Table of Contents

101 Powerful Day Trading Tips for Beginners

There’s always room for improvement if you’re a trader, especially when starting out. Professional traders are constantly looking to improve themselves and become better each day. If the pros are always learning, so should you.

After reading and implementing the day trading tips provided here, you are guaranteed to have higher odds of success as a trader. Following these tips will help you shorten the learning curve and save money from learning from other’s mistakes instead of discovering them on the expense of your own account.

Below you’ll find 101 swing and intraday tips that have been collected from successful traders that have been divided into following categories:

I General Trading Tips

II Trading Psychology

III Risk & Bankroll Management

IV Technical Trading Tips

General Trading Tips

1. Only trade the best opportunities – This has been touched briefly on another point, but keep in mind that for most professional traders, the majority of their profits come from only a small portion of their trades, where the set-up and odds of success were the best. Lousy set-ups will take money from you. Be very critical when choosing where to put your money on the line, cause you worked hard for it. Don’t just throw it out the window.

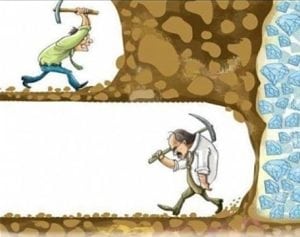

2. Invest time to educate yourself – Most traders lose, because they are too lazy to study, as cliche as it sounds, its true. People are super lazy, they just want to become a pro trader overnight and start making millions. Losers think that after reading about it for a few days up to a week and putting money down on a trading account is a sure way to riches. All successful traders have gone through extensive periods of studies and experiencing with real money and to reach where they are.

2. Invest time to educate yourself – Most traders lose, because they are too lazy to study, as cliche as it sounds, its true. People are super lazy, they just want to become a pro trader overnight and start making millions. Losers think that after reading about it for a few days up to a week and putting money down on a trading account is a sure way to riches. All successful traders have gone through extensive periods of studies and experiencing with real money and to reach where they are.

3. Establish a trading plan – You need to have a strategy to focus down on and perfect. In order to find one, you can try to locate a strategy from the web that suits your time schedule, financial resources and your personality traits. When you find something that meets these criteria, start practicing it and making your own tweaks and adjustments, take notes of trades and try to keep getting better through analysing what you did right on the winners and wrong on the losers.

4. Find a mentor who will teach you – Learning a skill in the medieval style: practicing under a master is one of the best ways to learn a trading. Key to this is finding a mentor that has a trading style that suits you. Also usually the pros that teach ask you money for their time, but this investment into education will most likely save you 10X+ of potential losses and so called „school money“ in the markets.

5.  Check the news of the stock – If you are trading something, just make sure you understand the underlying reason for the move. Either the company beat earnings estimates, has a new powerful CEO, failed to receive FDA approval or whatever the specific news is. It is important to know the cause of the move and to trade on the side of the news.

Check the news of the stock – If you are trading something, just make sure you understand the underlying reason for the move. Either the company beat earnings estimates, has a new powerful CEO, failed to receive FDA approval or whatever the specific news is. It is important to know the cause of the move and to trade on the side of the news.

6. Keep it simple – Do not try to overcomplicate things. Keeping it simple is the way to go. This means that you should find one method or strategy that makes sense to you and follow it. If it gets too hard or difficult to understand, move on to something else.

7.  Don’t follow anyone else’s alerts blindly – There are numerous services that offer free and paid alerts, some of those paid alerts have some value in them, although it is not advised to blindly follow them. Instead you have to learn the reasoning and the idea behind each trade. When you learn the idea, you’ll become self-sufficient and don’t need anyone else’s advice.

Don’t follow anyone else’s alerts blindly – There are numerous services that offer free and paid alerts, some of those paid alerts have some value in them, although it is not advised to blindly follow them. Instead you have to learn the reasoning and the idea behind each trade. When you learn the idea, you’ll become self-sufficient and don’t need anyone else’s advice.

8. Expect all possible outcomes – Everything is possible, you need to be prepared and not let the market scare you when shit hits the fan. If you are prepared, it is easier to follow your plan, emotions will have less control over you.

9. Print out your trades to real paper and write out the reasoning behind the trade and your trading idea, what went wrong, what you did right. This way you have something physical to go over weekly and to learn from. Learning from the physical “book” you will come out of your usual environment and memorize ideas, mistakes and best practices better.

10.  Never trust an automatic trading system – It goes without saying to most of you, but the forex systems and trading signals salespeople are still making a killing selling their services to trusting people. Don’t be one of them and realise that no one would sell their profitable system. It would be a lot wiser for them to just milk the system by themselves for as long as it works.

Never trust an automatic trading system – It goes without saying to most of you, but the forex systems and trading signals salespeople are still making a killing selling their services to trusting people. Don’t be one of them and realise that no one would sell their profitable system. It would be a lot wiser for them to just milk the system by themselves for as long as it works.

11. Think in terms of probabilities – There is no strategy that will make you money all the time. What separates good strategies from the bad ones is the percentage of winning trades they bring. If you think in probabilities, you are more aware of the potential pitfalls and successes that may occur in your trading career.

12. Don’t swing for the fences – instead try to catch small, predictable and easy gains time and time again. Big wins are rare, they will occur, but aim for the realistic profits will grow your account faster.

13. Don’t try to look for the best strategy in the world – pick a strategy that makes sense to you and fits your time schedule and personality and start practicing. You can improve from there. If you are constantly looking for the best strategy, chances are you are not going to find it as there is always something better to be found, but you won’t know before you won’t test it.

14.When no good trades available, focus on learning instead – When there are no good plays for you to take advantage of, try to use the time to study, analyse your past trades, mistakes and wins. Investing the time into education has an infinitely higher return that trying to force trades on a dead market.

14.When no good trades available, focus on learning instead – When there are no good plays for you to take advantage of, try to use the time to study, analyse your past trades, mistakes and wins. Investing the time into education has an infinitely higher return that trying to force trades on a dead market.

15. Aim to become consistently profitable – As mentioned above, becoming a successful trader is not an easy nor quick journey. It takes time and effort so you should set a long term goal to becoming a consistently profitable trader. Consistency is the key to earning the big bux and quitting your job if that is your end goal.

16. Don’t invest in hardware in the beginning – Hardware is expensive and many beginners get overwhelmed with the idea that they need 8 monitors and a supercomputer to begin their trading journey. This is not the case. You should start with what you’ve got and move on from there when you really feel the need to invest into an extra monitor, a better pc, internet connection or some software, but don’t worry about it in the beginning and invest in education instead.

17. The harder you work, the luckier you’ll get – Luck plays a role with single trades, but in the long run, skill takes over. The more you have studied, worked and focused on developing your skill, the “luckier” you’ll be.

18.  Write out your trading plan – it is easier to stick to it when you have your strategy/plan written out and displayed somewhere for you to see at all times when trading. You’ll be surprised how disciplinary this small piece of paper can be.

Write out your trading plan – it is easier to stick to it when you have your strategy/plan written out and displayed somewhere for you to see at all times when trading. You’ll be surprised how disciplinary this small piece of paper can be.

19. Hard work beats big bankroll – If you are worried about having less money to start with than other around you, don’t worry. The final determinant of success is hard work and dedication.

20. You learn faster with real money – paper trading is good for learning to know all the technicals with no risk, but you’ll learn a lot faster when you have some skin in the game.

21. Keep a list of your mistakes – every time you lose, write down the reason, make a list of those reasons and go over them every day before starting to trade. This way you are able to remember the past stupidities better in order to not repeat them again.

22.  Trade what the pros are trading – follow professional traders and try to find out which stocks or instruments they are trading and try to understand how the profits are being made, when did they buy and sell. This is important as experienced traders are like experienced fisherman – they know where to fish.

Trade what the pros are trading – follow professional traders and try to find out which stocks or instruments they are trading and try to understand how the profits are being made, when did they buy and sell. This is important as experienced traders are like experienced fisherman – they know where to fish.

23. Find a trading niche and master it – At first you need to wonder around and try different strategies, markets and trading styles. Then when you have tried and see results, cut out the ones that aren’t working and only focus on the strategies/niches that do work, focus on them and become the master of that niche. In trading you need to be at the very top to succeed, picking a certain strategy and becoming really good at it will improve your odds of overall success.

24. Don’t watch CNBC and other trading channels – these will only distract you from what’s important. All the news they feature are already priced into the stocks. You may find some valuable information if you’re a long term investor, but for a beginner, there is nothing of value there.

25.  Treat trading like a business, not as a hobby – If you want to be making money, you’ll need to treat trading like a business. Be meticulous and disciplined with the money you invest into this care

Treat trading like a business, not as a hobby – If you want to be making money, you’ll need to treat trading like a business. Be meticulous and disciplined with the money you invest into this care

er. If you are just looking to gamble, there are cheaper ways to do that

26. Don’t be afraid of penny stocks – they can be very efficient in growing a small account when you know what you’re doing. Although these stocks pack a lot of extra risk compared to regular stocks. Dedicate at least 3 months to learning to trade them and practice via a demo account before you put your own money on the line.

27.  Reaching consistent profitability will take time – Becoming consistently profitable usually takes between 5-12 months depending on how much effort & time you put into educating yourself. The faster you learn from your own mistakes the quicker you’ll become a persistent success.

Reaching consistent profitability will take time – Becoming consistently profitable usually takes between 5-12 months depending on how much effort & time you put into educating yourself. The faster you learn from your own mistakes the quicker you’ll become a persistent success.

II Trading Psychology

28. Practice discipline – A good trader has a trading strategy that has proven to work and they stick to it. After finding your own best method that works for you, it is vital to stick to it and not to wonder into other strategies from time to time to gamble. Pros don’t gamble, they practice what works and make a killing out of it. Switching between strategies often leads to losses.

29.  Be patient – only trade when you see the perfect setup that meets your strategy guidelines. Not trading is a skill, that can earn you money as crazy as it sounds. How you must be wondering? Well research shows that traders that trade less tend to be more profitable on average per trade. This is caused by the fact that when you trade average and shite set-ups, you won’t have the time to focus on finding good setups and thus you are missing out on those fat profits while sweating with difficult plays that won’t move your total profit needle to where you want it to be.

Be patient – only trade when you see the perfect setup that meets your strategy guidelines. Not trading is a skill, that can earn you money as crazy as it sounds. How you must be wondering? Well research shows that traders that trade less tend to be more profitable on average per trade. This is caused by the fact that when you trade average and shite set-ups, you won’t have the time to focus on finding good setups and thus you are missing out on those fat profits while sweating with difficult plays that won’t move your total profit needle to where you want it to be.

30. Have realistic expectations – You can not expect to make a killing when you are just starting out. You should aim for modest profits in the beginning and grow your account steadily. If you use a realistic percentage profit target and keep making profitable trades, your account will grow exponentially, but it will take months to years not just a few weeks.

31.  Build positive feedback loops – When you trade only the best set-ups, where you feel the most secure when entering into a trade, you are more likely to win. When you execute a trade according to your plan, you start forming habits of correct trade planning and implementation. Well performed trade will more likely bring in a successful trade and improve your confidence, which will motivate you to stay on the right course and not become lazy.

Build positive feedback loops – When you trade only the best set-ups, where you feel the most secure when entering into a trade, you are more likely to win. When you execute a trade according to your plan, you start forming habits of correct trade planning and implementation. Well performed trade will more likely bring in a successful trade and improve your confidence, which will motivate you to stay on the right course and not become lazy.

32. Keep your emotions at bay – Emotions work against a trader, they make you do irrational decisions. Common errors include adding to a losing position, letting the losses get out of hand and cutting winners too soon, when the right thing to do would be the opposite. People know that, but still fall into the same bad behaviour patterns when under the influence of emotions. One way to get past this is to be mindful of your emotions, you need to be aware and expect those emotions and admit that they will have a negative effect on your account size. Emotions is a huge part of trading that is overlooked 80% of the time by traders. Do not be one of them – it is highly advised to further work with the emotional side of trading.

33.  Never add to a loser – Once you are in a losing position, you need to exit when your pre-set stop-loss level gets hit or something drastically changes in the initial idea you had, but you should never add to a losing position to get your average down or to double-up to make back what you lost. This is a common error that traders do when they get emotional and want to make back what they have already lost.

Never add to a loser – Once you are in a losing position, you need to exit when your pre-set stop-loss level gets hit or something drastically changes in the initial idea you had, but you should never add to a losing position to get your average down or to double-up to make back what you lost. This is a common error that traders do when they get emotional and want to make back what they have already lost.

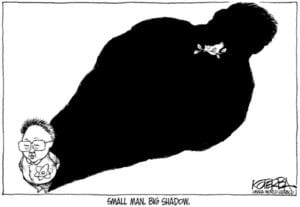

34. Do not fight the markets – the market is always in control and does whatever it likes. Your job is to find opportunities, where the odds of success are greater than 50% and try to participate in them. If you are wrong and the trade does not go your way, just accept that this was one of the losing trades and treat it as just a statistic, do not try to be right all the time.

35.  Share your trading journey with others – start a blog or join a trading community like profit.ly and import all your trades. You can add comments and reasoning there, answer questions and ask questions from other traders. This allows you to stay more disciplined as you feel more accountable for the trades and feel a responsibility to the community. Also you will try to take on better trades as you know there are other people keeping an eye on you and your results.

Share your trading journey with others – start a blog or join a trading community like profit.ly and import all your trades. You can add comments and reasoning there, answer questions and ask questions from other traders. This allows you to stay more disciplined as you feel more accountable for the trades and feel a responsibility to the community. Also you will try to take on better trades as you know there are other people keeping an eye on you and your results.

36. Put yourself in the shoes of other traders – If you try to put yourself in the minds of the masses, you can start to understand why the stock is moving in the specific direction. People tend to have similar emotions, like when the support level that has been holding for a long time gets broken, there will be a lot of traders panicking. If you however are able to predict this, you can learn to profit from it.

37.  Don’t get too excited – excitement will cloud your judgement and will hurt your ability to think clearly. When this happens, control your breathing and become mindful of the situation. If you find yourself too excited, it can be wiser to exit the position and walk away to calm down.

Don’t get too excited – excitement will cloud your judgement and will hurt your ability to think clearly. When this happens, control your breathing and become mindful of the situation. If you find yourself too excited, it can be wiser to exit the position and walk away to calm down.

38. Focus on trading well instead of the money – If you put more emphasize on the money, you will become irrational and while chasing big dollar gains you will lose sight of the real situation. Instead focus on executing good trades and trading perfectly, the profits will follow.

39. Sit on your hands if there is no action – trying to force action will lead to losses. When there is no volume and no plays, then accept it and do something else. Go out and walk, watch a movie or take your spouse shopping. Whatever you do, its most likely cheaper than trading when there are no good set-ups to trade.

40.  Look for opportunities not to trade – yea, you read it right, there are no spelling mistakes there. What this means is that a good way to practice only taking the best trades is trying not to trade at all and only take on a trade when the opportunity seems too good to let it go by. Only trade when you see money laying on the floor.

Look for opportunities not to trade – yea, you read it right, there are no spelling mistakes there. What this means is that a good way to practice only taking the best trades is trying not to trade at all and only take on a trade when the opportunity seems too good to let it go by. Only trade when you see money laying on the floor.

41. Believe in yourself – as corny as it sounds, people actually hurt their trading by not believing that they can win. This affects their mental game and will result worse trading results. Successful traders are no different than you are. They are no geniuses nor whizz kids, all they have done is learned from their mistakes and kept at it until they become profitable and continue learning.

42.  Do not let your losers run – If this is an issue for you, it’s an easy fix, just use hard stops until you manage to control your risk manually using soft stops that you have planned before entering into the trade. Soft stops can help you become more profitable, but only when you move them higher instead of lower in a long position.

Do not let your losers run – If this is an issue for you, it’s an easy fix, just use hard stops until you manage to control your risk manually using soft stops that you have planned before entering into the trade. Soft stops can help you become more profitable, but only when you move them higher instead of lower in a long position.

43. Accept that your wrong almost half the time – Being wrong is something that has been programmed into us that is bad, especially from school, and we try to avoid it. Trying to avoid being wrong can cause inability to trade and/or holding on to your bad trade and hoping that it will turn into a good one, while in reality the position should have been closed hundreds of dollars ago. Instead you need to focus on cutting your losses quickly and welcoming the fact that you are wrong. If you look at it from a statistical point of view, you can justify being wrong due to 30-50% of trades being losers even for pros, so it’s just a statistic, a stepping stone towards profitable trades.

44. Making mistakes is normal and to be expected – Pro traders make mistakes all the time and still make a handsome profit on their accounts. You don’t need to perfect on every aspect of trading. Mistakes are normal and you should treat them as learning experiences instead of putting yourself down for making them.

45. Control your itchy profit finger – This is a super common problem among beginner and experienced traders alike. When you see profits on your screen, there is an instant urge to take the profits and run so to speak. Again you need to be mindful of this emotional issue and not give in to it. Just remember, if you take those profits too soon, you won’t be able to become profitable in the bigger picture as this forms a bad habit which will lead to your average profit being less than your average loss.

46. When in doubt, stay aside – If you’re not fully sure about the trade, don’t take it. Majority of the time the trades you take when in doubt will result in losses. It is wise to write down your feelings along with your trading plan before each trade, so you can correlate your emotions with your results to see if there is a connection which can help you improve your game in future trades.

47.  Don’t abandon your strategy after a few failures – Statistics has been emphasized here in a number of times, which means you should by now already be aware that not all your trades are going to be winners and you may experience a number of consecutive losses. This is perfectly normal. In order to make any real conclusions, I’d recommend doing at least 20-30 trades before you can start making any real conclusions.

Don’t abandon your strategy after a few failures – Statistics has been emphasized here in a number of times, which means you should by now already be aware that not all your trades are going to be winners and you may experience a number of consecutive losses. This is perfectly normal. In order to make any real conclusions, I’d recommend doing at least 20-30 trades before you can start making any real conclusions.

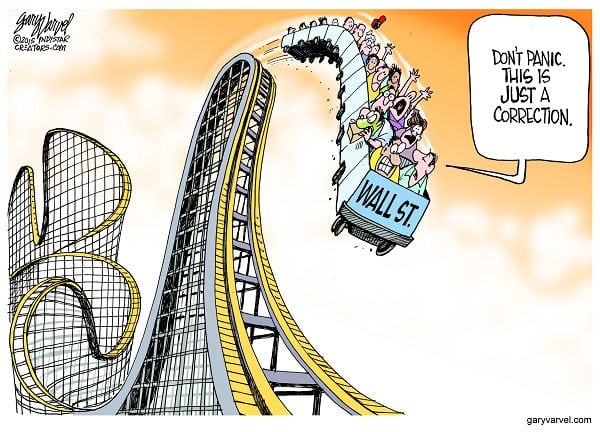

48. The market can stay irrational for longer than you can remain solvent – don’t try to pick the top or bottom of a stock thinking that the price can’t go any higher/lower. It sure can and will. Many people have lost great fortunes due to this, don’t be one of them.

49. Avoid revenge trading – This happens when you have lost with a position and are trying to make back the losses with risking more or trying to force trades. Revenge trading is a common problem among beginner traders, most professionals are mindful of this and usually can avoid this expensive behaviour (not always tho).

50.  If you’re in the trade and feel scared, you have too much size – you need to feel comfortable with your size. If you have too much size, you become nervous and emotions will hurt your trading. Recognize the situation and reduce your size or sell the position.

If you’re in the trade and feel scared, you have too much size – you need to feel comfortable with your size. If you have too much size, you become nervous and emotions will hurt your trading. Recognize the situation and reduce your size or sell the position.

51. Treat losses as tuition money – learn from them, take notes and write down what you did wrong in order to not repeat the same mistakes again in the future. Learning is expensive in the trading world, you either learn from other’s mistakes or make them yourself. The second option is more expensive.

52.  Put some coins or dollars next to your trading desk – It’s easy to lose track of the value of money when you’re trading. Having some paper bills or coins close to you will remind you that a 100$ is a lot of money to make or lose. Respect your gains, even the small ones and don’t let your losers get out of hand.

Put some coins or dollars next to your trading desk – It’s easy to lose track of the value of money when you’re trading. Having some paper bills or coins close to you will remind you that a 100$ is a lot of money to make or lose. Respect your gains, even the small ones and don’t let your losers get out of hand.

53. Check your mood before taking a trade – if you’re angry, furious, sad or in any other way affected by emotions, do not trade. Just sit aside and watch the action. Trading with emotions will likely hurt your account. Do a favour to your account and trade only with a clear head.

54.  Greed is bad for you – if you try to hold on to a winner after it has surpassed your profit target and still hoping for more gains without a rational reason, you will likely lose those gains. Lock in profit when you have met your target price, don’t deviate from your plan where there is no rational reason to.

Greed is bad for you – if you try to hold on to a winner after it has surpassed your profit target and still hoping for more gains without a rational reason, you will likely lose those gains. Lock in profit when you have met your target price, don’t deviate from your plan where there is no rational reason to.

55. Avoid FOMO – fear of missing out is one of the biggest mental problems traders have, even professionals. When you see that other traders are all already in the trade and making money, but the pattern or idea does not suit you/ the move has already happened, do not try to get in, as the risk/reward ratio is now highly stacked against you and chances of losing are far greater than chances of making money from the trade. All the pros are already selling while you’re still buying.

56. Don’t compare yourself to others – other people have different account sizes, different resources and risk levels. Get inspired by other’s successes, but don’t try to copy them. Trying to emulate other people’s success will not help you become a better trader. Trying to be better than you were yesterday, will.

III Bankroll Management

57. Set profit and stop loss targets before entering a trade – A wise trader knows in advance, when they should hit the road and when to take out their profits. If you set these levels in advance, either by an automatic exit order or in your head (harder), then you will have a lesser chance of your emotions getting the best of you. Emotions have been known to be the number one cause of beginner traders failing. Mastering this part can immensely improve your results.

58. Only trade with money you can afford to lose – you heard it. This may seem obvious to some, but deciding on the amount of money you can invest and realizing that you can lose this is vital. Only do invest the amount that you can do without. Trading is a venture, an undertaking that has high odds of failure. Many people lose their shirt trying to master the art of trading. Don’t be one of them.

58. Only trade with money you can afford to lose – you heard it. This may seem obvious to some, but deciding on the amount of money you can invest and realizing that you can lose this is vital. Only do invest the amount that you can do without. Trading is a venture, an undertaking that has high odds of failure. Many people lose their shirt trying to master the art of trading. Don’t be one of them.

59. Don’t risk it all on one trade – Professional traders use a set risk of 2-10% per trade depending on their account size. This allows you to stay in the game even at times of losing streaks. If you risk too much per trade, one bad trade can wipe out a month of good trades and your motivation to keep on trucking.

60.  Pros focus on minimizing risks – amateurs focus on making a lot of money. This again may seem controversial, but if you think about it, most people lose all they have due to letting their losses get out of hand. If you instead focus on minimizing risks and keeping them to a minimum, you will be able to remain in the game and have increased odds of enviable success.

Pros focus on minimizing risks – amateurs focus on making a lot of money. This again may seem controversial, but if you think about it, most people lose all they have due to letting their losses get out of hand. If you instead focus on minimizing risks and keeping them to a minimum, you will be able to remain in the game and have increased odds of enviable success.

61. Missing a trade is better than losing money on it – Don’t try to chase a stock/currency when it has already made the move that you were expecting. Traders often try to chase in these situation and thus increasing their risk level and often realising that they were too late to the party and have to take their losses.

62. Move your stop-loss to your entry point when in profit – if there is additional upside potential. This way your risk is exiting at zero with decent upside.

63. Don’t catch a falling knife – this means that you shouldn’t try to pick a bottom of a falling stock trying to profit from the bounce. Most of the times you will be wrong and on average, this strategy does not work at all. Wait for a confirmation of a bottom or a higher low to enter if you want to play it.

63. Don’t catch a falling knife – this means that you shouldn’t try to pick a bottom of a falling stock trying to profit from the bounce. Most of the times you will be wrong and on average, this strategy does not work at all. Wait for a confirmation of a bottom or a higher low to enter if you want to play it.

64. If your profit target is hit, but there is still potential, sell half – this way you’ll lock in some profits and still have potential to make more money from the opportunity.

65. Add to winners – when you’re in a profit and think there is more potential, you can increase size and risk only the money you have made. So if you end up losing, you would be flat in the end.

66. “Risk management – if you don’t respect it, there will be nothing left for you to manage.. Always set a max loss limit” –a spot on quote from @modern_rock via Twitter.

67. It’s easier to make multiple small gains than one big gain – try making small gains often instead of a few big gains. Small gains will add up and make you richer faster!

68.  Align your account size and profit expectations – If you’re starting out with a small account of 5K or less, don’t expect to make 1K+ per day. You first need to learn to make 50-100$ per day consistently. Expecting big wins and waiting for them will make you risk bigger amounts and have a chance of blowing up your account.

Align your account size and profit expectations – If you’re starting out with a small account of 5K or less, don’t expect to make 1K+ per day. You first need to learn to make 50-100$ per day consistently. Expecting big wins and waiting for them will make you risk bigger amounts and have a chance of blowing up your account.

69. Use limit orders instead of market orders – Market orders are a dangerous thing, especially in case of stocks with lower liquidity. Using a market order, the price you actually pay can increase significantly. With market orders, the total you will lose due to this can make a big difference in your trading account. Limit orders help to protect your account by not letting the price go out of hand when you enter a trade.

70. Never turn a day trade into an investment – This has happened to a lot of people and usually the result is a smaller trading account. People are unable to accept a loss and start rationalising why that stock is actually a good investment for the longer run. Do not fall into this trap. When you’re wrong, admit it and move on.

IV Technical Trading Tips

71. Avoid volatile instruments in the beginning – Sure options, futures and other derivative instruments are interesting, but they can lead to blowing up your account before you can say „oh shit“. Start by getting to know the market via more safer instruments and controlled risk and when you gain experience, you can move on to the more exotic types of trades.

72. Choose a broker that suits you – After you choose a strategy that suits your schedule and makes sense to you, it is important to locate a broker that fits your trading style. If you are a short-biased trader, you need to make sure that your broker of choice allows short selling and has normal fees for doing so. If you like to hold long term, you need to make sure that the broker does not charge too much for holding an overnight position etc.

72. Choose a broker that suits you – After you choose a strategy that suits your schedule and makes sense to you, it is important to locate a broker that fits your trading style. If you are a short-biased trader, you need to make sure that your broker of choice allows short selling and has normal fees for doing so. If you like to hold long term, you need to make sure that the broker does not charge too much for holding an overnight position etc.

73. Take one trade at a time – Even seasoned traders have trouble following multiple trades at a time and they have years of experience backing them up. But as a newcomer, it is wise to put all your effort and focus towards one trade at a time. When you an opportunity, try to play it as good as you can and learn from it. When the trade is over, move on to other ideas/trades.

74. Do post trade analysis – After you have completed a trade, whether it went good or bad, you have to save it to an Excel file and write comments about why you think you profited or lost money on that one and what should be improved in the future. This is vital for your personal development as a trader. Many people dismiss this and hence never make it to becoming a profitable day trader.

75. Pay attention to volume – The volume of the instruments you trade should be higher than average for you to make money off of. When the volume is average, the stock usually does not do anything interesting and there are much less opportunities to profit from. This of course depends on the strategy, but often is the case for day and swing traders.

76. Keep track of your commissions – you need to treat trading like a business and as business owners keep track of their costs, so should you. Commissions are the biggest cost when trading for most part. It can be possible that you are profitable, but including trading costs, you are still losing money. If you know this, you can adjust your trading, try to earn more per trade compared to stop-loss, weed out the trades and strategies that are the least profitable and so on. Use a trading journal.

76. Keep track of your commissions – you need to treat trading like a business and as business owners keep track of their costs, so should you. Commissions are the biggest cost when trading for most part. It can be possible that you are profitable, but including trading costs, you are still losing money. If you know this, you can adjust your trading, try to earn more per trade compared to stop-loss, weed out the trades and strategies that are the least profitable and so on. Use a trading journal.

77. 75% of stocks follow the overall market – The overall market direction usually dictates the direction of the stock as well, unless the news on the particular company is really influential. If you trade the US stock market, follow S&P500, if you trade German stocks, follow DAX. This is more complicated with currencies however.

78.  Time frames – Use at least 2 time frames to check the charts. Check the longer term time frame to identify the overlying trend and shorter term timeframe to enter into the position more precisely.

Time frames – Use at least 2 time frames to check the charts. Check the longer term time frame to identify the overlying trend and shorter term timeframe to enter into the position more precisely.

79. Check the stock’s price range – Take notice of the price range of a stock or the instrument you’re trading for the time period you are intending to trade within. These are the average barriers within which the instrument is most likely to move in the future as well. The same “walls” give you an idea of potential risk and profit, do not expect the stock to breach those levels, as this happens seldom.

80. Different instruments and stocks behave differently – Professional traders often focus on one currency pair when trading forex or a particular stock, because after trading it for a while they get a feel for the instrument. Now if you switch between different instruments, you need to keep in mind that they all behave differently and need to adjust your trading accordingly.

81. Stocks are the most volatile when the market opens – Be aware of this fact. Usually all hell breaks loose when there were some news during non-trading hours. People react to it and try to take or sell their positions. This in turn brings havoc and can lead to enormous price swings. Be vary of this and learn to profit from these swings.

81. Stocks are the most volatile when the market opens – Be aware of this fact. Usually all hell breaks loose when there were some news during non-trading hours. People react to it and try to take or sell their positions. This in turn brings havoc and can lead to enormous price swings. Be vary of this and learn to profit from these swings.

82. Use trailing stops – A trailing stop is a type of stop-loss order that follows the price by a set price. So if you leave your computer, but want to participate in the move still while protecting your gains, trailing stop is the way to go.

83. Don’t blame the outside world in your losses – If you lost, then it had something to do with how you traded that particular stock. You had all the possibilities to make money in the same scenario, but instead you didn’t. A mark of a true professional is their ability to take responsibility for bad trades and analyse their mistakes.

84.  Pay attention to trends – stocks and currencies often move in trends. It is important to pay attention to those when you make your trading decisions as it is likelier that the price will remain in the trend than it breaking out. The same goes to channels.

Pay attention to trends – stocks and currencies often move in trends. It is important to pay attention to those when you make your trading decisions as it is likelier that the price will remain in the trend than it breaking out. The same goes to channels.

85. Use moving averages on your charts – Prices tend to come back to equilibriums. Moving averages are a good indicator of how far the price has gone from its equilibrium. Choosing on the exact number of periods to use is up to you. Most commonly used are 14 and 50 period moving averages.

86. Locate support and resistance levels – as many traders follow those levels, they have significant importance. Even if your strategy doesn’t require checking those levels, you should still know where they are and be aware of other traders actions near those levels.

87.  Don’t use too many indicators – As said before, keep it simple. The more indicators you have, the more mixed signals you are going to receive. Some traders only use the price and are able to make a killing from the markets. Most pros have 1-4 indicators max and that’s it.

Don’t use too many indicators – As said before, keep it simple. The more indicators you have, the more mixed signals you are going to receive. Some traders only use the price and are able to make a killing from the markets. Most pros have 1-4 indicators max and that’s it.

88. Learn the technical side of trading through papertrading – This way you won’t mess up the buttons while putting real money on the line. When you first start out, technical errors are common, get to know all the buttons and try some paper trades first and only then but real money on the line.

89. Markets are constantly changing – what worked in the past may not work in the future. A good trader learns to adapt with the market to continue taking money from Mr Market.

90.  Prepare a watch list before trading hours – Prepare a list of stocks/instruments that are appealing to your strategy before the market opens, this way you’ll have more time to focus on trading instead of having to scan for stocks during trading hours.

Prepare a watch list before trading hours – Prepare a list of stocks/instruments that are appealing to your strategy before the market opens, this way you’ll have more time to focus on trading instead of having to scan for stocks during trading hours.

91. Technical trading is about pattern recognition – If you do your homework, you’ll be able to find patterns that appear time and time again. From that you can calculate the optional risk/reward and put together a trading strategy.

92. Use stock scanners to find plays before others – stock scanners will help you with screening for stocks before market open and also during the day. You will be notified of a stock that’s on the move straight as it happens. Live scanning tools usually cost money, but one good trade can pay for its cost. Definitely a wise investment for day traders. One of the best scanning tools in the industry is equityfeed. For swingtraders, the best option to find plays would be finviz.com

93.  Volume is a leading indicator for chart moves – if you notice volume picking up, it is highly likely that the stock is going to have a bigger than average move, which you can profit off of.

Volume is a leading indicator for chart moves – if you notice volume picking up, it is highly likely that the stock is going to have a bigger than average move, which you can profit off of.

94. Volume dries up during summer – you need to be extra careful when trading in summer. There is much less volume and hence less plays. You need to control your urge to trade when there is actually nothing to do.

95. Green to red/ red to green are very important indicators – This is a strong sign of a trend change in the specific stock or currency. Many people follow this and thus add fuel to the fire. Pay attention when these types of moves happen.

96.  Pay attention to platform fees – Just as with trading costs, you need to find out how big the platform fees are. Some brokers ask 100-200 per month, if you have a small account, this can amount to 10+% per month and really hurt your chances of success.

Pay attention to platform fees – Just as with trading costs, you need to find out how big the platform fees are. Some brokers ask 100-200 per month, if you have a small account, this can amount to 10+% per month and really hurt your chances of success.

97. Use Yahoo finance for biggest gainers & losers – if you don’t have the resources to invest into a 100-200$ per month stocks feed service, you can also check yahoo finance for biggest gainers and losers. Those are the stocks that are in play – they are the most interesting and profitable to trade for a day trader. Just remember that the information is delayed by up to 15-minutes.

98.  Cheaper stocks have bigger moves – in most cases. Meaning that it is easier to make bigger % gains from smaller stocks than from bigger stocks. A 5 dollar stock can go to 6 (+20%) a lot easier than a 100$ stock to 120$.

Cheaper stocks have bigger moves – in most cases. Meaning that it is easier to make bigger % gains from smaller stocks than from bigger stocks. A 5 dollar stock can go to 6 (+20%) a lot easier than a 100$ stock to 120$.

99. Get comfortable with short selling – Most beginners are not familiar with short selling and due to this can be missing out on half of the opportunities. Shorting a stock/currency is not that much harder than buying, learn this skill to open up a wide range of new opportunities to profit from.

100. Learn level 2 – when trading stocks, this can help you with better timing your entries, which is a key factor to winning. Many people are not using this tool, which will give you an advantage over those people.

101. Set your stop-loss according to chart and then adjust size – When you recognize a good price point that would prove your original thesis wrong, use it as a stop-loss level and adjust your position size according to that price to reach optimal risk percentage.

Resources: Modern Rock, Timothy Sykes, Nathan Michaud, Tim Grittani, Investopedia.com,

Thank you for reading this long-ass post, I hope you liked it, please share your thoughts below.

PS! If you think there is anything left unsaid, please write a comment and I will add it to the list!

![Etoro Review – My Honest Opinion [+TUTORIALS]](https://foxytrades.com/wp-content/uploads/2018/03/Etoro-Review-100x70.jpg)

Gr8 work Paul! Bookmarked your site.

Can’t think of anything to add atm.

Thank you!

That’s a epic post man!

What broker would you recommend if I want to trade stocks and forex, and also how much do I need as starting capital?

A wonderful job. Super helpful inmtofaoirn.

I’ve learned a bunch of those the hard way. Would love to add something, but Im afraid youve covered almost everythin.

Fun and comprehensive!

Thank you, Mitt!

Your thinking on investing are really remarkable, I’m

going to send many of my readers your way.

Very educational, many thanks for keeping everyone up to date pertaining to your investing

progress.

Your ideas on investing are really impressive, I’m going to drive a handful of my

fans to your web site.

Thanks, FF

great information and trading tips, thanks for sharing such kind of information.

Thank you James!

I put a lot of work into putting this post together, I’m glad you liked it 🙂

Great post, thank you. Learnt some things. Got validation for other things I already know / use. Appreciate the post.

Hey Angus,

Thank you for the kind words! 🙂

After 2 to 3 hrs of my position, the price has not touched my target as well as my stop loss.but the price is above my buy price. in this case can exit of my position and take a new position?

Hi Gopi,

If your initial trade idea is still valid, then you shouldn’t exit your trade solely based on how much time has passed.

Time isn’t a factor, unless you’re initial idea included timing due to some external event.

Thank you very much for your quick response. your post is really helpful thanks a lot.

Hi Paul,

One of the best educational guide for trading to people like me. it is good to understand better to miss out trading but don’t waste money on bad trading practice. thank you paul for sharing the valuable trading tips with us.

Great information, thanks for sharing these helpful trading tips. I’m going to share this guide with my friends.