Table of Contents

Interested in trading part-time and still making decent profits? Then this swing trading strategy guide is for you.

Swing trading is a perfect option for people that don’t have all day to concentrate on trading. It’s for people that work full time/study or just want to do other things with the majority of their day. In this article, I’m going to share my very best swing trading strategy.

Usually, the case is that the more you work, the more you make. This is true of course, although with swing trading, it is possible to achieve enviable profits with just 1-2 hours of “work” per day.

I invite you to read through this simple guide on some effective swing trading strategies so you can practice swing trading on your own.

These swing trading strategies are rather short and written in a very easy-to-read format and are meant for people with low to medium levels of experience in the markets.

Now, let’s begin…

What is Swing Trading in the First Place?

Swing trading is a trading style or strategy that attempts to capture gains or a swing (“one move”) in a stock or any financial instrument within an overnight hold to several weeks.

The idea behind this trading methodology is you endure “little pain” by exiting your swing trades before the pressure comes in. Such a swing trading system requires you to book your profits before the stock market reverses or wipes out your gains.

Swing traders use technical analysis to look for stocks with short-term price momentum.

Swing traders may utilize the fundamental or intrinsic value of stocks in addition to analyzing the price trends and patterns. – Explanation taken from Investopedia.

In my own words: The right swing trading strategy is to look for certain price patterns that are predictable and try to profit from them.

The pros of swing trading are that it does not require you to spend hours in front of your computer or monitor since your swing trades can last for days or weeks (swing trades take time to play out), which means less stress than day trading. Included also in our list of pros is that it is suitable even if you have a full-time job.

Another thing…

You analyze the charts when you have time, put in orders, set automatic stop-loss and profit orders, and move on to your other activities.

Swing Trading Strategy #1: Finding Diamonds (Profitable Patterns Swing Traders Should Search For)

Now as you have your account all set up and you’re ready for action, let’s go and find some diamonds for ourselves.

What I mean by diamonds is price patterns of stocks/ currencies/ commodities that occur often and thus are predictable.

With these patterns, you can forecast what they are likely to do in the future and profit from it more times than not.

Below you’ll find an overview of my favorite swing trading patterns ranked by my own success ratio with them.

Let’s take a look at these swing trading strategies!

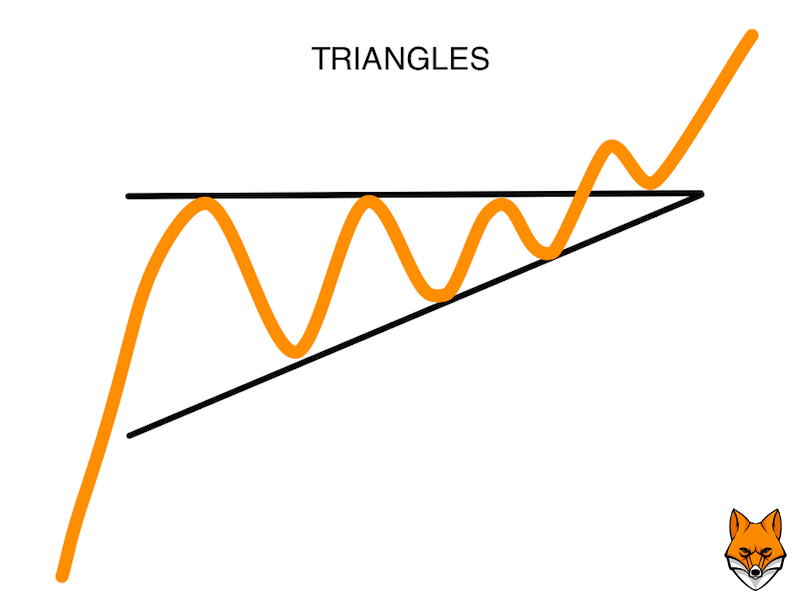

#1 Triangle

Triangle shape is, in my experience, one of the best working patterns in terms of chances of success in swing trading. You may find it in many forms, either ascending, like the one on the picture, descending, or even asymmetrical.

To learn more about triangle patterns, I would recommend checking out the triangle pattern section on Finvids website. Below you’ll also find a swing trading strategy video going over this pattern in a bit more detail.

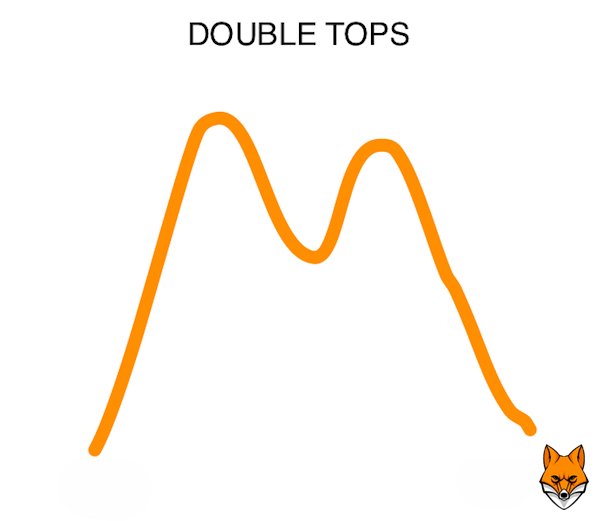

#2 Double Top

Double top is another great pattern that is well known among swing traders and yet works with a rather high success ratio. The same pattern works vice versa, if you notice one upside down, you can utilize it for going long in a stock.

Again, I’m not going to go into depth with this pattern, as someone else has already done a great job at that, which is why I advise you to check out Finvids double top section.

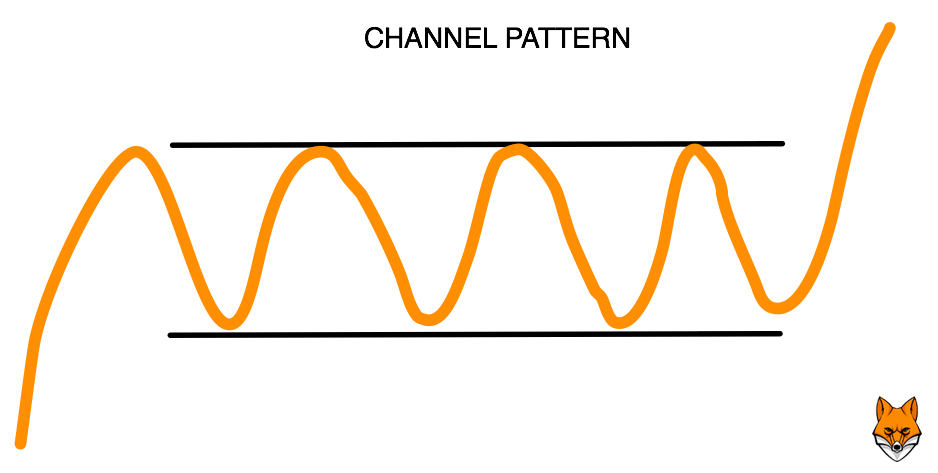

#3 Channel Pattern

This is one of my favorite patterns, despite it having less chance of success than the ones named above. I like the pattern because it can be found very often in various instruments. This pattern can be a great moneymaker if utilized correctly.

There are two main ways to trade this pattern: one is within the channel and the other is to trade breakouts. Both are explained in the below video. Also again I advise you to read Finvids channels section again if you want to learn a bit more about the specifics of the pattern.

Where to Find These Patterns [STOCKS]:

One tool that I use to find these patterns in stock charts is the good ol’ Finviz.com. Let me tell you how it works:

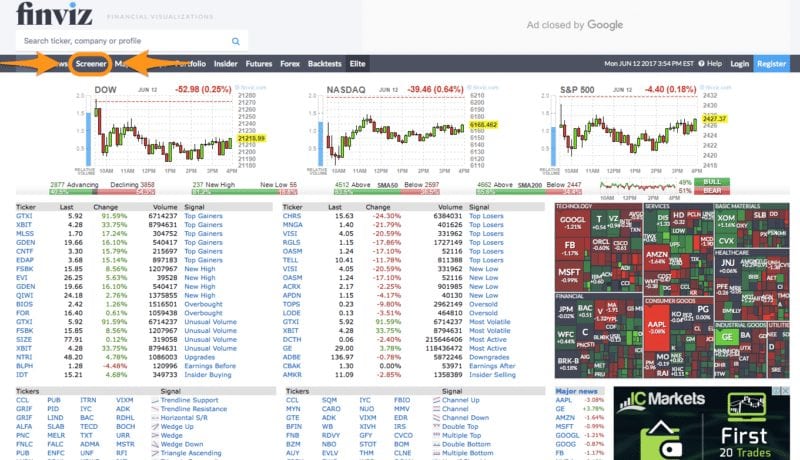

#1 Head over to Finviz.com and click on “Screener”

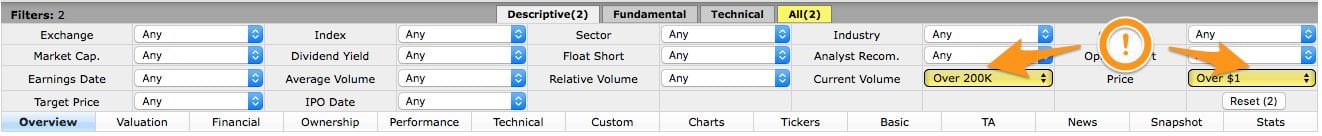

#2 Filter the Results by Price and Volume

I use two main filters:

- I want the price to be above $1 so that I wouldn’t be looking at super volatile penny stocks for this strategy;

- I want the volume to be north of 200K, this should eliminate stocks that aren’t moving much at all.

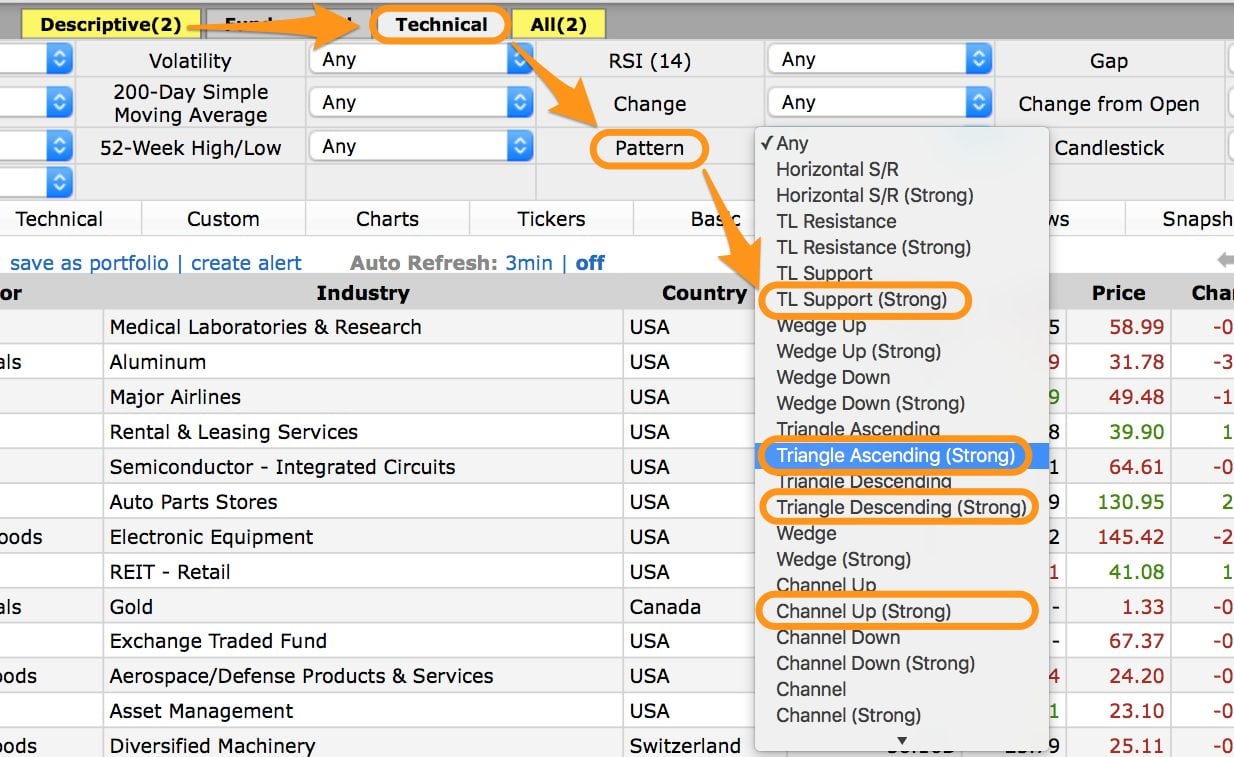

#3 Start Browsing for Your Favourite Patterns

Now click “Technical” and choose among your favorite patterns to look for potential plays. Below I’ve listed my favorites, but you will soon have your own – usually the ones that work the best.

#4 Check Through the Symbols to Find Good Plays

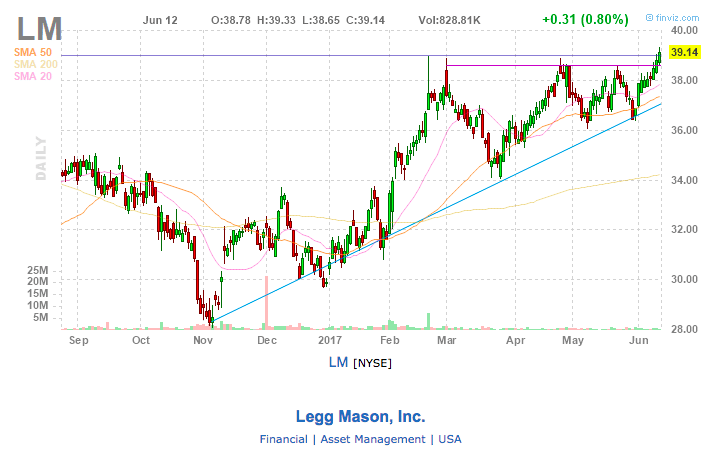

Having checked through a bunch of strong ascending triangles, I found one that seems like a potential play – Legg Mason (LM). The stock seems to be breaking out of its resistance and is ready to make a bigger move north.

Where to Find These Patterns [FOREX]

Luckily instead of having to go through hundreds of different patterns, with forex you only have a few dozen instruments to go through. If your FX broker offers various other instruments like commodities, you may want to check these out for patterns as well.

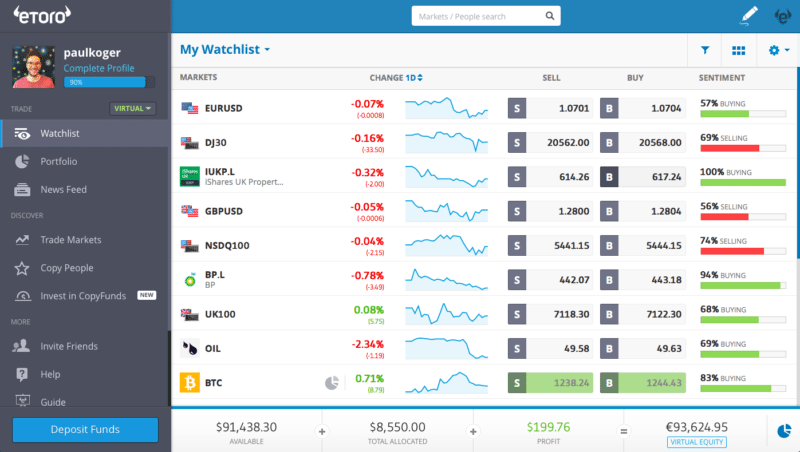

This is an example of Etoro instruments feed, that I go over to check for different patterns that will also be helpful for day traders.

As there are fewer instruments to check in case of forex, there are also fewer opportunities to be found. This is why I recommend learning a few additional patterns for forex traders to broaden their trading opportunities.

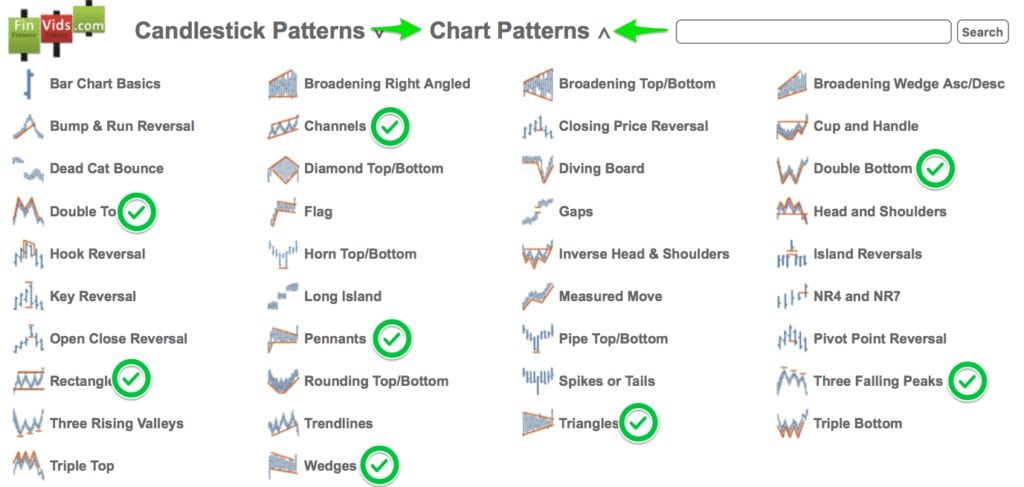

The three patterns shown above are my most favorite ones among other swing trading strategies, but you are by no means limited to those three. One good place to learn about more technical trading patterns is the Finvids website that I previously referred to.

From there choose Chart Patterns and you will have a myriad of patterns to choose from. I’ve outlined a few that have worked the best for me throughout the years. Check them out so that you can recognize them in various currency pairs.

Now let’s move on and see what we should do with these trading strategies…

Swing Trading Strategy #2: Grading the Patterns

Now as you know the 5 most profitable chart patterns, you can basically go and try to start making some money.

Although as you probably guessed, it is not that easy. If it was that easy, there would be loads of profitable traders, but as there aren’t, there has to be something more to it.

When you start looking for and recognizing the patterns, you will quickly realize that oftentimes the charts are rather messy.

Perfect set-ups are hard to find and hence it is difficult to decide which patterns you should participate in and when not to. To combat this common problem I suggest using a very easy, yet effective grading system.

How it works is that when you recognize a pattern, you rate it in a range of 1-10 based on how pure the pattern is. If it’s a messy chart, you use a lower score, if it’s very clear and easy to read, you use a higher score.

And every time you find and grade it, you take a screenshot of the pattern and save it to a folder or an Excel file (I use Excel myself).

PS! If you don’t know how to take a screenshot, follow this guide – https://www.take-a-screenshot.org/. It is a really important step and I highly recommend doing this.

The grade you put on each pattern is very subjective, but that’s ok. As you get more experience, your grading ability improves and you become better at this.

After you have decided on the grade, I suggest only taking on trades on patterns that are rated at least 6 or above. This is because the messy patterns tend to go all over the place and often stop you out before reaching your profit target.

Overall the best patterns make you money with a significantly higher probability.

Swing Trading Strategy #3: Bankroll management and growing your trading account exponentially

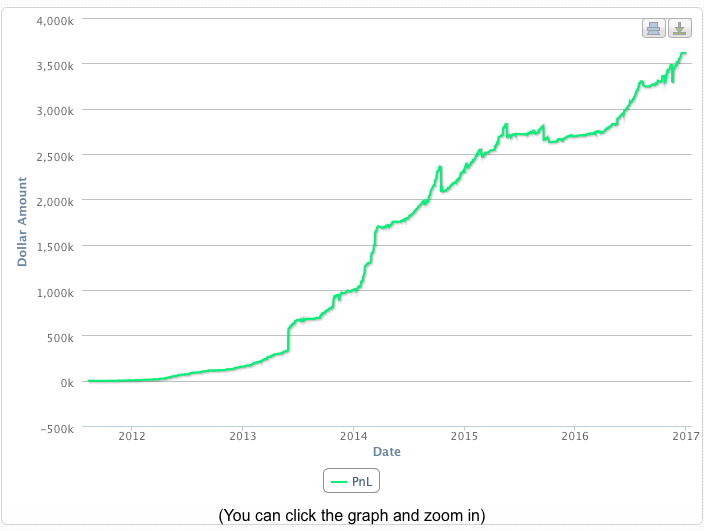

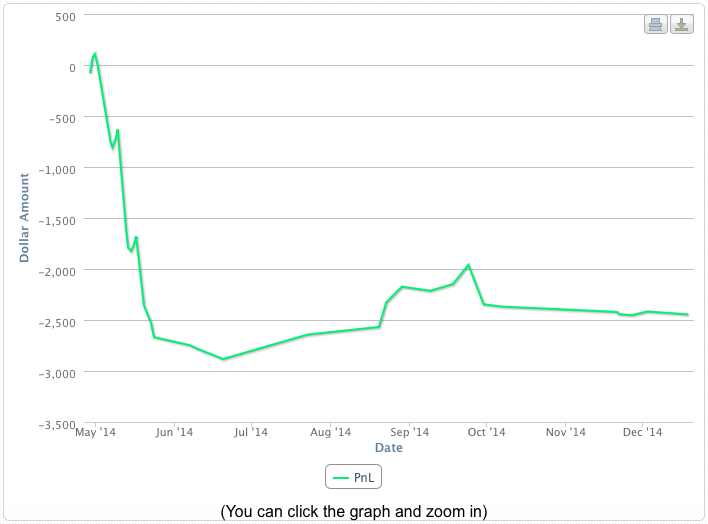

This is a picture of a real trader’s account balance growth over 5 years. This is what is possible when you steadily grow your account. Over time, the gains add up and you are able to achieve millionaire status.

The picture above shows how $1500 was turned into $3.63M. Want your balance to look something like this? Of course, you do. In this article, I’m going to share with you how this is possible.

But trying to achieve this as a swing trader, you need to mind the risk as well, which is why I’m going to emphasize endeavor the fact that please consider the possibility of losing your full investment when day trading. This is a risky endeavour, but can lead to riches if proper dedication and time will be invested.

As you can see from the above chart, consistent growth can become exponential, meaning that one is able to turn little money into a fortune in a few years or even faster.

In order to achieve consistent exponential growth, you need to set a certain risk level for each trade. This is a percentage amount that is the maximum you are willing to risk per each trade.

1. Minimizing Risk

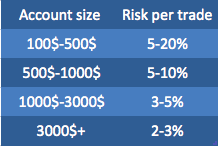

The general recommendation for good trading portfolio management is to have a maximum of 2-3% risk per each trade. This also depends on your account size. I currently use 2-2,5%, which is $400-500 per trade.

If you have a smaller account of let’s say 500$ or less, then you should use a higher percentage as risking 2% would be 10$, which can happen rather quickly. Instead, I would recommend using 5-10%. This is a lot, but if you are trying to grow a smaller account, there is inherently more risk involved.

Another important aspect is that the percentage system helps you protect your money. If you use a 3% stop-loss and lose, your account size decreases but you also risking less every time it happens.

If we take a very negative scenario of you starting with a 1000$ and losing 50% of your account, your stop-loss would at first be 50$, and after being left with 500$, the amount you risk per trade would be 25$.

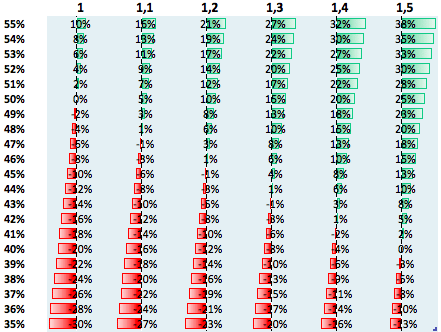

The table is just for general guidelines, but has been made to reflect the risk level that is needed to realistically grow your account. Also bear in mind that if you are starting out with a smaller amount, you will need to risk a very big portion of your balance to make money.

This percentage stop-loss system is vital as it keeps your account from drastically decreasing so it protects the downside risk. If you don’t do this, your account “growth” can and very likely will look something more like this:

2. Growing Your Account Exponentially:

There are many examples of successful day traders with similar account growth graphs as I showed above (I mean the first graph :). They all have one thing in common – making consistent gains while managing their risk, with a similar system as described above.

Vice versa to losing and the percentage risk amount protecting your account as the amount you are risking decreases – the same system helps you win more when your account grows.

If we take a simple example of risking 5% and trying to win the same amount, meaning that we are using a 1-1 risk/reward ratio, we would win 50$.

Now let’s assume after a number of trades our account has grown to 2000, the same 5% equals 100$, with 10 000$, 5% equals 500$ and so on, so if your account grows, you will be making more money helping you to grow the account the same way the swing trading professionals do it.

3. Profitability and Risk Reward Ratio for Day Traders

Profitability equals the percentage of trades that are profitable. If you win 60 out of a 100 trades, your ratio is 60%.

The risk-reward ratio is the potential profit for every amount you are risking. For beginner day traders, it is usually best to use a 1-1 risk-reward ratio. So that if you risk 5% on a trade, you would look to make 5% on a trade as well.

1-1 ratio helps you build confidence and is a good base to start adjusting from. I personally have different ratios for different patterns, these have all been described in the articles about swing trading strategies on this site.

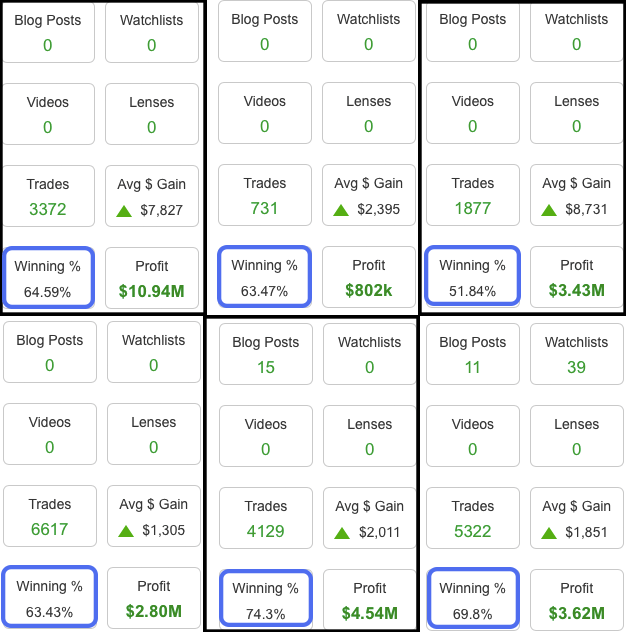

Most pro traders have a profitability ratio above 50% and risk/reward above 1.0, meaning that they are looking to gain more than they risk each trade. These trading opportunities, in turn, lead to overall profitability and riches.

Below I’ve listed stats from six pro traders. As you can see, their winning ratio varies from 52%-74%. This depends on their strategy, but you get the point.

The key is to find a strategy and be good enough of a swing trader to implement it in a way to achieve those numbers.

To keep track of your performance in the trading platforms of your choice, you need to also track your trades and make statistics or swing trading indicators to see what works and what doesn’t to improve your chances of becoming a successful trader. I will discuss this in detail in another article.

I highly recommend studying this paragraph in-depth and keeping this in mind before you enter a trade. Proper risk control is the key to win in the trading profession.

If you should have any questions about this topic about swing trade, please feel free to post a comment or contact me via e-mail traderpaulkoger@gmail.com or skype @paulkoger.

Now let’s move on!

Swing Trading Strategy #4: Analysing Your Results

The main idea behind grading is to analyze which patterns work the best and where do the majority of your profits and losses come from.

So if you have an Excel chart of graded patterns and the results from these patterns – did you eventually win or lose, you can analyze which patterns and grades work best and from which are you losing money from.

After doing this, you can cut out the losers and only focus on the winners.

To have a realistic base to make statistics on, you should collect at least 5 examples of each pattern and grade. You should start analyzing from the get-go, but make conclusions only when you have enough examples to form an objective view.

Profitability analysis

Another part of the analysis as a swing trader is getting to know your profitability per chart pattern. For this, you need to keep track of all your results.

This again requires a bit of extra work, but laziness to analyze their results is one of the main reasons why people fail at trading. Don’t be lazy, be profitable instead!

Before entering into each trade, I make a screenshot from the chart pattern and the profit and loss targets. After the trade is completed, I look at the closed positions to see how it went and write the results down to my Excel file.

The analysis page includes:

- Was the trade profitable? Yes/No

- What was the pattern I used? Triangle/Double Top/Break-Out/Channel

- Pattern rating? 1-10

- How much did I risk? Percentage of the total portfolio

- How much was I aiming to gain? Percentage of the total portfolio

With this simple swing trade technique, I can find out which patterns work the best and from the patterns, which grades are the minimum to be profitable on average.

If you know this information, you are already better than most swing traders. The difference between you and them is that the majority of swing traders do not track their performance and thus are at a disadvantage compared to you.

This statistics is super-duper important, as from that you know which patterns are money makers on average and which are not and to only concentrate on the ones that make you profits. In addition, I also check what is the average profitability ratio per pattern (profitable trades divided by all trades) and average gain compared to average loss, which gives me the average risk/reward ratio.

Now if I see that a pattern is profitable less than 50% of the time. I try to adjust my risk/reward ratio in a way that I try to set my profit target higher than my stop-loss level.

For example:

If I see that a pattern has a 40% profitability ratio, and I am currently using a 1-1 risk-reward ratio, meaning that I risk 3% and try to win 3% as well, I then adjust the profit target according to the below chart that calculates total profitability (TP).

In human language: TP means what is the average expected profit that you will probably make per trade. This consists of risk/reward ratio and pattern profitability.

When the profitability ratio of a pattern falls below 50%, you should increase the risk/reward ratio accordingly. From the chart below, you can see total profitability as mentioned earlier.

I usually try to aim for at least 15% of total profitability. The higher the better. Although do keep in mind that if you increase the risk/reward ratio, the profitability ratio of a pattern can decrease.

In the beginning, I advise starting off with 1-1 risk-reward and after gathering some data, adjust from there.

Most people don’t pay attention to this, because it may seem boring and a bit overwhelming/ However, this is also one of the main reasons why they won’t realize why they are losing and are unable to improve their trading.

Swing Trading Strategy #5: Opening a Trading Account

This guide on swing trading strategies is meant for people with different levels of experience, which is why the account opening process is also included in this trading guide.

I personally use this swing trading strategy over at Etoro, which is a Forex trading platform.

I use their mobile, desktop, and sometimes web applications. The last one I use when I’m abroad somewhere or using a computer that is not mine.

Etoro has a very user-friendly interface and it’s easy to use and understand, unlike many other brokers I’ve tried. I do recommend them for swing trading.

Here I’ve written a very useful strategy on how to get started with trading and about the swing trading system. Check it out!

To Sum Up

Swing trading is a powerful way to practice trading part-time aside from your daily responsibilities. Mastering the craft may allow you to earn a little extra or your whole income from the swing trading markets.

I do understand this swing trading strategy guide might be complicated to some, which is why I am more than happy to explain this in detail or share with you more about swing trading basics if you drop me an email at traderpaulkoger@gmail.com or via Skype @paulkoger.

Interested to know more about how to successfully swing trade stocks? Read our other stock market tips and guides at Foxytrades.com.

![Etoro Review – My Honest Opinion [+TUTORIALS]](https://foxytrades.com/wp-content/uploads/2018/03/Etoro-Review-100x70.jpg)

Would you recommend swing trading to someone with a small amount of money to expand his portfolio?

Yes, I would. Although you always need to keep track of your costs. If you have a small account, the costs can make up a big percentage of your position, meaning that is much harder to make a profit in the long run. Read this piece for more in depth in…

[…] Scalping not allowed – eToro such as many other CFD based brokers do not allow doing small short term trades. Focus on a bit longer time periods instead, such as swing trading. […]

Thank you so much! I’m new to swing trading and found this to be very helpful.

Thank you Danni for the nice words

Hi Paul, just wondering if there was any particular reason why you specialise in US equity stock for your swing trading as opposed to UK equity stock (or any other country’s equity stock for that matter)?

Hi Propa,

Good question!

I’ve also tried Swedish, Finnish, Norwegian, French, Dutch and UK stocks.

And to be honest, I’ve noticed that less liquid markets tend to follow the trends and patterns better. The success rate of different patterns is higher there.

Although mainly due to liquidity and time zone issues, I like US stocks the most. I can find the most plays there.

I’m currently residing in the US, so it is a bit complicated to trade the European stocks.

So if you have the ability to do so, I encourage you to trade the UK stocks as well.

[…] cannot rush success. It will take time to learn the market, build strategies, and adapt them. The traders that do so usually will see consistent profits after 5 to 12 months. […]

Hi Paul,

In your blog you refer to FinViz.com to find your stock patterns. Do you pay extra for FinViz elite subscription? If so, is it worth it? Does it give you a “trading edge”?

Also, any particular reason why you don’t use StockCharts.com to find your stock patterns? Again, in your opinion, is there any edge in paying for a subscription based service, or is free suffice for finding stock patterns for swing trading?

Hey Propa,

I don’t pay extra for Finviz at the moment, because when I swing trade, their free option does suffice. Then again, you do have extra features with the paid option so you might improve your edge with it through possibly finding more plays and getting timely notifications.

I have checked stockcharts as well, although I love Finviz’s option to browse instruments by patterns.

So to sum up, no particular reason other than I’m used to Finviz and it works well for me.

Hi Paul, You recommend etoro.com but they are only available to non-US residents. Do you have any you would recommend for US based users?

Hey Jason,

For US residents, I recommend Zulutrade. They do have less traders to copy, but on the other hand, their trading costs are lower.