Table of Contents

Are you interested in trading options? If yes, then maybe you have tried looking for a good options trading service for analysis and ideas to help you trade more profitably.

And by doing so, you may have also come across the name of Jeff Clark or his options-focused trading system (or advisory) called the Jeff Clark Trader. But is this system legit or a scam? If it’s legit, is the system worth investing in?

In this Jeff Clark Trader review, we will see if the options trading service lives to the hype. I’ll cover:

- What the Jeff Clark Trader service offers

- What is this popular 3-Stock Retirement Blueprint all about

- What actual members are saying about the platform

- The Pros and Cons of the service, and

- Whether I would personally recommend you to avail the service

But, before we go any further, let us first know who Jeff Clark is.

Jeff Clark – Who is He?

On his official website, you will see that Jeff is a man from Northern California with an impressive financial resume. As a matter of fact, he worked as an editor of various investment advisories before coming up with the Jeff Clark Trader platform.

These advisories were focused on profiting from options trading in any market environment. And among his most successful trading letters are the Pro Trader and The Short Report for the renowned firm Stansberry Research. He worked there as a newsletter editor for 15 years.

Prior to joining Stansberry Research, he was also a partner at a brokerage and money management firm in San Francisco. And if these achievements are not enough, he likewise developed a curriculum used for an international Masters of Business Administration.

These days, it is the Legacy Research Group that publishes his works.

Considering all his professional experiences (a culmination of about 36 years of career in options trading), you can say he is a trading expert who understands not just the art of writing newsletters but also of communicating with investors who are new to the market.

How much is Jeff Clark worth? (Net worth)

This is one of the most common questions people ask when searching a Jeff Clark Trader review. Based on the financial and investor toolkit Wallmine, the net worth of Jeff Clark is at least $41 million (based on February 2, 2021 data).

One of his biggest holdings is Dell Technologies. Earlier in 2021, Jeff Clark also owned almost 114,000 shares of Dell stock. His holding in this company alone is already worth upwards of $31 million.

After realizing that this man is already a multimillionaire but is still running the Jeff Clark Trader service, this must mean that he is not running it just for money.

Is it because he really is passionate to help average individuals or beginners in options traders so they too can take advantage of life-altering investment opportunities? Well, there’s a high chance that he is.

What is His Investing or Trading Strategy

Jeff’s trading strategies revolve around options trading – a type of derivative security, wherein you buy an options contract and it grants you the right to buy or sell an underlying asset at a certain price over a certain time.

Options are not the same as stock trading since they do not represent ownership in a company. Again, you are simply buying or selling an option. You don’t actually have to exercise it at the buy or sell point. This is why some traders consider options (when used correctly) less risky compared to stocks.

If you are a beginner in options trading and want to learn more about the options market, check out my list of the Best Options Trading Books You Must Read here!

Now, going back to Jeff’s options trading strategy. Every 2 to 4 weeks, he issues new trade ideas and he keeps between 2 to 3 positions open at any time.

His advisories on options trading are both speculative and conservative to take advantage of short-term and sometimes intermediate-term moves. He also teaches to maximize upside and limit downsize.

Rather than focusing on individual companies/ assets, his several advisories center on sectors. For instance, his recent options trades targeted a technology sector ETF (XLK) and a financial sector ETF (XLF). Aside from these, he provides trade ideas for certain commodities, such as gold.

In his most recent options trade advisory published by Legacy Research Group, Jeff gives a preview of what he believes to be the “best strategy to trade the market this year,” referring to 2021.

Considering the Covid-19 pandemic, he said that the “stock market has been absolutely nuts.” That it has undergone from the most oversold conditions (stock market lows) to the biggest recovery. Thanks to the forceful actions that the Fed and the US government made to minimize economic harm brought by the pandemic.

Trade recommendations: low prices, low risk

His focus as of April 2021 is what he calls “low-priced stocks.” With this trading strategy, he uses a certain set of technical indicators to spot low-priced stocks in patterns that tend to pave the way for “massive” runs, he said.

“Out of interest to my subscribers, I can’t reveal what those indicators are here,” his advisory reads. Instead, what he told the readers is that the indicators can tell when energy is building up in a certain stock that is waiting to be unleashed.

And the best thing about these stocks is that they are cheap, but are not penny stocks. This is what makes him comfortable recommending companies that are likely to produce large gains in investments.

Since he mentioned his model portfolio in options trades that only his subscribers to the Jeff Clark Trader can see, we might as well discuss what the platform offers.

Jeff Clark Trader – What it Offers

The Jeff Clark Trader is an options trading service and it is in Delta Report where Jeff builds on his trading foundations that laid the Jeff Clark Trader platform itself.

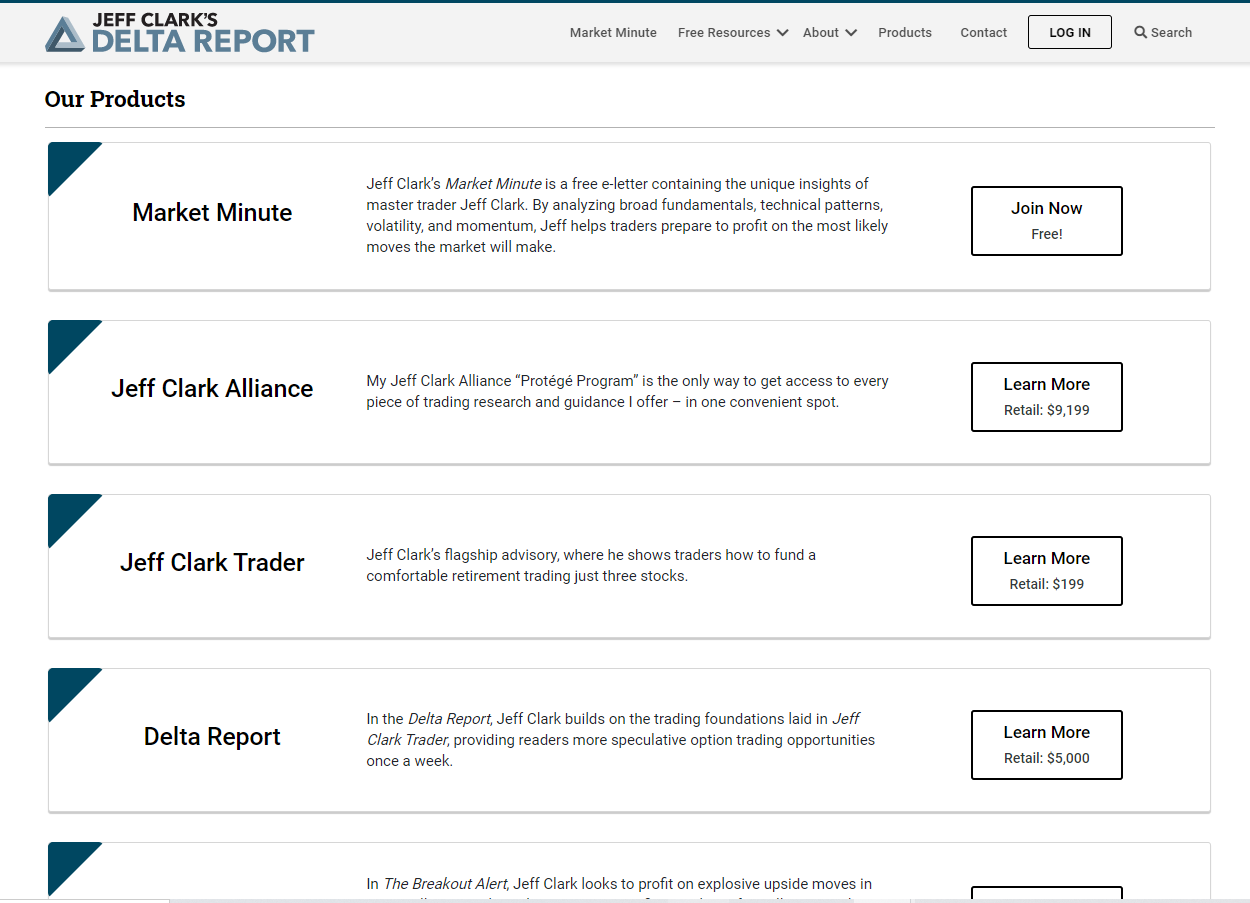

Market Minute – Free eLetter

Among the products offered by the Jeff Clark Trader platform is the Market Minute. It is a free e-letter that contains unique insights of the master trader himself, Jeff. Joining this e-letter is free so I think it’s a nice way to learn about options trading.

With his market analysis updates, Jeff Clark provides traders frequent updates so they can prepare to profit on most likely moves that the options trading market will make.

Other research services he provides include the Jeff Clark Alliance, also called the “Protégé Program” and his Delta Report. We’ll discuss the Alliance.

Jeff Clark Alliance

With a membership fee of $9,199, the “Protégé Program” gives you access to Jeff’s trading guidance and research.

I just observe, though, that although he promises a “wealth of information” on options trading, risk management, and technical analysis as well as multiple opportunities to profit each week, it can also be overwhelming to go through all this information and video training series. And if you decide to take it one step at a time, it could take a while before you grasp the trading techniques and tactics.

Jeff Clark Trader – Flagship Advisory

To know whether this platform can be your best approach to trading stocks, you also have the option to check out the flagship advisory of Jeff Clark. It is called the Jeff Clark Trader itself that is retailed for $199.

The flagship options trading advisory

In this options trading advisory, editor Clark trades three stocks month after month. By using this approach, Clark promises that readers can potentially fund a comfortable retirement.”

As part of this service, you will have access to monthly dispatches, portfolio tracking, educational special reports, timely trade alerts, and training videos or video series about options trading.

Jeff Clark’s Delta Report

In this product, Jeff Clark develops the trading foundation that he laid in the Jeff Clark Trader itself. The difference is that it provides readers with more speculative options training opportunities once every week. But at a price of $5,500, I guess that’s a little bit expensive!

By the way, Jeff said, “It’s a steal for such quality research… It’s worth every penny.” Also, you’ll get “cumulative gains over those plays added up to 2,815%.”

Is this service ideal for people who want to make fast money (for a short period) or those with higher appetites for risk? I think so since it focuses primarily on options.

The Breakout Alert

Then, here’s the Breakout Alert that you can avail of for a price of $4,000. Here, you’ll focus on the small-cap stock market. Jeff claims that you could reap options-like gains from trading stocks.

He developed this system in 2019 and soon after tested it using his own money. And once he was already sure of this

To sign up for any of Jeff Clark’s services, you can click this link here. Again, I am not, in any way affiliated with the service and am just reviewing his several investment advisories and the Jeff Clark Trader service itself whether it’s worth investing in!

Key Feature of the Service: The 3 Stock Retirement Blueprint

Once you sign up for the course, one of the key features that will likely catch your attention is the 3 Stock Retirement Blueprint, aside from the video training series of course.

As a swing trader myself who is not as familiar with options trading, the special report (ebook) or the 3-stock retirement blueprint provides a step-by-step options trade guide that you can execute.

What three stocks did Jeff Clark trade?

Jeff recommends three stocks upfront even without you subscribing to his newsletters. These three stocks are:

- Financial Select Sector SPDR Fund (NYSE: XLF)

- VanEck Vectors Gold Miners ETF (NYSE: GDX), and

- Technology Select Sector SPDR Fund (NYSE: XLK)

Jeff believes that out of the 5,000 stocks you could invest in, you can rest assured that these three have the highest probability of you making exceptional gains.

In the 3 Stock Retirement Blueprint ebook, Jeff details his unique system, certain investment recommendations, how it works, and a full breakdown of each underlying stock.

What You’ll Learn from Him

Jeff claims in a YouTube video that he’s a “battle-hardened veteran of nasty markets like we’re seeing today.” He also shared a way to profit from this crisis (referring to the pandemic) with a few precise options trades. That is by using the V-Line, which measures volatility – a trigger to make big trades.

His takeaway? “The more extreme the volatility, the more extreme the potential profits.”

Jeff Clark Trader: Who is this Service Best For?

The one-year subscription or the one-time lifetime subscription of any of Jeff Clark Trader’s products is best for people who don’t have prior experience in options trading and need a helping hand to get familiar with the options strategies.

It is also best for long-term investors who want to profit from options trading and can tolerate fast-moving plays.

As for the 3-stock retirement blueprint, it is best for people who do not have time to really micro-manage their investments because you are focused on specific stocks to work.

Jeff Clark Trader Review: Feedback from Others

When you search online, there are numerous investors who credit their options trading success to Jeff Clark Trader.

There’s a reviewer on Google, who rated the service with 5 stars out of 5. “I have become, may I dare say, a professional options trader over the years of following Jeff,” he said. Yet, he admits that he did spend a lot of his time with the courses and he found that the trading approach of Jeff Clark also mirrors his.

This same reviewer even comes to a point that he already anticipates the stock recommendations that will be released by the Jeff Clark Trader platform. He highlights that Jeff caters specifically to investors who have less time to watch what is happening in the market.

Another gave Jeff Clark Trader a four-star rating on Google out of 5 stars. He said, “Mr. Clark’s recommendations/suggestions/guidelines are well-thought-out with plenty of chart backing.” Acting on those suggestions or trading strategies, however, require independent follow-up charting, a fair bit of knowledge in options trading, as well as time.

This does not mean there are no negative reviews. One member shares, “So totally frustrated with this organization. I like Jeff Clark and his descriptions and explanations. But, the 90-day guarantee is NOT CASHBACK, but credit with him or his associates.”

He added that he is locked with the annual subscription with no refund. And to top all of his negative comments, he said in the end, “No successful trades in six months!”

Pros and Cons

Pros

- Trade parameters are clearly defined

- It teaches you to trade on market sectors and not on individual stocks

- By following the 3 Stock Retirement Blueprint, it suggests 3 positions (at most) to track

- Subscription of investment advisory services comes with a 60-day money-back guarantee

- Helpful video training series for people new to options trading

- Determines trading options for which your money will be at risk

- You’re not required to be on the Jeff Clark Trader platform for long so you’ll have free time to do other activities

Cons

- The Jeff Clark Trader does not provide details on performance ever since it was established

- It may take a while before you fully grasp the options trading techniques that the Jeff Clark Trader course offers

- There are still trades that carry steep losses

- Risks are not discussed

Bottom Line: Would I Recommend Jeff Clark Trader?

The creator of the Jeff Clark Trader is a successful options trader himself and with a track record to back up his claims. So, from my analysis, I can say he is a real deal. His credibility when options trading is the subject matter is unquestionable.

But would I recommend you to pay and sign up?

My answer is yes, but only if you begin with the free e-letter and one-year subscription ($49 in the first year and $99 per year onwards). The service helps you learn not just basic options trading techniques, but intermediate as well as advanced techniques.

In general, his technique (as explained in this Jeff Clark Trader review) falls within the adage of Wall Street, which is to “buy low, sell high.” It’s also a plus factor that this options trading service provides a money-back guarantee so you get to try the products first before you eventually continue with the subscription.

However, I caution you that there’s still a possibility of losing your money. At least what Jeff Clark Trader can do is reduce those risks so you will be on the right path to achieving your financial goal.

Wishing you a bright financial future!

![Etoro Review – My Honest Opinion [+TUTORIALS]](https://foxytrades.com/wp-content/uploads/2018/03/Etoro-Review-100x70.jpg)