Table of Contents

What is mean reversion? How does it apply to trading? Is mean reversion trading strategy profitable? When do you apply the trading strategy and what indicators do you need to look at? Are there any challenges in applying the strategy?

This article attempts to answer the above questions for your trading benefit. Although it may not be exhaustive, it certainly covers the most important issues that relate to mean reversion as a trading strategy.

Mean Reversion

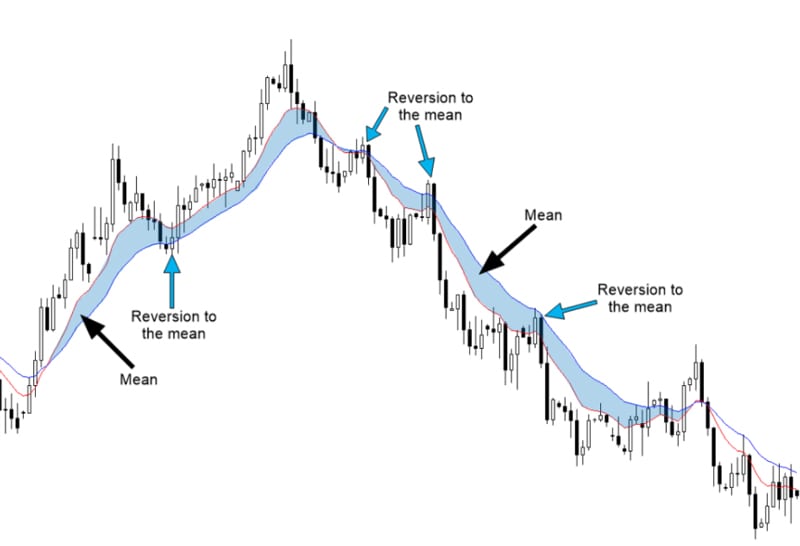

Mean reversion is a theory suggesting that a moving price or return of a stock or security eventually reverts back to the average or mean price (equilibrium).

Simply put, it is a trading strategy that involves trading with an eye on the mean or average price of a stock or security.

Mean reversion is not limited to looking at the price of a stock or security. You also need to look at changes in such other measures as return and interest rate.

The mean or average (equilibrium) you choose to analyze can be the known historical average of a price, known average return or the general economic growth relating to a specific industry.

Therefore, a mean reversion implies that a price or return that strays significantly from the average known price or return eventually starts to move back its normal (equilibrium) state in the long term.

Mean Reversion trading

Like most traders, you probably rely on trend-trading patterns. Mean trading means going against the established trading trends. Consider mean reversion trading as a trading strategy that counters the general trading trends.

As a mean reversion trader, you need to look out for extreme changes in the price or return of a stock or security. In particular, you need to look out for changes in price or return that stray significantly from the average price or return (equilibrium).

Such extreme changes, in most cases, turn out to be unsustainable and do return to their normal state after some time. Doing so enables you to profit from unexpected swings when trading in the market is generally low.

Like with any other trading strategy, the mean reversion trading strategy does not guarantee you profit. Unexpected highs and lows on the market that easily ruin your trade.

For instance, the release of a new product, recall of a product and unforeseen lawsuits are just some of the unexpected events that can impact on your trade.

It is also important to note that an extreme change in price or return of a stock or security may remain sustainable. Such is normally an indication that a company is not enjoying the same prospects it used to enjoy. In such a case, a mean reversion never occurs.

Trading using the mean reversion strategy requires a lot of careful considerations.

From the start, it is not wise to apply the strategy to a single asset. This is because doing so exposes you to market movements and either the failure or success of a specific company.

From the foregoing, you may find yourself either consistently undervaluing or overvaluing the stock if the price increases or falls.

The best scenario to apply the strategy is when trading a pair of stocks of different companies. In this case, what you need to examine is the distance between the stocks.

In order to make a reasonable statistical assumption, the two stocks need to be products that can substitute for each other. What this means is that their price movements do follow the same pattern in the market.

How to develop Mean Reversion trading strategy

The use of mean reversion as a trading strategy requires careful analysis of historical data. In particular, data relating to the historical trading performance of a stock or security is very important.

This raises the need for data mining. By analyzing the historical market performance of a stock or security, you find a statistical edge that you use to predict market patterns that are most likely to emerge in the future.

Your data mining activity should involve looking and analyzing pre-existing databases relating to specific stocks or securities. Your aim here is to establish correlations that exist between known indicators and return on a specific stock or security.

It is only after the identification of existing trade performance patterns that you can develop an effective mean reversion trading hypothesis.

You need to use the hypothesis developed to design a trading strategy. Designing the most effective strategy involves testing the hypothesis on a fresh data set. You use the result of the testing to come up with a robust mean reversion trading strategy.

It is never a good idea to rush to the market to trade with your new trading strategy. It is recommended that you trade on paper over a certain period to determine whether or not your strategy works on current market data.

A strategy that does not yield expected results or does not yield results that are close to market results will be a faulty strategy. You will need to go back and look at the quality, quantity, and source of data you mined.

You can use mean reversion trading strategy when buying or selling stocks or securities. It is particularly suitable as a trading strategy when you need to buy low in order to sell high.

It is important to point out that you are not restricted to developing a single mean reversion strategy. You can develop several mean reversion strategies for use with different markets and different securities.

Challenges with Mean Reversion trading strategy

There are several challenges that you are bound to encounter either when developing or when using the mean reversion trading strategy. Luckily, there are also different ways to handle the challenges.

Unreliable data

This is often the biggest challenge that beginner traders do face when developing their trading strategies. A trading strategy only becomes effective and useful if the data mined is of high quality.

The data that you use to develop your mean reversion trading strategy should be from a reliable database. A good number of data service providers are available online that you can use to get reliable data to work with.

Poor emotional control

This is a challenge that beginner traders and a few established traders do face. As a mean reversion trader, you need to have control over your emotions else you burn your fingers.

Knowing when to keep off and when to take a trading position requires a high level of emotional control and personal discipline on your part.

For instance, it can take several months before you notice a trading signal on a specific stock or security when the price or return of the stock or security may start moving back to the mean average.

There are also other instances when the price or return of a stock or security keeps going against what you expect. The decision not to take a position in order to minimize your losses can be catastrophic.

Whichever the case, you need to make informed decisions to take a trading position to profit or minimize losses. You need to have emotional control and personal discipline to know how to identify a trading signal and when to take a position or keep off.

Determining the equilibrium

Determining the average price or return of a stock or security to analyze, although it seems obvious, is often a major challenge to both beginner and established traders.

For instance, you may choose to work with a known low and high price of a stock or security as your moving averages (equilibrium). Although the difference between the two may appear to be insignificant, a close look at the details brings out the significant differences to the fore.

A low price is often a fast-moving average. The price moves in either direction often and faster. The price can also move back to the equilibrium within a very short period.

A close analysis of a low price average also reveals that it offers you increased trading opportunities while trading at a short distance from the equilibrium with a small reward/risk ratio.

On the other hand, a high price is often a slow-moving average. The price takes a long time to move away from the equilibrium. The movement can be in either direction.

Other characteristics of a high price average are few trading opportunities and a high reward/risk ratio. A common characteristic of a high price average is the fact that it can take a long time for the price to revert back to the equilibrium.

From the above analysis of the two moving averages, there is no wrong or right judgment when it comes to which average to work with. The decision on which average to work with depends on your personal preference and trading style.

It is only important to note that your choice of equilibrium to work with has a wide range of possibilities.

Prevailing market conditions

Prevailing market conditions can present a big challenge when using mean reversion trading strategy. The strategy works effectively in markets with known range limits. This, therefore, means that the strategy is bound to fail when there is an established trend in the market that trends for a long period (beyond the known range).

A clever way to deal with such a market condition is to employ a different trading strategy. In this case, it becomes necessary to employ a trend-following strategy. Indeed, it is always a good idea to have two or more trading strategies to employ at different times depending on prevailing market conditions.

Risk control

Like with any trading strategy, the mean reversion trading strategy has its risks. How to deal with or manage the risks can be a big challenge.

As a mean reversion trader, you view a price or return that has dropped from the equilibrium as a cheap price or return. The challenge that emerges is that the price or return becomes even cheaper if the trend continues.

Your response, as a mean reversion trader may be to continue buying as the fall continues. Doing so is certainly not in line with the principle of risk control. This is because you will be going deep into a losing position.

In such a case, your ideal reaction should be

to employ an exit trading strategy to stem possible losses. The best you need to do is to employ a time-based exit strategy to counter the otherwise negative trend.

Conclusion

It is most likely that your trading strategies have been focusing on the popular trend-following trading philosophy. You may have realized that employing the mean reversion strategy can at times be more profitable.

The only thing is that the strategy can take long to yield desired trading results. It also involves taking into account several considerations to develop.

Whichever way you look at the strategy, the fact remains that financial, commodity and cryptocurrency markets often revolve. They are constantly moving in cycles.

There are times when the markets do trend. This is when trend-following strategy becomes effective.

There are also times when the markets move in a range before reverting back to the equilibrium. That is when mean reversion strategy becomes effective.

The other fact is that range-bound markets have become more common compared to trending markets. What this means is that mean reversion strategy offers higher profit percentages compared to the trend-following strategy.

The theory of mean reversion trading strategy is a phenomenon that has been tested and attested to. It is a powerful strategy that you can use either alone or in combination with another trading strategy (depending on prevailing market conditions) profitably.

The trading strategy can be suitable for beginners, but requires a signficant amount of work to be put into mastering it in order to become profitable.

It is also very important that you start off using the strategy with small investments. It is only after mastering how to use the strategy that you can take trading positions with bigger investments. This is to minimize the level of losses you may incur.

![Etoro Review – My Honest Opinion [+TUTORIALS]](https://foxytrades.com/wp-content/uploads/2018/03/Etoro-Review-100x70.jpg)