Table of Contents

It’s no surprise that over 95% of traders lose money in the long run when you consider that a lot of traders are taught and follow the same principles of analysis.

They read the same books, follow the same strategies, and they stick to the same rules for risk and money management. Ultimately, they get the same results in their trading. They end up losing their money and giving it to the rich 5% that are doing something different.

What is Contrarian Trading?

Contrarian trading is a trading style that involves going against the herd in your trades. A contrarian trader is doing the opposite from most other traders and is, in fact, betting against the masses in order to profit from it.

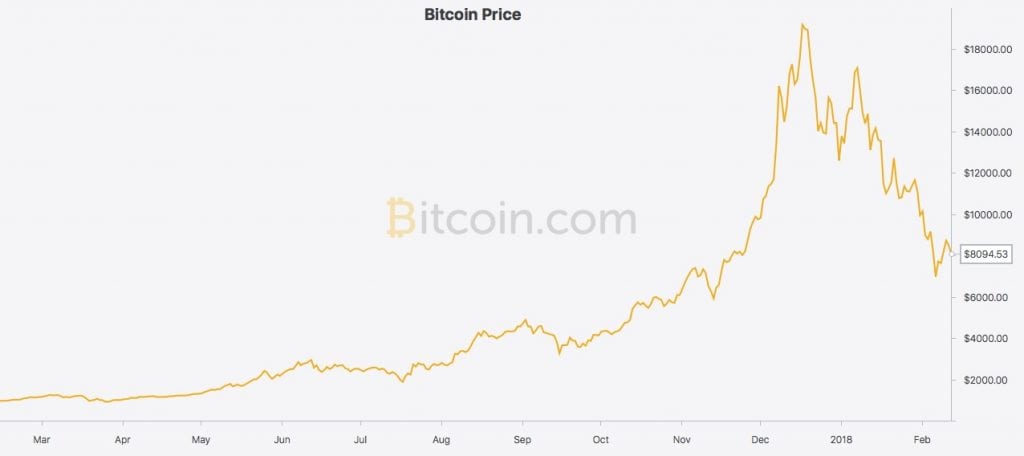

These traders basically determine what the prevailing market trend is, and then intentionally go against it. They buy when prices are low and sell when they go up, as opposed to the amateur traders who buy when the trend has already been established or when the smart money is already moving out (remember Bitcoin?).

Contrarian traders believe that those who predict that the market is going up do so when they are fully invested (meaning that they have no purchasing power left), and those who classify the market as going down, usually have already sold out (which means the market can only go down).

Some famous contrarian Traders:

- Jim Rogers

- Sir John Templeton

- Warren Buffett

- George Soros

- Sam Zell

- Marc Faber

- Kyle Bass

Basics of Contrarian Trading Strategy

They figure that if something goes up in price, it only makes sense that it continue to go up, and vice-versa. A contrarian trader, on the other hand, is of the mindset that nothing goes up forever. and nothing can fall indefinitely, either.

Their strategy can take many forms – it can be with the trend, against it, or even inside a trading range. The point is that they use their skills and knowledge of the market to profit from taking a position against the masses.

Contrarian Trading is Risky as Hell

The contrarian trading theory involves monitoring the sentiment of the market as well as other important market indicators in order to take positions against the majority of market participants.

Because contrarian traders are fighting the trend, this can sometimes work against them. This strategy promises great rewards, but it also comes with increased risks. That’s why this style of trading is best suited to those who know the market through and through so that they know when exactly to move against it.

Markets tend to follow the prevailing trend until it exhausts itself, and because of this, the one most important factor in placing contrarian trades is that the trader has to time the reversal with precision in order to take a successful counter-trend position.

There may be times when a trader takes a trade in anticipation of the market turning, but the market hasn’t yet reached its actual reversal point, this increases their risk. They have to ensure that they always have adequate capital in reserve in the event of this happening.

Why Contrarian Trading Works

If you have ever had the experience of taking a trade that looked like a sure winner, only to have it almost immediately turn around and hit your stop, it wasn’t because your broker was hunting your stops, (and no, there isn’t a mischievous little imp sitting inside your computer, whose sole purpose is to move the market against you after you place a trade…)

So if it’s not your broker and it’s not the imp, then who is taking the other side of your trades? The answer is the professional traders. They are selling to you when you want to buy and buying from you when you want to place a sell trade.

By taking the other side of your trade, they essentially take on all the risk and so if they are going to profit from that trade, the market needs to move contrary to where you expect it to go! The good news is that if you can adopt the mindset of a contrarian trader, your own trading results will immediately begin to improve.

How To Adopt the Contrarian Mindset

If you want to adopt the mindset of a professional trader, then one of the most important questions you can ask yourself while trading is, “What is the herd (amateurs) doing?” Answering this question, whenever you’re looking at your charts, will help you to start to think like the pros do, and ultimately increase your chances of winning in the markets.

Provided that all new traders actually lose money in the long term, it makes a lot of sense for anyone who wants to be consistently profitable as a trader to do their best to trade as the professionals do rather than to follow the herd (who according to the previously mentioned statistics don’t know what they’re doing anyway).

Of course, that’s not all there is to it. Asking yourself those questions works to put you in the right mindset, but you also need a disciplined approach and a solid market analysis in order to pinpoint the best entry and exit points for a trade.

Contrarian traders use 3 essential tools when it comes to analyzing the market:

#1 Technical Analysis

#2 Fundamental Analysis

#3 Market Sentiment Analysis

The Typical Tools of a Contrarian Trader

Technical Analysis

Most contrarian traders use either technical or fundamental analysis or a combination of both when determining when to enter or exit the market. A technical trader typically uses technical indicators to establish when to enter or exit a trade.

This type of analysis uses most of the same tools as those used for traditional technical analysis. The tools include moving averages, oscillators, sentiment analysis, and of course, price action analysis.

The contrarian technical analyst may also use any of the other numerous means of technical studies that are available for predicting reversals in the market.

Using technical indicators in their analysis greatly helps contrarian traders to optimize their trade entries and exits. For example, the technical trader may use specific price action clues or indicators signaling a market extreme as well as analysis showing reduced upside momentum. They can combine these two clues to find the market top.

Fundamental Analysis

For contrarian traders who use fundamental information for their trade analysis, useful indicators might include the release of a major economic indicator like GDP, or a central bank interest-rate decision.

As an example, after a benchmark interest-rate increase, a contrarian trader might wait for the release of the data, then short the pair once it has reached a certain overbought level in response to the news (instead of placing a long trade along with everyone else). The contrarian trader does this in anticipation that the market would retrace after the initial momentum ebbs and profit-taking begins.

Market Sentiment Analysis

This is yet another way in which contrarian traders can predict market tops and bottoms. If you were to ask yourself when the market is the most bullish or bearish, the answer would be – the market is the most bullish at the top and most bearish at the bottom.

What this means is that most amateurs will be feeling the urge to jump in when it’s most bullish or bearish, but the contrarians will understand that the trend is most likely over. Knowing this, one can see how the majority of smaller traders lose money in the market.

Again, remember the story with bitcoin? The biggest buying was happening when the price was at the highest. People were hearing stories about people making millions with cryptos and wanted in. Most of them are sitting with a substantial negative position.

Making a Contrarian Trade Plan

Having a plan has many benefits, one of which is to keep you from being swayed by the opinions and emotions of others in the ‘herd’ while executing your trades.

Contrarians, like all other traders, need a clear, well-defined trading plan that is consistently profitable and has acceptable draw-downs. They need to write down their trading triggers and indicators in a way that is easy to follow.

Pros and Cons of Contrarian Trading

PROS

Huge potential for hitting the jackpot

By the very nature of trading, no matter what the trend, one side of the trade will always be a contrarian trade and so without contrarian traders, the whole market would collapse. There has to be those who bet for and those who bet against the market (winners and losers).

CONS

Higher risks of significant losses

This can be an extremely risky endeavor if you don’t know what you’re doing. Getting caught up on the wrong side of the trade could put a huge dent in your account balance. To survive as a contrarian trader, you need to learn to cut your losses quickly. There can also be a lot of lost opportunities because if the crowd’s decision prevails, this can mean missed opportunities for contrarian traders.

It’s mentally taxing

The Bottom Line

The mass consensus is usually wrong and especially so when the market becomes overextended from frenzied buying or when it’s oversold from fear-based selling.

Although the use of a contrarian strategy can seem downright crazy to a lot of amateur traders (because they are taught that ‘the trend is your friend until the end’) contrarian trading has proven over the years to be among the most effective and profitable strategies.

It’s particularly appealing because when implemented the right way, it can be used in all types of markets.

![Etoro Review – My Honest Opinion [+TUTORIALS]](https://foxytrades.com/wp-content/uploads/2018/03/Etoro-Review-100x70.jpg)