Table of Contents

Brief Intro..

Plus500 is a CFD broker that is listed on the smaller London Stock Exchange section (AIM). This Israeli company also has multiple subsidiaries that serve customers in different countries.

Its subsidiaries include Plus500UK Ltd, regulated by the FCA and also Plus500CY Ltd which is regulated by Cysec. They also operate in countries like Australia and South Africa.

By having so many subsidiaries, it essentially means that service will be provided to you by a specific Plus500 company depending on where you are in the world. At the time of writing this Plus500 review, the company does not accept U.S. clients, though. So if you’re from the states, you better look elsewhere homey.

So Who is This Broker Best For?

Plus500 is a huge site that is mainly aimed at catering the newer traders. The platform is built for beginners by following the keep it simple method in order to simplify trading as much as possible while still allowing people to trade in various stocks, forex and other instruments.

The platform is easy to navigate, although it does take some time to get used to it. Compared to most big brokerages, Plus500’s platform feels more like a video game than a forex broker.

Having said that, we still recommend that the traders interested in starting to trade with the platform to proceed with caution. As our review is going to show, although this is an easy-to-use platform which provides a great user experience and has a lot of other benefits for traders, it also comes with some disadvantages as well.

Features of Plus500 Platform

Plus500 CFD trading platform offers its traders a variety of outstanding features like advanced technical analysis tools, guaranteed stop loss and more. Here is an in-depth look at some of the features that are offered:

#1 Account Types

There are two account types offered at Plus500, a demo account, and a live account. A demo account is a great way for beginning traders to get acclimated to the trading platform and all the features it offers before depositing and trading with any of their real money.

Opening a demo account at Plus500 is free and the demo account comes with no time limit, you can use it for as long as you want. This is one advantage that this platform has over a lot of other trading platforms which offer demo accounts for only 3o days or so.

On the flipside, Plus500 only offers one type of live account – individual accounts. There are no corporate accounts offered. Opening a live account at Plus500 is seamless, fully digital and easy to complete. The usual documents like ID and proof of residence are required and there is a minimum deposit which varies according to the country you are in.

There is a very wide variety of base currencies that they support, and the maximum leverage for forex accounts is 1:300. This kind of trading may not be suited to everyone because the high leverage can be beneficial or detrimental to your trading account, depending on how well you know what you’re doing.

#2 Trading Software

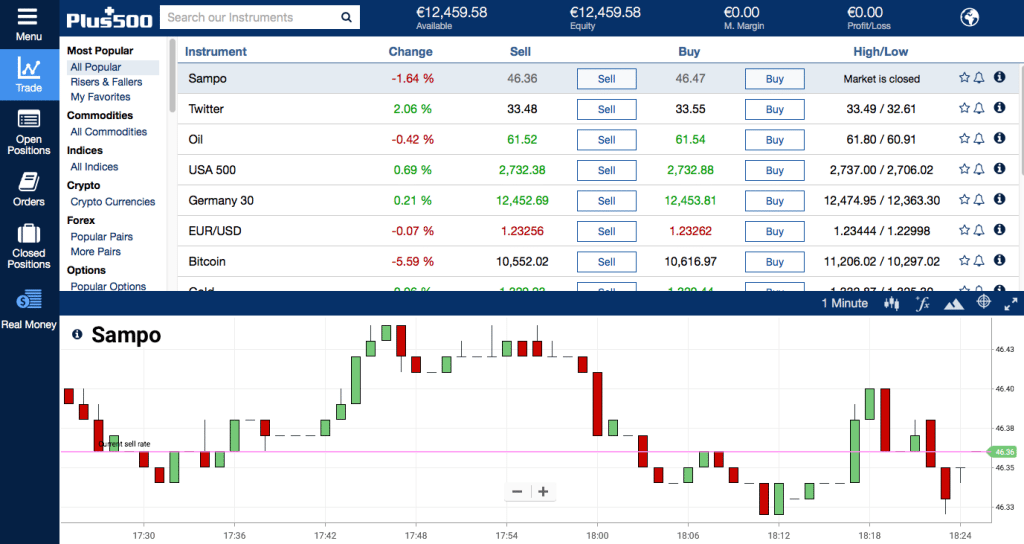

Plus500 offers their clients a comprehensive, user-friendly trading platform and technical analysis software which is available as a browser-based WebTrader or as a downloadable program, It’s also available as a mobile trading interface which includes apps for iOs, Android, and Windows smartphones as well as an Apple Watch platform.

Traders can use the platform to trade in multiple markets from the same screen and there are real-time quotes for all products. On the Plus500 platform, you can trade CFDs on Forex, cryptocurrencies, commodities, stocks, indexes, and ETFs. Unfortunately, this platform does not integrate with MetaTrader and traders who want to use MetaTrader specifically will have to find another platform.

One of the main advantages of this custom software from Plus500 is that it has a trading screen that is all-inclusive and has simple tabs for details on current positions and past trades. There are also tabs which enable you to trade multiple markets. The Plus500 platform also comes with charting software, although the charts have to be viewed separately since the software doesn’t allow for multiple graphs on the same screen.

One unique feature of the Plus500 platform is that it remains constant in all versions, making it possible for you to switch between devices seamlessly without having to regroup. This is a feature that most other brokers haven’t been able to provide.

On the other side of the coin, Plus500 only applies a one-step process for authentication, and there is no option for a two-step authentication. From our experience, this is not the best practice. Also, although this trading platform seems reliable, there’s a concerning amount of negative reviews and complaints online about the questionable trade execution rate of this platform.

#3 Deposits and Withdrawals

Funding your account at Plus500 is easy as deposits and withdrawals can be made through Visa, Master Card, debit cards, bank transfers, Paypal, and Skrill. The quickest way to fund your account is through credit or debit cards. Using a wire transfer deposit is also straightforward, but it can take up to five days for the deposit to reflect in your trading account.

Before being allowed to withdraw any of your money from your trading account, you will have to provide Plus500 with a valid copy of your photo ID and also verify your registered address. All this information can be completed and sent digitally via the trading platform.

Funds can only be withdrawn through the same channel that they were deposited in. For example, if you used a debit card to deposit money into your trading account, then the amount withdrawn will be sent back to that same card.

The first five withdrawals of the month are free, but after that, there is a charge of $10 per withdrawal request. The minimum withdrawal amount is $50 for Paypal and $100 for bank transfer and credit card. For withdrawal of amounts lower than that, a $10 charge will be imposed.

In the event that you want to close your account and withdraw all your money, $10 will be charged, unless you’re withdrawing to a credit card. There is no minimum balance and the fee for account inactivity is charged after three months with no use.

#4 Trading Fees

Plus500 charges no commission and offers competitive fixed or dynamic spreads. Their fee structure isn’t very transparent as far as trading brokers go because all fees related to trading are built into the spread. In addition to that, the calculation method for the overnight rate is hidden.

The spreads at Plus500 are competitively priced when it comes to FX but not so much in CFDs. Some traders consider that for the price that you pay (spreads) some advanced research tools would have been nice.

#5 Customer Support

Plus500 customer support is available in multiple languages 24/7. They have an online chat as well as email support through the Contact Us form. A distinct disadvantage is that they do not offer phone support (what happens if you lose your internet connection or your computer crashes while trading?)

Although Plus500 says their online chat service is active, and that it’s quick and reliable, our research revealed that there have been a lot of online reviews to the contrary.

Most people claim that if you get connected at all, the customer care representatives respond to questions in a vague manner and you get ‘copy-paste’ answers to whatever issues you may have. With some customers reporting a wait time of more than 15 minutes, it doesn’t really qualify as a ‘live chat’ anymore, does it?

#6 Safety and Security

Investor protection is a major factor in deciding which trading platform to use, and should definitely be on the list of your broker selection criteria. When it comes to security, Plus500 is listed on the London Stock Exchange AIM section and this is a major advantage.

As previously stated, the Plus500 investor protection scheme and regulation depends on the country in which you reside. They have various subsidiaries, and each one has a different investor protection scheme.

For example, if you’re from the UK, you will be served by Plus500UK and therefore benefit from the FCA’s up to 50,000 pounds cover. Plus500’s segmented subsidiary approach along with other aspects like ownership, regulatory compliance, and company profitability are all transparent and clearly documented. This data can be accessed by anyone through the company’s annual report.

#7 Risk Management Offerings

Having a trading platform which offers great risk management options is necessary if you want peace of mind. At Plus500 you can manage your own leverage depending on your ‘Equity’ and ‘Total Position Value’. This is dependent on the amount you deposit or withdraw from your account.

The risk management tools are easily accessed and utilized from the main trading window. Traders should note that all trades taken on the Plus500 platform attract a minimum leverage requirement.

One way to manage your risk would be to set a guaranteed ‘Close at Profit’ or ‘Close at Loss’ price level for whichever instrument you’re trading. This helps you to limit the amount of money you can lose on any given trade. Not all brokers offer this feature.

Additionally, you can set price alerts to notify you whenever the market is approaching a certain specified buy or sell price. A price alert is different from a stop because it keeps the position open, giving you the chance to look at the market conditions and decide if you want to close it or keep it open.

Also offered at Plus500 as another tool to help limit your risk is the trailing stop loss. This is quite similar to a price limit as both are designed to help protect your profits. When you place a trailing stop on a trade, it will close a position at the new level for the trailing stop and not at the original stop level placed on entering the trade (thus locking in profits).

This is an added advantage as it means that you limit your risk and maximize your profit potential without having to manually monitor and adjust the stop level yourself.

Summary of the Good and the Bad

What I Love

– Wide range of trading assets, more than 2,000 CFD instruments to trade

– Fast and seamless live account opening process, free unlimited demo account

– More account currencies

– Multiple ways to fund account

– Multiple ways to fund account

– Welcome bonus without any required deposit

– Regulated in multiple jurisdictions

– Regulated in multiple jurisdictions

– User-friendly trading platform

– Website and support in multiple languages

– Especially well-designed mobile platform that can be used on iPhone, iPad, Android smartphones and Windows tablets

What I Can’t Stand

– No option for a two-step authentication

– FAQ poorly positioned making it hard to find required help

– No MetaTrader trading platforms

– No trading education support

– No trading education support

– Many customer complaints about poor quality of customer support

– Although the app is simple and easy to use, there are a lot of features missing such as research tools and the leverage setting option, and the app is hard to customize.

In Conclusion

The bottom line is that on paper, Plus500 is a great choice for traders who are new to the world of day trading. It is a fairly good platform to get your feet wet and get accustomed to the buying and selling various instruments for your own financial gain.

Plus500 offers multi-asset trading with very tight spreads. It also conveniently offers the ability to integrate trades in other financial markets, all in one screen.

Having said that, there is an alarming number of negative reviews of this platform online. A simple search of the Plus500 broker yields a lot of contradicting results with concerns, complaints, and accusations of possible unethical behavior and court cases.

Considering all this, we would suggest moving forward with a lot of caution. No matter what your choice is after reading this Plus500 review, remember that CFDs are leveraged products, and trading them can result in the loss of all your money.

If you don’t fully understand the risks associated with trading CFDs then maybe this is not ideal for you.

Either way, good luck in your trading ventures!

![Etoro Review – My Honest Opinion [+TUTORIALS]](https://foxytrades.com/wp-content/uploads/2018/03/Etoro-Review-100x70.jpg)