promo codes available at the moment.

There have been promotions during Xmas, but that’s a long wait 🙂

How much starting capital do I need to be able to follow his alerts successfully?

I think you could begin with as little as $500 however the more you start with, the better your chances of success.

If I were you, I’d start with a minimum of $2000 to increase my chances of success. Also if you don’t have the capital right now, you can always start with a demo account just to get the hang of it.

What is a demo account

Demo account is a paper trading account. You get to practice trading without losing real money.

They are good to get a hang of all the buttons and learning how to get in’n’out of trades.

Why do you need your ssn if you not dealing with real money?

Which education option would you pick if you were me?

I am starting with $2,000 and can spare 2-3h per day

Hi Lauren,

If I were you, I’d go for Sykes’ silver subscription option. The only way to actually learn how to trade on your own in addition to just receiving the alerts.

The trading challenge is not worth it for you, should have at least $10K to start with for that option.

Good luck!

P

I noticed that most of the students were quite young. Would you recommend this system to a retired

senior looking to enhance their very low income?

Hi Deb,

I believe the main issue is the time that you are able to dedicate to this.

Students usually have more free time on their hands compared to regular folk that have a 9-5 and a family.

As a retired person, I believe you have the same edge as students do. However you likely unable to risk as much as youngsters do, but you do have more cash to start with .

So all in all it really depends. I would still give it a go if I were you, but only invest the amount of money that you can afford to lose.

Good luck in your trading ventures, Deb!

Would you recommend Tim to a more advanced level trader?

I have been broker/trader myself, but am constantly on the lookout for new strategies and angles to tackle the market with.

Hi Killy,

Yes I would. However if you’re more advanced, you probably have more money to trade with.

Provided that the above applies to you, I would recommend checking out Investors Underground. They have more picks and are even more active.

Good luck, Killy!

Hi Paul,

What platform can u reccomend to start trading? Or what platform does Tim use? It would be good to choose demo account. Thanks

Hi Camile,

Tim himself uses Centerpoint Securities. But he does recommend Suretrader for newer traders.

Centerpoint requires $25,000 to open an account, whereas Suretrader’s min requirement is $500.

Hello, I’m just curious if this is a paid review. Like are you being paid to push the mid level silver package? This all just seems to good to be true. I’d like to give it a shot as I have some cash I was trying to get working for me, I just don’t want to get ripped off.

Smart question, but the answer is no.

I’ve expressed my honest opinion. If the review would be paid, it would have to be stated as such.

It isn’t too good to be true, as you have to work hard in order to achieve success, just like in any other business. Sykes is just the most effective option to start out on a path that has the best odds of success in my opinion.

Paul, Thanks very much for the review. I tried some day trading and aggressive investing about 20 years ago, and eventually lost well over $50k. I realized that I was not prepared to swim with the sharks. Since then I have bought only solid, blue chip dividend-paying stocks and I’ve done OK. But I do miss the thrill of trading. I’ve set aside some speculative funds and might give Sykes stuff a whirl. Your review here is a huge help.

Regards, Dave F.

Hi Dave,

Thank you for the kind words and sorry for your losses.

I hope you find a way to figure this out, this time around.

Good luck!

I see you said ” miss the thrill”, I would highly recommend reading the book “Trading in the zone”.

Hi Richard,

Yes, It’s a great book and I know what you mean. All that aside, if you get to a level where you start to consitently see green days, it is thrilling.

The point in Douglas’ book is not to let that affect your decision making.

Hello.

If I just go for the cheaper option, I get the pics and just mimic them. No learning needed. No time I have to invest. Why study if someone else like Tim had already done it and is giving me the pics. Am I missing something?

Great review it’s really hard to find someone giving an honest opinion. I have to tell you I really appreciate it.

Hi Frank,

Good question. You can just mimic his trades in order to just try and make money day trading.

I was talking about learning how to day trade yourself and become self-sufficient.

I think you’ll see more success (and money) this way.

But yes, you can just follow his alerts and trade based on them.

Just mimicking him – could this yield a steady, modest income?

Yes, I sure believe so, but do it at your own risk.

Meaning that there are a number of variables in trading. If you’re too slow, too emotional etc, your results will vary.

I just came across this blog and it’s so interesting , thanks for sharing

(I just read your comments) so when you say mimic his trades, you mean he literally posts exactly what he buys and sells and if you sit on the computer all day you can literally make the same moves and the same amount of money if you invest the exact same as him!? I mean your own added knowledge to add on top of that is amazing but that almost seems to good to be true to just lazily copy a millionaire’s moves! Right?! Am I missing something? I guess that’s why he charges money. I have absolutely NO experience trading, how do I even learn the basics (jargon and such)? How long is the Timothy Sykes’ Challenge and were you ever a student? Thanks for the article! How can I sign up JUST for the chat room you’re suggesting? Because everything clickable on his social media links toward the challenge, ugh! I am a stripper (lol) and I want to turn my cash into a profitable business so I’m not stuck stripping in my 30s haha!!. Thank you!!!

Hi Deja,

It’s not as easy as clicking when Sykes says to buy or sell. You should have to think on your own as well. Yes, I’ve seen people simply copy his every move with fairly good success rate, but I don’t think that you should stick to just following someone. Whenever he stops giving out alerts you would be out of business.

I do recomment learning his strategies to become self-sufficient, you’ll eventually earn more compared to just copying his every move. If you’re only interested in copying, use eToro instead.

The link to his chat room access can be found from here: https://foxytrades.com/go/sykes/

Hello. I found your review very helpful seeing that I’m a little anxious about starting in this path or day or swing trading. I noticed on the etoro link that it says no US traders allowed. So how exactly can I use that platform or other platforms that dont allow US traders??

Also since I’m completely new to this..I figured I could spare $500-2000 and thinking about Starting with Tim’s Pennystocks Silver account but Have you tried it yourself? Any success and if so…how soon did you gain results???

Paul,

Great review. I have been on and off about Tim Sykes since I first stumbled upon him about a year ago. I listened to a podcast interview of him by Two Blokes Trading and I gotta say I dig how he is a no bull shit guy. My question is can this be done while still in a full time job? I have zero problems putting in the effort and time to learn his teachings. In fact I would actually be interested in Tims Challenge BUT I dont have the ability to sit in a chat room all day. My goal is to have the ability to trade from home and not chained to a desk..hence my interest in actually learning and applying a proven system.

Would love your input

Cheers

Tom

Hey Tom,

Yea, it’s possible. Most people are in a similar position as you are.

It all depends on how bad you want it, just as it is with anything else in life 🙂

I do recommend taking the leap and putting in as much effort as you possibly can, otherwise you’ll never really know.

Good luck, Tom!

Hi Paul, thanks for the review.

I have been reading his stuff for the last week or so. Is it possible to go from zero knowledge (apart from last week of reading) to jump straight into the millionaire challenge? Does he guide you step by step in this instance? I understand he wants to teach students to trade off their own knowledge rather than just follow his trades (which is great) – but will he teach/show/demonstrate EXACTLY what is necessary to get started?

From my reading he is advising people to get educated, but reading about stock movements and learning about pump and dumps doesn’t tell you how to actually GET STARTED – This is where I don’t know how to move forward and am looking for advice. Am happy to start small , but how do I just GET STARTED, hence wondering if the millionaire challenge might be the best way?

Hi Seamus,

I think that the challenge is a great way to start, but it is expensive.

If you have the money to spend, it will fasttrack your learning curve, but if not, just start from Penny Stock Silver.

One of Tim’s most recent successful studens, Roland Wolf, started from the Silver chat room subscription and once he had made some money, he reinvested it into the Challenge.

They discuss Roland’s story here: https://www.youtube.com/watch?v=KnhbW8unQfI

Hey Paul,

Thanks for the info. You mentioned a Demo account above and I can’t seem to find it. What does that entail? Trade and learn w fake money?

thanks

Joe

Hi Jpersi,

There are a number of options, but usually I would recommend to go for your broker of choice. Most brokers offer paper trading or demo accounts. This means that you are able to learn without losing real money. The flipside to that is that you might get bored easily trading paper money. If that is the case with you, use real money instead, but use super small sums. Don’t be afraid to burn through commissions. It’s way cheaper than testing and learning with real money.

Hope it helps,

P

Thanks Paul

I have been watching videos all day so learning bit by bit, that one with Roland was very informative. Appreciate your advice and looking forward to getting my feet wet and learning to make some $$ once I have learnt a bit more.

Cheers

For the silver subscription, are the videos all online? Or are they literally DVD’s?

Hey,

They are online.

I’m am very new to this. When I went to Suretrader and started to read about their fees I had a question right away. What does “fees are as low as a penny per share ($4.95 minimum) and $0.50 per option contract.” mean?

Hey Lou,

They have structured pricing. Penny per share means that if you trade 100 shares, you pay one penny per share. I don’t use that option, I have a strict $4.95 per trade pricing.

So if I open a trade for 1000 shares, I pay 4.95 when I open it and 4.95 when I close the trade.

Hi Paul, I’ve read your review and all the comments. Now, I’m at the end of Timothy Sykes’ video called ‘Weekend Profits’ where he offers a weekend Caribbean Cruise to all subscribers. As far as I’m concerned, I’d rather have just one free trade to see if could actually do something with it before I commit to it. That would make more sense to me. He said the first trade would make enough to pay the $3,000 (down from the original $5,000) fee. Why couldn’t he do that so I’d have money to pay it without taking the money out of my savings?

Hey Nancy,

He has his ways of doing marketing. I have no clue why.

But, you are talking about the Tim’s Trading Challenge, which costs 5K-ish. You don’t have to jump into that straight away, choose Pennystocking Silver instead. You get a huge list of video lessons and his stock picks/trade ideas.

Hope it helps, Nancy

Good luck!

Paul

Hi paul, just a question…i have set aside a money enough to purchase tim sykes weekend trading startegy. However , will this be worth to buy I just open an account on e-trade and completely I have no idea what to do…no knowledge in trading not a single experience.

Hey AC,

I believe it’s not a problem that you’ve not traded before, it’s a good place to start.. However there are two things that I would say.

1) You need to have at least a couple grand to start trading with.

2) Try to make a few trades with papermoney on e-trade. You should do this to get the hang of executing orders. It’s not difficult, but it’s better to make mistakes when you don’t have real money on the line. You should know how to open and close positions and calculate position size before putting any real money on the line.

Hope it helps you Guillermo! 🙂

Hi paul thanks for the input…just open an account with e-trade however, I don’t know what and where to look for that penny stock so I can try the papermoney you had mention.

I heard that there is a tinkerswim that you can download tru other brokerage but not woth etrade…any suggestion? Thanks a lot

Hey AC,

I’m sorry, E-trade does not offer paper trading, I wasn’t aware of that.

The one you mentioned is thinkorswim. https://www.thinkorswim.com/t/index.html

They do have paper trading option available.

Hi Paul,

Nancy is talking about his new “Weekend Profits” (in on Friday out on Monday), that he alerts you to so you can get it on it before the weekend. It’s NOT ‘Tim’s Trading Challenge”… It has nothing to do with “Pennystocking Silver” plans… It is it’s own plan…

By the way, loved your review. He is so showy and flashy that it feels phony and fake and forced… Very huckster-ish… And the phony infomercial with the “interviewer” was too much. I liked the Weekend Profits one, with just him talking to the camera, but he got all showy again. People with true wealth are quiet and understated, not flashy and phony. And Yet…I find myself liking him and his ideas!

But he offers zero money-back guarantee, and offers zero payment plans! People who stand by their product should be ok with refunds. Or payment plans! Hey, if this is as good as he says, then there is no risk to him to accept payments in installments! But he doesn’t offer that. And who can hand him $2,995 if they don’t even know if they can open a $100 brokerage account or if they need $10,000-$20,000 just to get started using his info to start trading?! And if they don’t have enough money to open a brokerage account (which he never mentions or talks about!) then the non-refundable $2,995 is lost! Lots of red flags on that…

And yet, I really like him and like his “in on Friday out on Monday “Weekend Profits” program, where he walks you through it, and alerts you 3 times per month with just ONE simple thing to invest in on a Friday and he will notify you on Monday when to sell it! He says he will only tell us to get into ONE thing, maybe 3 times a month. Not a zillion choices of many things and not daily! 3 times a month to strike on a Friday and sell 3 days later on the Monday after…

If he had a payment plan, I’d do it immediately! But I don’t have $3000 to just hand him… Maybe someday…

Thanks again for your review!

Hey Maureen,

Very, very good points there, thank you for your opinion!

Hey, Maureen!

Take a new look at Tim’s sites now. He’s offered some discounts since then that you may be interested in.

Good Discussion,

Hi Paul – Do you know anyone who is using Tim’s weekend Trades ? Do you mind if I ask are you also Millionaire following Tims Systems ?

I wish he should consider some profit sharing instead of large fee like 5K for service.

Not sure what happens to people when they make money, suddenly they behave like Gods 🙂

Hey SP, no I’m not a millionaire yet, although I am a profitable trader.

I’ve heard the weekend profits subs have received some profitable alerts already, but I haven’t yet used it myself. I will test it out myself ASAP.

i signed up for your monthly allerts and have not yet received a email from you

Hey John,

I do not provide any services myself. You probably signed up for Tim Sykes’ chat room. In order to get the alerts you have to log in to the chat room.

You were likely sent an e-mail with instruction on how to log in.

Let me know if you have any issues, perhaps I can help.

Thank You Paul for your comment. and hope you will get there soon.

I registered for his millionaire challenge, I did not pay anything yet, but I am getting at least one new email from him with a short videos and I do not understand what is his final product, some of them just say weekend profit and chart that has blue line and great profits. But he never talks about when to get out of trades and secondly how much he is investing to get that kind of profits. for example when he says you could have made 6000 USD this weekend, he does not say now much he invested.

so which system are you using from Tim ? and can you please explain how does it work.

if try the system here is what I want to know honestly.

1. How many oppurtunities / trades the week end system shows ?

2. How do I decide which one to go with ?

3. How do I know when to get out ?

4 what is accuracy in this system ? if I have 1000 USD to trades, how much should I invest in each trades so that I do not blow up my account in 2-3 weeks because I picked up wrong trades.

Guys like Tim has to understand, people looking for such systems are not rich guys and I would say people who look for systems are either who have lost money in other systems or who needs additional funds to support family or some kind of unaccepted expenses in life. so loosing even small amount matters.

can you image millionaire like Tim does not want to refund 5000 fee if customer is not satisfied, how greedy is this person ?

Only reason I am writing this is may be you can share these comments with him, so he knows what other thinks.

Again thank you.

Paul, I appreciate your no frills review on Paul Sykes. I am really considering the silver option of the program, I have zero experience in trading, but have interest in getting started. I did consider the Tim Alerts but it seems the silver package has more value with training and videos. This is something I really want to put effort in learning. I plan to have a starting stake of 1500-2000. I feel that I could get started right away with the alerts and just copy, but as you mentioned that learning the methods are invaluable. Would you recommend going through the training and videos before even trying some of the alerts? Very excited to start this venture with otc stocks. I’m currently at a 9-5 job, well its night shift hours and they suck but it pays the bills and I would love to generate some real other income and hopefully cut down to a part time job or work less eventually. Thank you sir

Hey Matthew,

I would do some paper trading at first to get the hang of it, even with his alerts.

Once you are accustomed to entering and exiting trades with correct position sizing, you will make a lot less mistakes with real money, where emotions kick in.

TDameritrade has a good platform for paper trading. You can also use Suretrader for that. Also be mindful that most paper trading accounts have delayed market quotes (lagging behind 15 minutes).

So learn order entry and position sizing and only then put your hard earned money on the line.

Also the more you learn, the better you’ll become and the less you would lose. The hours invested into learning will definitely pay off in terms of trading profits.

Sorry for the fuzzy explanation, but I hope it helps.

Hi All

If anyone gives a shot to Tims weekend trades please share some details. if it is worth, we will work out something.

SP

Paul, Like a lot of comments I see on here I work full time from 6:00 am to about 4:00 pm and then have a full evening with 3 kids that have activities. Do you know if you need to be in the chat room all day or are the alerts sent to your email. Also,would I sign up for one of the packages and then use a paper money platform to test out the buying and selling portion. I have no experience with trading and sometimes have limited time and funds to work with. What do you think my best approach would be and how much time would I need available to do it and make some money. Thanks for the review as it was a very interesting read.

Which broker does Tim recommends ?

hey SP,

He recommends Suretrader and Centerpoint Securities when you have $25,000 or more to invest.

Thanks Paul,

So if I use different broker will there be problem in filling price while trading ?

Hey SP,

Depends on the broker 🙂 The ones that I have recommended are all doing a great job at executing orders.

Here is an update on Tim Sykes latest Weekend Profits program. I just signed up with an option to sign up for only three months at a cost of $850 with auto-renew. No refund. But you may cancel at any time before the auto-renewal. This adds up to $3400 a year compared to $2995 for an annual membership but annual has no refunds either except this guarantee, “I guarantee that our model portfolio will give you the chance to pocket at least 20 winners of 50% or more over the next year.

If we don’t… just give us a call and we’ll give you an extra year completely FREE.” Yea, big deal! BTW, after watching Tim Sykes video promotion and go to the sign-up page, move your mouse towards the upper right of the page and you will get the popup that offers you the 3-month subscription. Be forewarned after you sign up that you will be hit with a few lifetime options and other of his programs before completing the purchase. Just opt out at each link to move to completion of your order.

Anyway, I try to update here on my three months results.

Hey Phil,

Thanks a lot! Your input is super valuable.

My first weekend with Tin Sykes Weekend Profits program was a loss of about 10%. He did promptly inform members to sell on Monday when his recommendation was not moving positive. He does post all of his past closed positions in his portfolio on the website. His first recommendation started on 6/27/18. If you add up his positive and negative gains, there would be a positive result of 36%. Not bad for such brief time for each transaction. Here are the individual results starting on 6/27, 10%, 13%, 37%, 16%, -9%, 0%, -17%, -4%, & -10%. Typically, you would buy on Friday and exit on Monday, although two buys exited on Friday.

Thanks Phill, much appreciate it. Will you continue on his program ?

Hi Phil, do you have any 1 week result since joining weekend profit ? I am considering to join this program too. Thanks

Maria

Hi Phill,

Do you mind to share what is the result of your weekend profit subscription? Thanks

Is there anyone using “Weekend Profits” and are you making money following Tim’s trades? If you can prove profitablity I am ready to join Tim’s program.

Hey guys, do you think that these methods could be applied to other stock markets? I’m from Brazil, starting this trading life, heard a lot of good stuff from Tim Sykes, but I’m worried if his method is reliable to other markets.

Is there any downside to using my Roth TD Ameritrade account to place the stock buy and sell transactions that are recommended by the Alerts? Thank you.

I couldn’t see why not 🙂

Hi Paul,

Great review. Im from the UK but spend a lot of my time in India and most of the students i have seen tim involved with seem to be from the US. In your opinion would it put me at a disadvantage not living in the US whilst using his material?

Cheers

Cam

Hi Cameron,

He has tons of people who are not from the US, it doesn’t really matter.

The thing that really matters is if you are able to trade during market ours 9.30 am to 4pm Eastern time.

If you can do that, it doesn’t matter where you are located at.

Hi Phil, can you please give an update from your recent weeks email f trading?

Thanks Phil for your update on Weekend Trader. Good that we can test the waters for less. Does anybody have any results…proof that this is a legit program?

Thanks

Hi. I just recently came across Tim Sykes’ penny stocking training. With the Tim alerts vs the Pennystocking silver, does that mean I have to join the chatroom and be in front of the computer the whole day for it work for me? I’m working full time and on the road a lot. I want to learn penny stocking but I don’t know if it will work out with my work schedule.

Hi Emily,

This can be an issue. The chat room does require you to have at least a couple of hours of screen time during trading hours.

If this is a serious issue, then there is another guy that offers the same thing for people with full time jobs – his name is Paul Scolardi and his service is called Super trades. It’s specially catered for people with full time jobs.

I seriously recommend to check him out.

Hi, Paul. Thanks for the response. What would you say is the main difference between the strategies of Tim Sykes and Paul Scolardi? And do you have a recommendation as to what plan to start with if I sign up with Paul Scolardi? I was looking at Tim’s And Paul’s plan and Tim’s Alert plan seems similar to Superman’s Alerts but the former is $75/month while the latter is $147/month. Any feedback as to their similarities/differences?

https://profit.ly/guru/timothysykes VS https://profit.ly/guru/superman?aff=1611

Hi Emily,

They main difference was that Paul was mainly doing longer term plays, whereas Tim is doing faster trades.

Unfortunately Paul is not so active anymore, while Tim is more active than ever before. If I were you, I’d go with Tim.

Hope it helps,

Paul 🙂

I recently left penny stocking silver for investors underground. I like Tim’s DVDs but his online videos are so freaking disorganized and filled with fluff. Just too chaotic for me. I do trust that he knows what he is doing though. I just need a more structured environment.

Hi Phil,

I am interested in Weekend trades, would it be possible for you to share more details offline , via email ?

Let me know, Thank You

Hi Phil,

Tim claims on his videos that his looses are less than 5%, but your results show lot more and 4 looses in a row, did you ask him why ?

any new updates on TIMs weekend trades please ?

Hi guys,

What up ? no one is ready to share information. what happened ? is it working so good or not good at all ?

appreciate if some one can share some information.

Hi its amit from nz how much do i need to start with .i m seriously interested in this .which one would you recommend to start with. Does it really successful that you could make that much money thanks

Hi Amit,

I’d say you need at least $2,000 to start with.

Otherwise it’s really hard to battle the trading costs.

Making a lot of money is hard, but doable in this business. Just like in every other business venture 🙂

If you stick to it and learn the methods, you’ll have good odds of success.

This is my first time looking into something like this … My question is Tim ask you to pay to be VIP then now charging monthly for the chats and then then video. I want to know because I’m very interested how does someone get into this when they live check to check.. I’m not looking to be a millionaire I’d be happy with and extra $1000 a month .. Also stock lingo can be overwhelming at times ..Are things simplified or dumbied down for the avg. person…aka. Tim Sykes Trading for Dummies.. Thank you for your time

Hi Shane,

Then the Millionaire Challenge is not for you and that’s OK. Most people don’t enter it. Instead, join the chat room to receive alerts and try to learn the underlying strategy. If I were you, I’d start off from the Making Millions DVD, it’s the cheapest option and goes over every aspect of his strategy.

Good luck, Shane! 🙂

Very interesting article however, any comment form the guys that left a reply earlier this year (like in February or March)? What about their experiences?

Hi Paul,

Thanks for the review. I have zero knowledge when it comes to trading and am 100% green with any experience. I am a single mother working 60 hours a week and am a psychology student. My time and money are tight but am willing to make sacrifices if the Challenge is worth it. I recently came across the option to buy his education at $197. Since I do not have money laying around to invest, I am skeptical for the ROI, as I would risk a lot investing at the moment. What is your advice for someone like me looking to make money trading? Should I wait until I am in a better financial situation and have graduated to free up more time? It would be awesome if I could quite my day job and trade while going to school. Your thoughts?

Hi Joanna,

Trading is a risky endeavour with potentially great rewards. However you should not get involved unless you have money that you can afford to lose. I would raise some more money if I were you and see from there.

Hi!

Just reading some comments and replies. I have been watching several of Tim’s videos and webinars. I wanted to point out that in several of the videos he ALWAYS says NEVER trade off his alerts. He tells you that alerts are for you to study and learn from. They are not guaranteed good trades. You have to watch for movement before reacting. He had also stated in several recent videos that he DOES NOT recommend Suretraders or ANY off shore brokers; Suretraders looks to be in the Bahamas. They have caused some issues with some of his trades so he verbally expresses for people not to use them. E-Trade and Interactive Brokers are who he recommends and for those who need no account minimum then TD Ameritrade is a decent one recommended. Just wanted to pass that along. Always have to do your own research!

Thank you Crystal this is the best information I’ve read thus far. I have an ETrade account do you have any information about how to incorporate Tim’s platform with E-Trade? It’s an IRA account.

Hi,

E-trade works just fine with Tim’s platform. You can import all your trades to profit.ly. Tim’s platform does not incorporate with any broker, it’s a separate platform that you can use regardless of your brokerage account.

Hi Team,

I am really interested and a do a bit of stock trading in Australia. What platforms I can use from Australia. Is this alerts are only for US Stocks? or other like Australian stocks as well. Mainly need to know about the trading platform to use.

Thanks

SAJ

I would love to get into this, but I just don’t have that kind of funds that he is asking for.

Is there anything a lot less to get started with then work my way up?

Thanks

Hi Ricky,

You don’t need to go for the weekend profits offer. Join his chat room with video lessons instead and go from there. You get to learn his core strategy from the videos + get alerts on stocks to trade from him and other chat room members.

Thanks Paul, great review. My daughter just turn 18 yrs old. She have 9k saving on the side from working par-time while she in High School. That her hard earn money. We come cross Tim, from Steven show and my daughter very interesting in. We have paid $197 for the first time already but now they ask for $5620. I like to ask you for your opinion to see what you think? Is it wroth for my daughter to give it a try since she is too young?

I would not pay that much if you’re just starting out. The odds of success do not justify this sort of investment with a 9K account.

Just join the chat room with video lessons and learn from there. The 5-6K deal will be more clear-cut, but you can get majority of the information from the videos that come with the Silver subscription option.

Gooc luck, Ma!

Hi Paul, great review.

I am foreign, could you give me some advice on how to invest from overseas and what plataform can I use to trade.

I also want to try Tim’s material, wich one do you recomend in my situation.

Thanks

Hi Oliver,

Being from abroad doesn’t affect you much. You can still open up a trading account with most brokers. These days I’d recommend E-trade or Interactive Brokers.

Also in regards to Tim’s services, I always recommend the pennystocking silver chat room. Best value for money in my opinion.

Good luck 🙂

Hi Paul,

Can I use the Meta Trader platform or it has to be a TWS?

Thank you

Hi Brigi,

No, you can’t use MT. MT is meant for forex mainly. Use E-trade, TD Ameritrade or Interactive Brokers.

They all have different min deposits, so make sure you pick one that suits you.

Hope it helps 🙂

Hi Paul,

Thank you for your prompt reply.

I am based in the UK.

I opened a paper account with Interactive brokers however I don’t find their platform very user friendly at all. Or maybe I am just too set in my ways with MT4 :).

I think E trade and TD Armeritrade for the US only. I might be wrong….

Do you know which broker could I use from here (UK)or have an easy to understand platform?

Thanks again.

B.

Hey Brigi -> For TDAmeritrade go to https://www.tdameritrade.com/international.page

Yea, IB takes some time to get used to. MT4 is a platform meant for total beginners and it’s handicrafted to be as easy-to-use as possible. While IB is being used by people that are more experienced and require greater functionality.

Trading in MT4 resembles gaming while IB resembles work 😀

Thanks for your reply 😉

Paul,

Thank you for this very informative site, and for sharing your insights with such candor. It’s very helpful. Like you, I have an experience-based trust issue with online sellers of educational schemes and it’s difficult to weed through what is actually worth investing in. I’m also considering the weekend profits as a jump-off program that requires less of my time to test the waters, but it’s good to know about the other programs for learning the strategies — important for sure if one is planning to do this seriously for any length of time. The comments by your other readers are also helpful. I am an early retiree and have some cash I’m looking to grow, and the banks certainly won’t do the trick at the measly interest rates offered. Investing long-term is great for the long term, but not so good for cash flow. It sounds like this would be worth investigating further. I did one penny trade a few years ago based on a recommendation from a financial newsletter. It was a test to see if there was any “salt” to the idea. From that experience, I know it can be profitable — invested $500 and made $4500 in a small amount of time (I didn’t want to be greedy and lose what I’d gained, but if I’d waited a few weeks more, that would’ve more than doubled!). Not bad for the first time out. I tried a few others but they were stagnant, lost slightly, or had relatively insignificant gains. The lesson learned was that the chances of success are only as good as the information you have going in. Sounds like Tim Sykes may be a good person to learn from in that regard. As one other commenter posted, it woukd be even better if his videos, such as the weekend profits, left out the fluff and got down to business. I probably would’ve jumped on this long ago were it not for the selling approach. The fluff is annoying (I don’t really care about the various marketers’ high-living braggy videos either. Happy for them, but a waste of my precious time! Get down to business!). Thanks again for the valuable insights!

Hey Beth, I agree 100%.

I personally really dislike his marketing style, but it seems to work well for him.

Two main things to remember about Tim Sykes:

[1] He makes more in subscriptions than he does in trading, so the selling will always be present.

[2] If he didn’t market his winning students/trading history, etc., no one would take him seriously enough to invest in his program. He’s got to show you proof before you invest your hard-earned money.

Just my two…

Hi Paul.

I’m Tim’s fan resident in Nigeria. I appreciate your review so much and I love the Penny Stock Sliver strategy.

I just finished watching Tim’s Podcast on weekend profit making strategy which I would want to subscribe to. But my challenge is can I invest in this deal as a non US resident?

Your candid advice please.

Hi Goddy,

As long as you’re able to open up a trading account and trade in US equities, you are also able to use Tim’s education/advice.

Hi Paul,

I have zero knowledge on trading. I came across one of Tim’s student and it was really interesting. Like many others, it could be overwhelming all the ads and marketing. In your opinion, what is the most basic way to start learning the vocabulary and concept of trading? Do you recommend that I start by opening an account somewhere? Or which of Tim’s packages are meant for beginners? I thank you for all your great responses!

Hi Ana,

I’d recommend that you start off from Beginner’s video lessons. These are done by a good friend of Tim’s – Nathan Michaud.

In regards to the packages. The Pennystocking Silver package is the best option as it comes with video lessons on how to get started, which strategies to use, brokers, etc.

Hi Paul. This comment is coming in really late in the year and I hope you see it. I ran across Syke’s video while I was watching YouTube and was immediately skeptical. I’m glad I decided to really look him up before spending any real money. Your review convinced me to take the leap.

I want to start trading and learning from Sykes but the problem is I’m currently living mostly paycheck to paycheck. What do you think is the best option for someone in my position as I’m uncertain if I’ll be able to afford my monthly expenses and the silver chatroom. I’m also not naive and know making some good income from trading will take time, so I wanna be in it for the long haul. Thanks.

Hi B,

You’re in a similar situation with a lot of people.

What I would do in your situation given that you’re passionate about this is to raise money to fund your trading account. Try to save at least a couple hundred each month. While you do so, I’d join a trading chat room and start to practice trading with paper money. This way you won’t lose your own money while learning. And you get to experiment for free.

Most people put $2,000-$10,000 in and start to experiment with that.

Once you’re profitable with a demo account, you’ve probably also saved up some money.

if the $150 is too much of a stretch, go for the $75/month option. You’ll get trading ideas and recommendations + advice from other traders in the chat room.

Good luck B!

Hi Paul – Ditto to B’s comment. Reading your unbiased review has allowed me to get passed the hype and onto the work at hand. Very insightful. Thanks,

Hi, Paul.

Thank you so much for taking out time to respond to all these important questions. My question to you is that which is the best company to open a stock account with that enables the use Of paper trading and for beginners as well as inexpensive t

o open.

Hi Barbara,

TDAmeritrade has a 60 day paper trading option. And it has fair pricing.

Hope it helps!

Hi Paul, i hope you´re still answering.

I currently work a 9-5 job from monday to friday. I have saved about $4000 and im looking to invest my money. Im considering between stock trading or a setting a business. If i was to choose stock trading, what educational service (not the most expensive) would you recommend me to begin understanding stock trading? Considering i know nothing about this.

I really hope you can answer.

Hi Jorge,

If you were to choose stock trading and you know nothing about it, I’d go for the pennystocking silver subscription and complement it with Sykes’ DVD called “how to make millions”. The first one is $150/month, the DVD is $300-ish. And in the first 3 months, trade with a demo account. This one recommendation will save you thousands! Trust me on this one.

Or if you don’t want to spend the 300 on the DVD, you can check out this beginner’s video series: http://investorsunderground.com/s/GuWyC/. It’s not as advanced as the DVD, but it’s a really good resource for beginners.

Good luck Jorge, which ever path you choose!

What i would like to know is why is he so Rude ? Its been twice that i have tried to ask his team and recently him a question to clarify things since they are not clear before i buy his products and his answer is study this and study that until then dont waste my teams time ! What the heck ? If this is how he approaches to clarify questions by snapping at you then i dont want to have anything to do with him. Thanks for your review man !

Hi Nadia,

Thank you for your input!

That sucks. I’ve been going back and forth with his team for years, and I’ve never been treated badly.

But Tim himself replies with 1-3 words Max. I think he gets hundreds of e-mails every day and he can’t handle the load.

Should probably invest more into his customer service.

Have a great day, Nadia!

Hello Mr. Koger, first I really appreciate you for your info. And I know who Tim is just yesterday, and till that moment till now I realm like everything about him and that he is a real hustler. So stock trading is for the first time for me, and what would you recommend me to do first? And actually I don’t have that much money to afford for the training and that am from horn of Africa, so what can you help me to do first to follow on truck to Tim Sykes.

Thanks in advance and sorry my English is not good I hope you understand.

Hi Ermias,

No problem, man.

First, you should start out with watching through this free beginners video course: http://investorsunderground.com/s/GuWyC/

Thanks so much, everyone, for all your comments. Very helpful – and somewhat reassuring, though my main interest was in Weekend Trader. I just bought the $850 version of Weekend Trader which included a series of training videos and some other materials. I’ll be starting on all that later today. The company I bought through (Agora) tried the upsell and their pitch included “We wouldn’t be able to give you the special pricing for the year if you wait until your 3-month trial ends because you’d have ‘used up all your credits’ !!” That had no meaning whatsoever; in fact, it was absurd. So no. I’ll be able to afford $3400/year if I make what they promise, so that extra $400 shouldn’t be a problem, right? $850 is still a lot to lose. I’m 76 and just want to make a little extra cash flow and have no experience, so this “hold my hand” approach by Weekend Trader seemed like it might be a good fit. But. Still TBD. And I SO agree with the complaints about the huckster approach! Yes, you have to give success examples, but why do they think we’re fooled by the few big successes? That approach used to work when people were more naive. Now we just have to wait impatiently through all their hype and try to weed out the basic facts for ourselves to see if it’s something we want to do (because it’s never as simple or quick as they portray). Even at my age, it was a huge waste of my time. Let’s hope the program isn’t a waste of both time AND money!! But thanks again for all your input. I’m somewhat reassured that it might work! 🙂

I started in the Weekend Profits program in December this past year and haven’t had a single profitable trade yet, 2 losses 1 break-even. When I looked at the Portfolio tab this morning to see what closed since June of 2018 to current it definitely shows more losses than gains with the total losses being -43%. Assuming I would have bought 500 shares of each transaction I would have lost $1,670 since June.

Granted I’m a novice at Tim’s system/service but this is not what I expected to see for a 6 month run of trades and likely I should have looked at this sooner.

Can anyone make me feel better about the investment I made in his Weekend Profits program?

I have lots of questions. If selected to be a challenge student what kind of money are we talking? It cant be 197 VIP to the front of the line. I dont want my time wasted if this is pay me 197 no give me more. I trying g figure this out. I researching like a mofo I came across you Paul Kroger

Hi Paul, I would like to know whether Tim’s Pennystocking Silver course would be beneficial to other aspect of the trading as well? I have been trading part-time Forex & Indices for many years without much success. can I apply his trading style to other markets as well. I won’t have much time to hang on to his chat room but i can manage find couple of hours everyday to learn & watch his videos.

Would you please suggest whether joining his course be beneficial to broaden my trading skills?

Hi Nirban,

I would say yes, there is a tonne of knowledge in the 5K+ video lessons. However you won’t be able to take the core strategies used and implement them with forex. The strategies and meant for stock trading.

It seems odd that “Phil” postings about Tim’s Weekend results never was followed up on. If you do a straight average of the 9 trades that Phil described starting 6/27/2018, the overall result is a loss of about 7%, not the 36% gains that Phil described. It would be impossible to have an “average” of 36% when only 1 trade made more 13%, and that was 37%. If you reinvested all profits on these trades, your average return would be about a total of 28%. However, as John Gabrys saw, the first 3 trades were 2 losses, 1 breakeven. If Tim’s results had started with the series of losses shown, and then had the winning trades at the end, with reinvesting, there would have been an overall loss.

The other thing to look at is that say, an “average” trade can profit 10%. For someone to make the kind of money Tim pitches on his video, $6K a weekend, $9K, etc., one would have to be putting $60,000 to $100,000 of their money into each trade. Sure, 10% per weekend is a fabulous return, and if it was possible, every hedge fund manager in the world would subscribe to Tim’s service. And that right there should tell you, if it’s too good to be true…….

As John as found, buying on news can often result in losses since the smart money on the Street has already factored in the news into the price. While Tim goes on about how there’s pent up demand over the weekend based on this wonderful news, keep in mind that when trading stocks over a weekend, while you’re upside is unlimited, your downside is also pretty much unlimited. You have no stop loss capability. Let’s say some news is expected out of a company over the weekend, and you take a position. Turns out the “news” is bad, and the stock drops by half. You’ll have no protection against taking a 50% loss on Monday morning, since you can’t trade the stock (and actually many stocks trade starting Sunday night, and there’s often a 3AM trade available on Monday morning). Think Enron, GE and many other companies where people were trapped in their shares by bad news.

It’s a nice fantasy, but seems like that’s all the Weekend Profits is.

Hi Paul, I’ve seen the comments that you stated a minimum of 5 – 10k to join the challenge,can I know what are the underlying reasons behind the recommended value?

Also I have 1000+ but would be able to get more once I have gotten a part-time job, am I still eligible for the challenge?

Hi Govan,

Good question.

I think that the comes from it being concised, concentrated and hard core.

There’s not much of beating around the bush, but a straight forward guide on how to actually trade with a myriad of examples of patterns and real trades.

If I was a beginner with really serious intentions about trading and with enough starting capital, this is what I’d choose. However I would be first try out his other materials to see if Tim’s teaching style is something that you can work with.

Hi. I am begining in crypto market. Do you think, is Pennystocking Silver course useful to work this markets? Could I apply this knowledgment to this kind of markets and be profitable?. Thank you

Hi Christian,

I think that the only way to go about is if you traded crypto related stocks.

In that case – YES, if not, then NO.

Hi Paul!

This was a very helpful read and I was super skeptical at first. If you can just clarify something. Does TimsAlerts and Pennystocking Silver have the same chat room? Is there a difference in the chat rooms?

Hi Marilyn,

The chat rooms are the same, but with the Silver sub you’ll get over 5K video lessons divided into different categories.

The lessons will help you become a self sufficient trader. I strongly believe that this is where the real value lies.

Hi Paul,

Thank you for your effort in putting this review together. However, I must say that I am pretty sceptical about your review and the reason being that you are an “affiliate”. You make commissions from referring products and systems and even though there is nothing wrong with that (after all everyone needs to make money). It arises the question whether it is actually an honest review or this is just another product or system that you are trying to upsell. Also, If someone knows the secret formula to making money why on earth will they share it to everyone? they can just make all the money themselves!

Another point I would like to add is that his chat room seems similar to a “pump and dump” scheme. He tells you which stocks to buy, therefore all his students buy it and drive its price up.

Hi Joe,

Thank you for taking the time to write.

Very valid points.

First off, yes I am an affiliate for Tim Sykes and a few other services. However, I only recommend the products that I personally use and consider to be valuable. I’ve reviewed over 80 different trading related products and I only recommend the ones that are really good in my personal opinion. I would never vouch for services that are out there to scam you.

To answer your second point – in most cases, Tim’s followers don’t affect the stock price more than the general market does. Meaning that the stocks are liquid and there is enough action to counter his followers trades. However there is power in many people buying all at once and it can affect the prices. In order to make more money, you should learn his strategies instead of blindly following his alerts. That’s why I mainly recommend the pennystocking silver chat room.

He spends so much of his time promoting, doing webinars and other stuff that isn’t related to trading. If you learn his strategies, you’ll be able to find more plays and make more money than him eventually, cause you’ll have more time to spend on actual day trading.

Hope it helps and thanks again for the smart questions!

Paul

Anyone what is the current price for millionare challenge price ?

Hi I paid $6500. I would like to know if this is what others paid. What is the difference between pennystocks silver and the challenge, apart from the price obviously?!

In regard to Tim’s Weekend profits issue. I have seen a review by this Jeff Lenney say he had purchased the weekend Profits subscription to review Tims product and swears that it work. On Jeff’s review site a Michael Goode made a statement that he too purchased Tim’s subscription to prove Tim’s weekend Profits does not work and clams that it indeed works.I would like if you could give your review of it if you could. I trust your review is why I would love see your review on it.

Bill

Hi Paul,

I came here to find out if tim sykes is legit to start off. I have no clue on stock market. Please tell me where to start with. Adding that i don’t have enough money to invest, as i am 20. Hope you narrow the answer!

Hi Paul. I got messages from Timothy Sykes, He recommended for newer trader using platform Stockstotrade.com How do you think about that?

Hey Aviano,

I think stockstotrade is really good, but if you’re still a beginner, you should try to avoid recurring costs as much as possible. Try to see if your broker has an in-built stock scanning feature. Perhaps it’s for free (as it is with some brokers) or it may cost some money, but less thant the STT’s $150/month.

It’s really good, but as a beginner, the cost might be a drag on you.

Not sure yet if want to get into day trading. I’m looking more to the long and most of my stocks are pot related, not just the pot but supporting industry. Any way my ? Is will this program help me being a long and not short.

The Tim Challenge is part scam part reasonable.

You’re paying for loads of content and the strategies actually work.

HOWEVER, you only get a year in the challenge before you have to renew.

Tim in his video lessons repeatedly says, “it wont be a year before your successful, it will be 3,4 or 5.”

Tim knows this, so it forces you to renew your subscription in order to become successful.

The benefits are endless, but also it’s going to take closer to $10k -15k for you to reach a stage where you profit.